At Platinum’s 2015 AGM, one thoughtful shareholder asked about Platinum’s view on the oil price and, in particular, how the emergence of electric vehicles (EVs) will impact it. This article seeks to elaborate on the response given by our Managing Director at the AGM and to provide a little more context around the developments of EVs.

WTI crude oil price fell some 60% between June 2014 and August 2015 from more than US$100 a barrel to about US$40, notwithstanding disruptions in parts of the Middle East and sanctions against Russian exports. It seems only fair to question whether this has been largely a cyclical movement, reflecting a temporary oversupply resulting from record production levels from both the US shale producers and OPEC, or whether a more fundamental shift in demand and auto consumer preference is pointing to permanently lower oil prices.

Platinum’s view is that, while exciting new technologies such as batteries and hydrogen fuel cells will provide a major energy source in the future and there is an unmistakable secular trend of increasing EV/hybrid vehicle take-up, they are not yet capable of offsetting the growth in overall auto sales in emerging markets in the short to medium term. Moreover, gasoline fuelled vehicles only account for some 25% of total global oil consumption1, which means the EV industry is unlikely to have any significant immediate impact on the overall demand for crude oil. Adjustments on the supply side will likely play a more conspicuous role in determining the movement of oil prices in the short term.

Demand in Emerging Markets

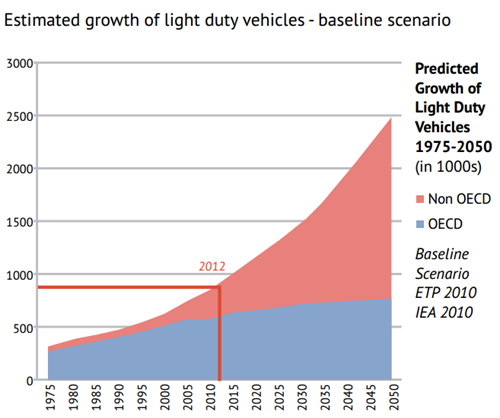

Of the current global fleet of 1,100 million light passenger vehicles, OECD countries take up nearly two-thirds and have an ownership rate of 500 per 1000 persons. Compare that with China, whose ownership rate is around 120 per 1000 persons, or the rest of the non-OECD countries, which average fewer than 70 cars per 1000 persons.2

But it is the emerging markets that will likely experience the greatest growth in both population and per capita income in the next decade, with Asia and Africa forecast to see an increase of 1 billion people between 2015 and 20303 and per capita GDP in emerging markets expected to double from US$5,600 to US$11,000, led by China (US$6,300 to US$16,000) and India (US$1,800 to US$4,500).4

On the back of growing demand from emerging markets, some estimate that 800 million cars will be added to the global fleet in the next 20 years.5 Things can get a little fuzzy at one end of the telescope when one tries to see so far ahead. Ownership pattern in developing countries may not follow their OECD forerunners; the emergence of Uber-styled “sharing economy” may reduce the need to own; governmental restrictions (think of Beijing’s lottery draws for car plates) may tighten further in order to meet emission reduction targets and curb global warming… But factoring all this into the equation, it is still relatively easy to imagine the emerging markets, with their expanding middle class and increased urbanisation, experience substantial growth from current ownership levels.6

Figure 1 – International Energy Agency (IEA) Projections of Light-Duty Vehicle Fleet Growth

Source: IEA; Global Fuel Economy Initiative (GFEI)

How Quickly Will EVs Penetrate the Market?

