“Was lange währt, wird endlich gut” meaning “good things come to those who wait”. This describes perfectly what has happened to pharma.

It has taken years rather than months but numerous restructuring efforts, together with several acquisitions and licensing deals have today placed pharma in a good position. Most companies are entering a new stage of their lifecycle after many years of remoulding their structures. In the meantime, profits have not collapsed; cash generation has continued to be strong and the research and development (R&D) engine is running again - maybe not at full speed yet but productivity is on the rise and drug approvals are forthcoming globally.

Despite patent expirations being at their highest level, big pharma (at least some of them) has been doing something right. Even the market cannot ignore such progress anymore and has started to look beyond patent expirations.

Over recent years these companies have undergone significant changes. Some have been bold such as divesting divisions or completing significant acquisitions, while others have been more subtle and often coincided with senior personnel changes which are something we track closely.

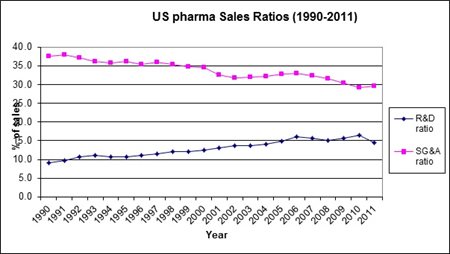

In a nutshell, these companies have adjusted their cost structure (see graph below of combined R&D and selling, general and administrative (SG&A) budgets of US pharma companies).

Manufacturing sites have been consolidated, sales forces are being reduced, pipelines have been cleaned out and R&D budgets are being managed a lot more carefully. This has in no way stifled progress; to the contrary, the outlook for the majority of pharma companies has improved.

The quality, rather than quantity of pipeline assets has risen. The late-stage decision making process within the companies has been overhauled. Management layers have been removed and the process now takes into account not only the efficacy and safety of a new product, it also assesses carefully the commercial potential of a new drug vis-à-vis competitors, along with its potential to be reimbursed by payors. Remuneration schemes have been adjusted accordingly; staff will be rewarded once a product gains approval AND receives a positive reimbursement decision by the relevant agencies. As Roche told us, under the new decision making process several recent failures would have not been allowed to enter phase 3 trials. There is no longer room for ‘me-too’ drugs in today’s market place.

Pharma has accepted that biotech continues to be an essential ingredient for pharma’s success and the relationship between the two has become a lot more sophisticated. Previously, big pharma simply acquired an equity stake and expected to run the show. More often than not this ‘barging in’ approach did not result in a commercial product; it resulted in write-offs. Today, lessons have been learned; equity investments are rare while Joint Steering Committees are almost standard. At the same time, biotechs are now more likely to retain options to co-promote the product in certain territories.

Acquisitions will continue as externally sourced opportunities are now firmly part of the growth strategy. Pharma has learned how to use its cashflow more efficiently; making upfront payments to biotech specialists has been found to offer an elegant solution to exploring new potential drugs.

Large acquisitions, some may call them transformational, are more or less behind us and those in process are approaching completion. The benefits from these acquisitions (e.g. Sanofi will have an outstanding position in Latin America) will soon become visible and contribute growth as well as cash. Debt levels will decline quite rapidly, dividend payments will continue to rise and gradually the ‘patent’ hole will become a distant memory.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.