Swiss pharmaceuticals company Novartis has gone through a lengthy transformation that significantly changed the company. Bianca Ogden investigates.

Re-visiting an old investment idea is never straightforward. All you can think of are the flaws of the business and how well we did to remain on the sidelines. However, this is often a mistake as there will be a turning point.

Novartis, the Swiss pharma company headquartered at the opposite end of Basel to Roche, is such an investment. The Platinum International Health Care Fund has had a small position in Novartis for some time but the case never fully worked out and we kept being disappointed. This year, however, with valuation being more compelling, we forced ourselves to take a fresh look.

Novartis has a remarkable history (dating back to the middle of the 18th century) when Johann Rudolf Geigy-Gemuseus started trading ‘chemicals, dyes and drugs of all kinds’ in Basel. Centuries, divestments, acquisitions and mergers later, Novartis still remains headquartered in Basel and trades ‘drugs of all kinds’, albeit now globally.

Throughout its journey, the company faced tough times that demanded changes[i] but more often than not, the company continued to grow.

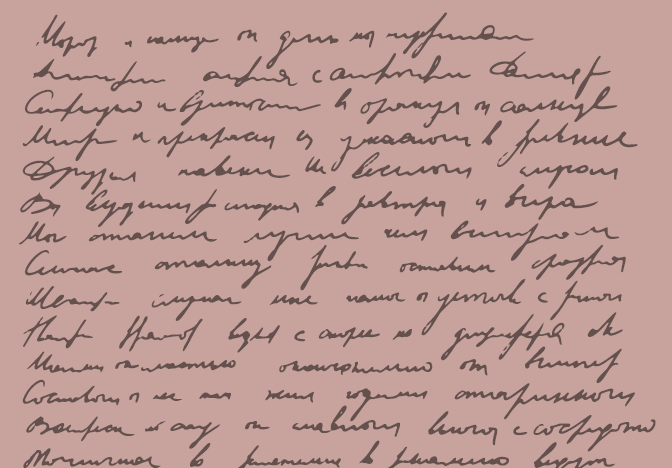

The most recent transformation of Novartis has been long and started with the merger of Ciba-Geigy and Sandoz in 1996. Sitting across from each other on the river Rhein in Basel, Ciba-Geigy and Sandoz had complementing product portfolios and were no strangers to each other. However, their geographic reach was limited, their research and development (R&D) sites were mainly in Basel and the chemical heritage was still very dominant. Following the merger, under the leadership of Dan Vasella (Sandoz executive with a medical/marketing background), Novartis embarked on a decade long transformation increasing sales from $19 billion to over $56 billion today (see table below).

By 2010, many new pieces and new buildings[ii] had been added, while others have been divested and Dan Vasella handed over the CEO reign to Joe Jimenez, a consumer executive who has to make the puzzle work (Mr Vasella remained Chairman until 2013, when he retired).

Novartis (Asset)

1996, Merger of Ciba-Geigy and Sandoz

2000, Formations of Syngenta: agricultural assets of Novartis and Zeneca combined

2001, Acquisition of stake in Roche for $2.8bn and start of Basel Campus Project

2004, Opening of Boston Campus

2005, Acquisition of Hexal and Eon Labs (generic drugs) for $8.3bn

2006, Acquisition of Chiron (US biotech: vaccines/diagnostics) for $5.1bn

2007, Divestment of Medical Nutrition business and Gerber Baby Food for -$8bn

2008, Acquires 25% of Alcon (eye disease business) for $10.4bn

2009, Acquisition of EBEWE (generic drugs) for $1.2bn

2010, Completes acquisition of Alcon for $41.2bn

Source: Novartis

This multi-year transformation was not cheap (+$61 billion spent) and while in 2010 the pieces were in place, integration was in no way complete. Additionally, Novartis still had to deal with unexpected generic competition and unsuccessful drug applications in the US.

Today, several years on, Novartis has forged ahead. The heavy lifting has been done, the new campus is now functional in Basel as well as in Boston (with trees rather than cranes). Emerging markets contribute 24% of sales and Novartis is no longer fully dependent on pharma (57% pharma, 15% generics, 2% vaccines/diagnostic/animal health, 19% eye care, 7% consumer). This is a good start in today’s pharma world and implies that Novartis shareholders should be the beneficiaries of the cashflow.

Novartis is not without problems. The past decade has been driven by the success of the Diovan/Valsartan[iii] cardiovascular franchise and the leukemia drug Glivec. These two drugs account for 20% of Novartis' total sales but have come to the end of their life cycle. Diovan’s US patent expired in September, while Glivec has time left until 2015. To us, this is a temporary roadblock as diversification, particularly the contribution from the eye disease division Alcon and new products, will buffer the blow. For growth to return, however, the pipeline has to deliver and we believe it will.

One of Novartis’ weaknesses has been its spending habit. Deals are usually on the expensive side and budgets are always a bit higher compared to its peers, while the pipeline tends to be a little cluttered. But even these habits are being addressed and we should see further reductions to its cost base. Some of the savings will be used to expand in emerging markets which we are happy with.

In summary, Novartis has gone through a lengthy transformation that significantly changed the company. We think it is unlikely that the next five years will be as dramatic and as such, should see steady growth and improving returns.

[i] Eg. 1970: merger of Ciba (Chemische Industie Basel) with Geigy to form Ciba-Geigy.

[ii] Dan Vasella with the help of renowned architects has transformed an old chemical site into a campus with 10-15 R&D buildings.

[iii] Valsartan (Diovan) franchise: so-called angiotensin receptor antagonist. Used to reduce blood pressure either alone or in combination with other drugs.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.