Unlike ‘patent cliff’, ‘the aging population’ and ‘cost inflation’, the truly interesting themes in healthcare today do not always receive the most attention in popular media. Bianca explains the exciting progress being made in precision medicine and its enormous potential for the future of healthcare.

Below is an edited extract from the presentation given by Dr Bianca Ogden at Platinum’s Regional Adviser Presentation Series in mid-August 2016.

“Patent cliff”, “aging population” and “cost inflation” are familiar phrases to most of us. They are indeed relevant to healthcare today, but there are also plenty of other themes that have just as much relevance, if not more, but which may not be as familiar to us because they receive less coverage in popular media: immunotherapy, biosimilars, neurosciences, rare disease, eye diseases, gene therapy, vaccines, robotics, 3D printing, data, software… There are plenty.

Precision medicine, in particular, is one very important area of development, and will be the focus of this presentation.

The complexity of healthcare goes far beyond an aging population. At the very core of healthcare is innovation, and innovation today is alive and well-fund. Old pharma no longer exists, thanks to the rise of biotech. Data, analytics and interpretation, which are at the heart of precision medicine, will transform the way in which diseases are diagnosed and patients are treated.

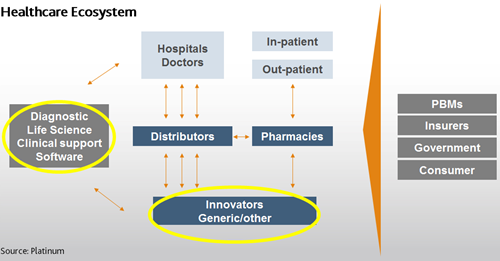

Looking at the healthcare ecosystem in its current form as represented in the following chart, we have doctors at the top and innovators at the bottom, with distributors and pharmacies being the “middle-men”. On the right side of the chart we have the groups that pay, while on the left we have a diverse group that provide “support services”, ranging from diagnostics companies to tool providers for scientists, to providers of services for clinical trials.

To us, the innovators and the support service group are the most interesting. The innovators include both pharma and biotech. Clients often ask “what exactly is biotech” and “what is pharma”. From our perspective, they are not that different. Biotech companies seek to harness cellular and molecular processes to develop technologies or products for healthcare, energy as well as food. Pharma companies have embraced biotech internally as well as externally. Today, pharma companies are essentially diverse biotech companies with a global commercial reach. The patent cliffs of the past have forced companies to adjust their R&D and approach to commercialisation.

Biotech is what makes healthcare tick.

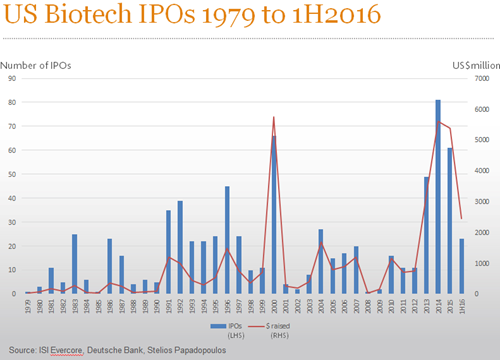

Looking over the history of biotech IPOs in the US since the late 1970s, one observes that we have had two boom periods with one coming to an end this year after raising a significant amount of money. What this shows is that today we have a well-funded industry that is ready to get to work and come up with the next wave of innovations for healthcare.

When I first joined Platinum in 2003, I found myself in a similar situation. A boom had just come to an end, pharma was very keen on restocking their shelves, and biotechs were well funded. It was (and now is again) the time to invest in the next crop of companies for the coming years.

So what has been happening in healthcare innovation?