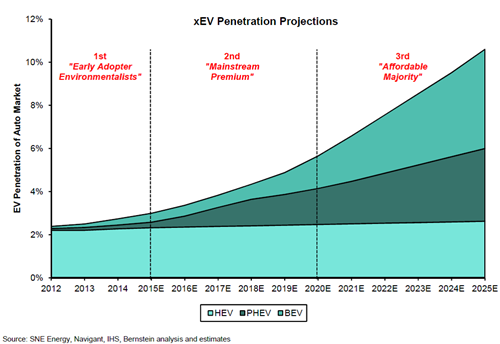

From the eco-conscious to the tech-savvy, to those who are simply trendy, more and more consumers are embracing EVs (including battery electric vehicles (BEVs), hybrids (HEVs) and plug-in hybrids (PHEVs)). But of the 100 million cars sold in 2015, EVs accounted for less than 3%. Considering that the first generation Toyota Prius, the first mass-produced HEV, became available in 1997 and Tesla’s first commercial model, the Roadster, hit the market in 2008, the market share so far attained by EVs is not overwhelming. While Elon Musk has made EVs sexy, high initial (battery) cost, range anxiety and limited charging infrastructure are deterring consumers from converting, meaning that EVs, while accelerating in growth rate, are estimated to make up only 6% of the global volume in light passenger vehicle sales by 2020, 11% by 2025 and 26% by 2035 on an optimistic high-adoption model.7

Figure 2 – The Three Waves of Adoption of EVs – Rates of Sales Penetration

Charge up or Pay up

High battery costs are the single biggest factor currently preventing EVs from being more affordable without sacrificing driving range. Battery technology has been developing fast and costs have already dropped from US$1,000/kWh in 2007 to around US$300/kWh.8 However, at US$300/kWh, the 24 kWh pack in a Nissan LEAF costs a quarter of the car’s US$30,000 retail price but provides only 120 km on a charge. For a Tesla Model S with an impressive 450 km driving range, its 85 kWh battery pack bring with it a US$90,000 price tag.

Improved technology and economies of scale will continue to lower battery cost – with Tesla’s Gigafactory set to commence production in 2016, some expect it will drop to US$150/kWh within two years. But it will be some time before production capacity can meet demand. Incumbent leading Lithium-Ion battery producer, Samsung SDI, unveiled its new EV battery plant in north-western China last month. With a capacity to manufacture enough batteries to power 40,000 vehicles a year, SDI’s new plant is not quite on par with the Gigafactory, which plans to produce 500,000 battery packs annually by 2020, a number that easily dwarfs today’s total BEV output globally but pales next to the 20 million internal combustion engine vehicles manufactured in China alone.

Finding a Charging Station

In addition to superior technology and cost competitiveness, for EVs to become true substitutes for gasoline-powered vehicles, it will also depend on developing affordable, convenient and compatible charging infrastructure. Japan now reportedly has 40,000 charging points (including those in private homes), surpassing the country’s 34,000 petrol stations (though not the number of bowsers),9 and in the US there are more than 11,000 public electric stations providing 28,000 charging points.10 But progress is slower in emerging markets. Out of the 2000 charging stations China had planned to build by 2015, less than a third were installed – a long way from its 2020 target of 10,000 stations.11

Scrappage Takes Time Too

There is little doubt that the EV sector is developing rapidly. But the exponential growth is starting from annual sales of just 3 million units (BEVs accounting for only 210,000) at 2015 levels, which make up a very small part of the overall market for light passenger vehicles. It would appear that gasoline-powered vehicles will make up the majority of the hundreds of millions of cars to be added to the global parc over the next 20 years to meet growing demand in emerging markets.

Besides new sales, one must also not forget the existing fleet. There are some 1,100 million light passenger vehicles on the road today, of which EVs account for less than 1%. Some estimate that EV penetration will grow fivefold in the next five years and exceed 10% of the global parc by 2035.12 Not an unambitious forecast, but it shows that nearly 90% of all the cars on the road in 10 years’ time will continue to run on fossil fuel.

