Today, our flagship Platinum International Fund reached its 25-year milestone. Over that time span, the results have been impressive, yet managing money is about looking forward, not back. Reflecting is, however, important and the current portfolio positioning is a function of decisions taken over the last few weeks.

The big question we are grappling with is whether we are seeing a correction (as market behaviour suggests) or if we are in a more troubling bear market. The latter tends to see changes in market leadership. We have not seen this change yet with growth/defensives continuing to outperform – perhaps driven by even lower bond yields, indicative of extreme risk aversion.

Bear markets tend to coincide with deep recessions – high unemployment and other unintended consequences – and high starting valuations don’t help. COVID-19 hastened the speed of the economic slowdown – the obvious victims were hit hardest. For a bear market to materialise, the market favourites also need to be hit. Technology mega-caps are propping up market indices.

Near the bottom of the market sell-off just over a month ago, we had started to add exposure. However, taking the US S&P500 as an example, almost two-thirds of the return from 23 March to 28 April occurred in the first three days and we were not inclined to chase it higher.

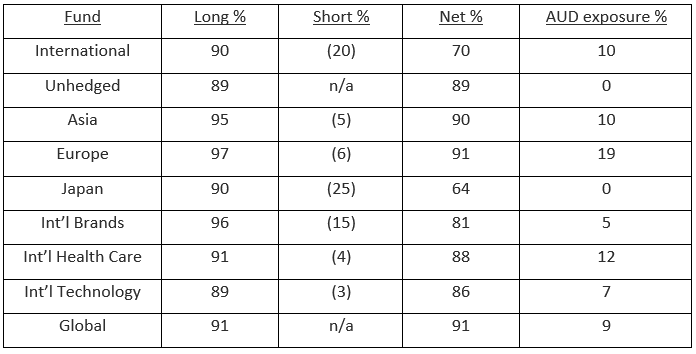

The Fund currently has a net market exposure of 70%, so it is worth considering what would prompt us to increase this.

There are two key things to look at – sentiment and valuations. After the sharp rebound, sentiment does not reflect the challenges of our new reality – high unemployment and a lockdown that has struck at the heart of most developed economies, being the service sector and SMEs. On the valuation side, we want to own strong businesses with long-term growth trends that have been hit in the short term. These are, however, less plentiful than we would hope, with the market currently keen to completely look through any mid-term challenges many businesses will face. Removing our index shorts (approaching 10% of the Fund) provides a readily available lever to increase exposure quickly, should we see fit.

An area we have been starting to carefully build exposure to is travel – a long-term growth industry that will come back in time. In major sell-offs we always hope to add a group of out-of-favour stocks that increase portfolio diversification and quality. We are not trying to time our entry into beaten-up airlines, for example, but are looking at the building blocks, such as travel booking engines and aerospace. We have preferred to accumulate new stock ideas rather than top up our oil-related capex investments for now.

On the short side, we are concerned about iron ore in the face of collapsing steel prices versus a market hoping for a China stimulus or a COVID-19 related mine shutdown. A collection of industrials priced for perfection (e.g. robotics, some expensive consumer staples and concept stocks) are also cause for concern.

The medical sector has the scope to change the probabilities around recovery paths and we are fortunate to have a virologist, Dr Bianca Ogden, in the team.

Bianca notes that our understanding of the virus as well as the disease it causes is increasing day by day as clinical trials are initiated to treat the disease. The momentum is gradually building with clinical data becoming available - encouraging news on Gilead Science’s remdesivir trials, gives the market hope. Looking through the politics of the timing and the complexity of allocating the therapeutics, we are edging closer to having a solution, with caveats around patient type and timing of prescription. Data is also emerging for the anti-IL-6 antibody class (Sanofi/Regeneron's sarilumab and Roche's tocilizumab) showing how important it is to select the correct patient group.

On the vaccine front, Moderna has moved to the next phase of testing, while BioNTech/Pfizer have started to test their mRNA vaccine candidate in humans. China's CanSino is also progressing, rapidly moving its vaccine candidate into phase 2 as well as starting a clinical trial in Canada. Sanofi and GSK have joined forces on the vaccine front with GSK providing the adjuvant. Manufacturing capacity for some of the vaccine candidates is already expanding despite uncertainty about the effectiveness and safety of these vaccines. Testing also remains a key topic in the months ahead.

Our European portfolio manager, Nik Dvornak, notes that the economic impact of the lockdowns is becoming increasingly evident. Roughly 20% of the labour force is on various interim short-work schemes across the region, which preserve jobs via salary contributions. Some governments have started easing restrictions and the markets are rewarding cyclical stocks. The key questions are how quickly and effectively these 30 million employees can be re-engaged and whether we will see a ‘second wave’ of infections.

Closer to home, in the Asia-Pacific region, Asia portfolio manager, Dr Joseph Lai, continues to see positive signs coming out of China as its recovery evolves at varying speeds across sectors, while India remains in lockdown. The majority of our Asian exposure is in China. We have reduced our net invested position in India to 0% in the Platinum Asia Fund as a temporary hedge against market risk (as at 29 April). Meanwhile, Japanese portfolio manager, Scott Gilchrist, notes that the lockdown has continued to tighten up there. Investing in Japan is a balancing act between uncertainty in the near term and an attractive multi-year story. This week’s traditional Golden Week holiday will see few passenger movements given the current situation.

Below are the most recent portfolio exposures as at the close of business on Wednesday 29 April 2020.

DISCLAIMER: This information has been prepared by Platinum Investment Management Limited ABN 25 063 565 006 AFSL 221935, trading as Platinum Asset Management ("Platinum"). It is general information only and has not been prepared taking into account any particular investor’s investment objectives, financial situation or needs, and should not be used as the basis for making an investment decision. You should obtain professional advice prior to making any investment decision. You should also read the Platinum Trust Funds’ product disclosure statement before making any decision to acquire units in any of the funds, a copy of which is available at www.platinum.com.au. Past performance is not a reliable indicator of future results. Some numbers have been rounded. The market commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. No representations or warranties are made by Platinum as to their accuracy or reliability. To the extent permitted by law, no liability is accepted by Platinum or any other company in the Platinum Group®, including any of their directors, officers or employees, for any loss or damage arising as a result of any reliance on this information.