Innovation 1: DNA Sequencing

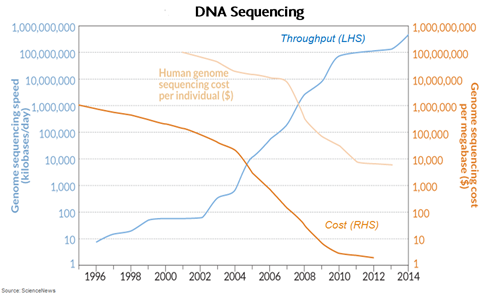

Big leaps have been made in DNA sequencing since the Human Genome Project was completed in 2003. The cost of sequencing has reduced dramatically since 2006-07 (as shown in the bold orange line in the chart below). But more importantly, sequencing has become a lot easier and faster – the blue line in the chart below shows how many kilobases (or thousand base pairs) one can sequence in a day. It took about 13 years to complete the Human Genome Project and sequence the entire human genome, consisting of more than 3 billion base pairs. Today, it is possible to sequence a whole genome in less than two days.

But, as always, this phenomenal progress has come with its own challenges:

- Scientists are faced with an immense data overload and are struggling to keep up. Sequencing is also finding its way into the clinic which presents new challenges. Storage is a problem and a cost component not to be under-estimated. Each genome occupies 100GB of storage space, and scientists like to store raw data as they love to come back to it and “take another look”. Someone has to pay for cloud storage which, once factored in, makes the “$1000 per genome” number quite misleading. The overall cost is in reality much higher.

- Analysing the data is cumbersome and relies on algorithms, reference databases and fast computers.

- Most importantly, how do we interpret the data and use it to guide our decision? How can a physician compare one patient’s data to that of other patients?

Scientists need help. Biotech will provide that help.

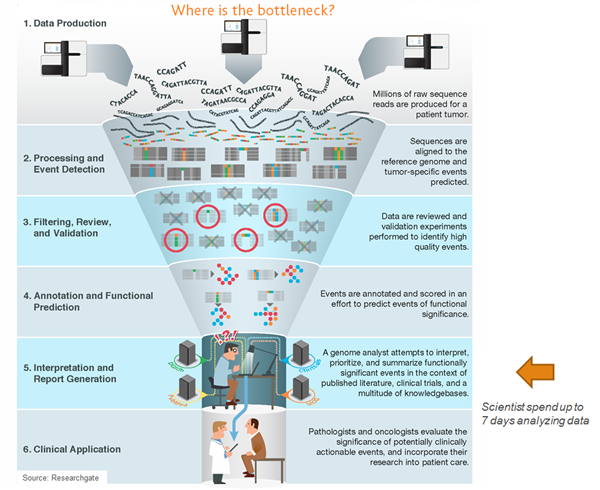

This is where we are today:

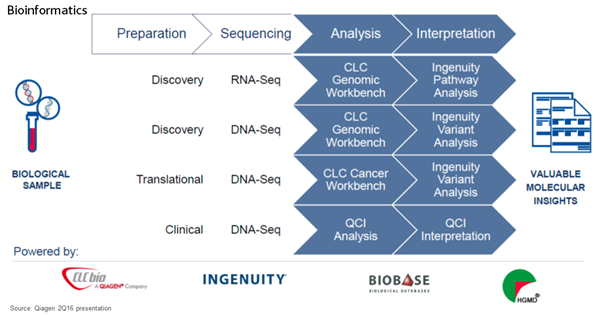

Patient-specific data is fed into the system. It is processed, filtered and annotated. Out comes a report that says “such and such difference has been identified in the patient’s data compared against such and such reference data”. It is then up to the bioinformatics guru to make sense of the report somehow, and that it where the biggest bottleneck currently lies. How do we know that these differences have any meaning? And how do we know what to do with it? It is not uncommon for analysts to spend over a week on data interpretation before coming to any conclusion.

So what are biotech companies doing about these challenges?

