A Martian listening to Donald Trump’s unsavoury election rhetoric would be led to believe that middle class Americans are among the poorest and most deprived peoples on Earth. Economic data, however, does not look quite so dismal.

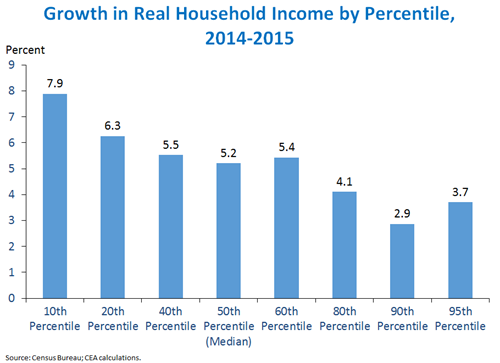

According to the latest report by the US Census Bureau, real median household income in the US rose by 5.2% to more than US$56,510 in 2015, the fastest annual growth since the Census Bureau began reporting data on household income in 1967. Moreover, the growth is broad-based, with the benefits accruing to every demographic, whether by geography, race, gender or age, and across the income scale.

.png?width=500&height=351)

Importantly, real income is rising faster among lower and middle income households, with the poorest percentile of families experiencing the highest rate of increase, nearly 8%. Growth in 2015 was the highest since 1969 for the 10th, 20th, 40th, 50th and 60th percentiles.[1]

While this has not been enough to meaningfully lower the Gini co-efficient or other such measure of income inequality, it is encouraging to see a 1.2% reduction in poverty rate, the largest one-year drop since 1968, which translates to about 3.5 million people being lifted above the poverty line. The Census report also estimates a 1.3% reduction in the percentage of the population without health insurance, from 10.4% in 2014 to 9.1% in 2015, and bringing the cumulative gain since 2013 to 4.3%.

The strong growth in real income at the household level is the result of a combination of rising real median earnings (1.5% and 2.7% year-on-year respectively for men and women who worked full time, year round) and a greater number of people in paid employment.

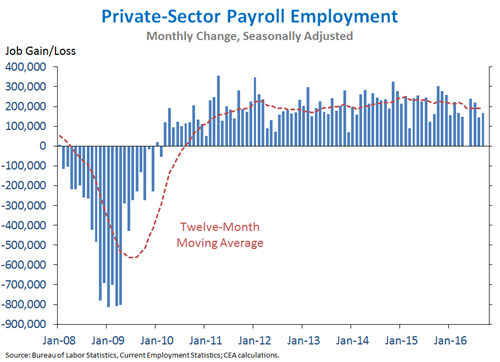

It is patent from the above statistics that Americans have lived in the shadows of the Great Financial Crisis (GFC) since 2008 and that the recession has brought upon them a huge set-back in real incomes and living standards. But the data also show that the recovery of the US economy has been persistent over the past eight years and that its fruits are finally flowing through to working class families.

Why, then, has growth in real spending been flat? Is it because for ordinary Americans recovery from the GFC has been slow coming? The 5.2% growth in real household income achieved in 2015 was the first substantial rise since 2007, and the increase in real earnings the first significant rise since 2009. After all, real median household income in 2015 is still 1.6% lower than 2007’s pre-GFC levels and 2.2% lower than the historical peak in 1999.

There is also no assurance that 2015’s good outcomes will be repeated this year and no one knows for how much longer the US economy will continue to expand. Perhaps higher minimum wages and eight consecutive years of expansion mean that we are now approaching a ceiling on the number of new jobs being created. Unemployment has remained at around 5%. Job growth in 2016 has averaged 178,000 per month, compared with an average of 229,000 per month in 2015.

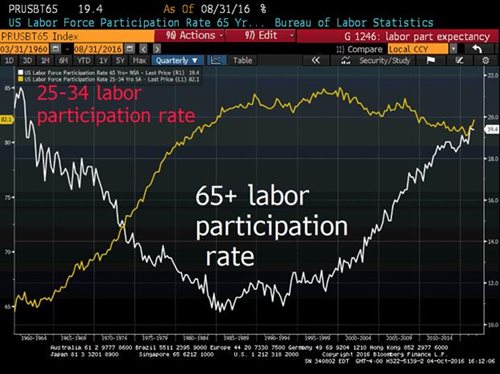

Then there is the miserably low nominal growth. With nearly half of the nation having no private provision for retirement and what they do have in the retirement account earning meagre returns, no wonder more and more Americans over 65 years of age are staying in or returning to the workforce.

Nevertheless, there appears to be a disconnect between the way people are “feeling” and the reality presented by economic data. The level of crowding in the “certainty trades” (bonds and bond-like defensive equities) is looking inexplicably excessive (see Market Panorama charts in our June and September Quarterly Reports). Considering also the broad-based economic recovery in China and Europe, it makes good sense to look further afield and beyond the hyperbolic scaremongering of the US election campaigns. Kerr Neilson noted in the September Quarterly Report that “we sense there is a move afoot towards real or inflation assets and away from financial/safety assets (like bonds)”. One can expect that move to gather pace as people’s “feelings” catch up with reality.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.