Cutting Carbon Emissions

Public policy aiming to reduce carbon emissions worldwide is one factor that will have an impact on oil consumption regardless of how quickly EVs become the car of choice. With the Global Fuel Economy Initiative’s (GFEI) target of halving the 2005 CO2 emission levels in new cars by 2050, governments around the world have adopted emission standards which collectively aim to improve global fuel efficiency by 50% over the next 10 years. Manufacturers are responding with not just alternative fuel innovations like EVs, but also internal combustion engine vehicles with greater fuel economy. Another factor in calculating fuel consumption – average distance travelled per vehicle – is also expected to decline in the medium to long term, as road congestion in fast growing metropolises reaches unsustainable levels.

What about the Other 75%?

With increasing EV take-up and ongoing improvements to in fuel efficiency in conventional vehicles, growth in oil demand from light passenger vehicles is set to moderate and eventually flatten. But, gasoline fuelled vehicles only account for one quarter of total crude oil consumption. Other forms of transport, accounting for some 30% of overall oil demand, are expected to increase the demand for diesel and kerosene(jet fuel). Heavy duty freight trucks, freight rail and shipping are not easily substitutable by gasoline or electricity powered alternatives due to range and weight limitations. Demand for petrochemical feedstock (e.g. naphtha, LPG and ethane), some 12% of crude oil consumption, is also expected to rise.13

Conclusion

Nothing in this paper should be taken as an under-estimation of the long-term transformative force of EVs and other alternative fuel advancements. At Platinum, we are always excited by the investment opportunities presented by new technologies and market disruptors and have been following the development of EVs, batteries and related sectors closely. But the long gestation period required for new technologies to mature and new industries to become profitable and eventually displace market incumbents means that EVs are unlikely to have a significant impact on oil prices within the next five years. While the growth rate in oil demand will ease from its current five-year high of nearly 2 million bbl/d as a result of slowing economic activity globally, declines are not yet in sight as consumption in the emerging markets is expected to continue growing.

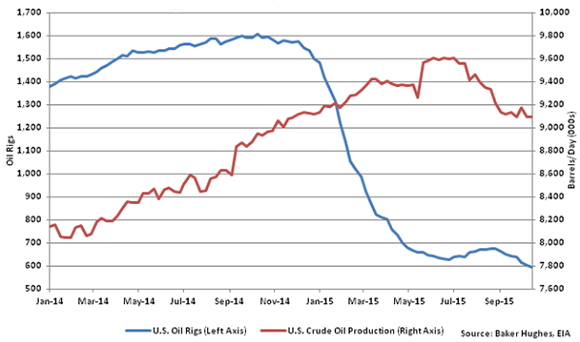

The short to medium term outlook on oil will therefore depend largely on supply adjustments by oil producers. US output has begun to decline after peaking in May 2015 at 9.6 million bbl/d, an 18% increase from early 2014. More telling is the sharp fall in drilling activity and rig count (see chart below) as a result of significant capex reduction, the knock-on effect of which will likely be lower production through 2016. It is estimated that there are some 4500 drilled-but-uncompleted wells in the US due to low crude prices. Assuming US$55/bbl to be the trigger point for the completion of wells, there would still be a six month lag before production picks up and growth resumes. The IEA is forecasting a 600,000 bbl/d reduction in US shale oil output in 2016, with a similar fall by other non-OPEC producers.

Figure 3 – Weekly Total U.S. Oil Rig Count vs. Crude Oil Production

Source: Baker Hughes; U.S. Energy Information Administration (EIA)

OPEC has so far defied all expectations of moderation and increased production to above its 30 million bbl/d target in spite of the collapse in prices.14 However, if the refusal to cut production was to “combat the shale oil boom”, logically, a pause in that boom should lead OPEC to put a check on its rather heavy-handed defiance and a stop to the price free-fall. A significant voluntary reduction of OPEC’s quota is unlikely though, as potential easing in production by Saudi Arabia may well be offset by increasing output from Iraq and Iran.

All in all, we can expect to see oil prices stabilise as supply and demand re-balance somewhat over the next 12 to 24 months, which will lead the oil price higher.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.