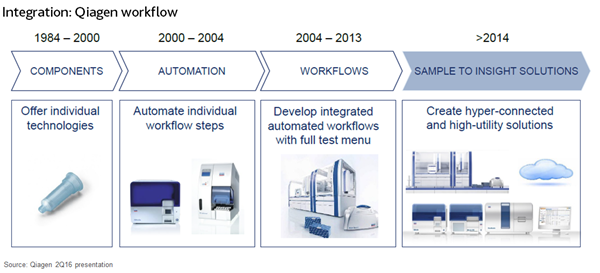

Take Qiagen as an example. The company is an integrator and has been doing exactly that. Qiagen knows how to isolate DNA and RNA in the best way possible. It revolutionised how genomic information is isolated in the lab in the 1990s. Over the years the company gradually moved into clinical applications and put together a menu of diagnostic tests. But it has been less active in developing next generation sequencing equipment, which is not at all unusual, as Qiagen is not an equipment company. It likes to observe and then put different pieces together to make them work better. That is the stage we are at now.

Qiagen has applied its thinking to sequencing from start to finish or, as the company calls it, from “sample to insight”. It has made a head start, as already over 80% of sequencing experiments use Qiagen products. But Qiagen has also taken a big step further and made sure that it has a very comprehensive back-end bioinformatics portfolio.

Qiagen’s bioinformatics offering is made up of analytical tools as well as a powerful database – the “Ingenuity Knowledge Base”. This knowledge base provides the linkages to up-to-date research and clinical data, the ever-evolving real world of science. One could call it an epicentre of genomics analysis (or the Google of genomics) which allows the user to interpret data in the most efficient way. To us this represents a powerful asset for the coming decade.

Data, its analysis and interpretation will change the dynamics in healthcare over the next decade. This is relevant across different fields of science and is by no means limited to diagnostic labs. IT spending at drug developers is rising. For instance, Johnson and Johnson spends $2 billion a year on IT. The position of the Chief Technology Officer at a pharma company is now as important and prestigious as the Head of R&D.

Innovation 2: Targets and Weapons

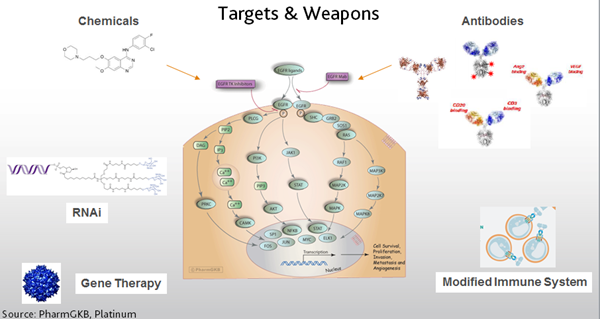

Our knowledge about drug targets and how they influence disease pathology is getting deeper and deeper, thanks to many new tools available to scientists. It is all about signalling pathways.

This diagram depicts a signalling pathway: A signal comes to the surface of a cell and triggers a cascade of events that can lead to different activities, including cell growth or cell death. In cancer, for example, DNA mutations occur which manipulate this signalling cascade so that the cell is led to believe it should continue to grow indefinitely. Mutations can happen at different stages of the cascade and scientists have identified more and more of them in the past decade, thus deciphering the intricate pathology that is cancer.

Chemicals have been the go-to class for drugs for many years as they are easy to make and we have learned to rationally design them, but they have their issues. Today, we have other weapons to choose from: Antibodies, which are made of living cells, are more difficult to make, but are very targeted. We have also learned to manipulate antibodies further and stick chemicals onto them. We are also working on manipulating cells of the immune system to enable antibodies to attack the cell that we want them to attack. We have learned to introduce more sophisticated chemicals, such as RNA interference (RNAi) into a cell and let it penetrate deep into the cell. There is also gene therapy which, after many years of tweaking, is starting to produce interesting results.

Sequencing and other molecular tools have played a major role in identifying mutations along signalling pathways (which is why we like the tool providers), and progress will continue.

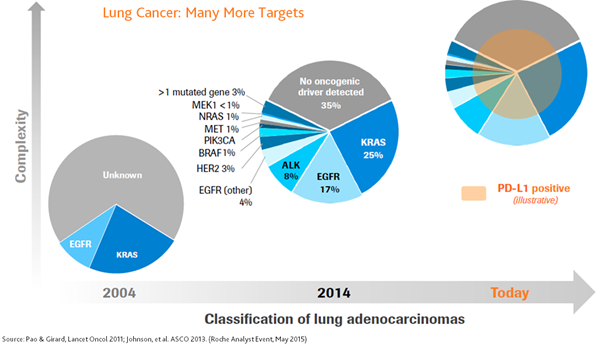

Take lung cancer for an example. In 2004, two mutations were identified and one of which, EGFR, was successfully targeted by chemicals and antibodies. Ten years late, more sequencing and more data analysis found other mutational events, and today there are several drugs targeting these specific mutations which have either been approved or are in development.

There is now another layer of complexity – immunotherapy. This is innovation at its best.

It is very clear that a tumour will now be defined by its molecular profile, rather than its location. There will be more mutations, and more work for biotechs. Immunotherapy alone is a whole new treasure trove.

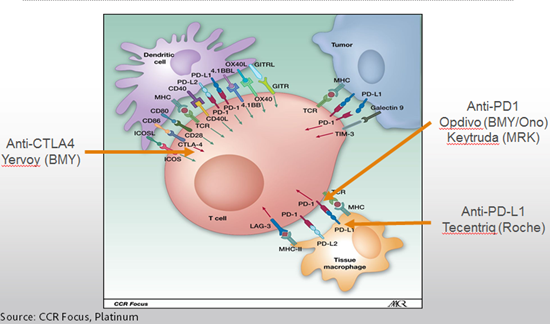

The following diagram provides a snapshot of the immunotherapy world as we know it today. The little connectors represent the different signalling pathways that play a role in immunology. In the top right corner is a tumour cell and in front of it is a T cell which is the first line of defence sent out by the immune system. Usually these T cells will recognise when something is not right and will recruit other “soldiers”, but cancer is smart and has learned to manipulate the immune system.

In recent years, scientists are gaining a better understanding of the intricate signalling pathways of this system and through that work we have been able to develop drugs that release the brakes and attack the tumours. Three drugs have been approved to date. However, there is much more to come and combination therapy will be absolutely key in the coming decade. For now, these drugs are used as monotherapy. They work in some patients, but not in others. Companies are trying to work out why that is the case and how best to combine different drugs.

How does a company stay ahead of the game in this space? They try to understand the molecular and genetic make-up of the tumour and its microenvironment.

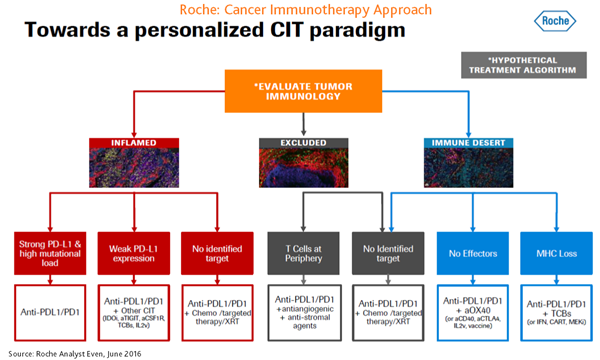

Take Roche, a company we own in the Platinum funds. It has been the pioneer in targeted antibody therapy in oncology, despite its peers being less convinced at the time. Roche stuck to its science approach and today has a deep oncology franchise and a clinical trial network in this area that is very hard to beat. Roche is all about science and diagnostics. This is a very valuable combination, particularly in immunotherapy, as it is all about detailed analysis and combination therapy.

The above chart shows just complex – but also how exciting – drug development has become. A tumour is no longer simply defined by its location. Instead, the doctor needs to understand what mutations have occurred. But even that is no longer enough. The doctors now has to also understand the immune components, i.e. whether the tumour is inflamed, what brakes/accelerators are in place that are stopping the immune system from attacking the tumour, and what immune cells are hovering around the tumour…

Again, answering these questions requires a large amount of data to be compiled, analysed, interpreted and linked to ongoing research globally. Roche’s scientific rigour as well as the expertise of its diagnostics division provide an advantage and the company has made sure that it partners with leaders in the field to make its database as well as diagnostic tests even more powerful.

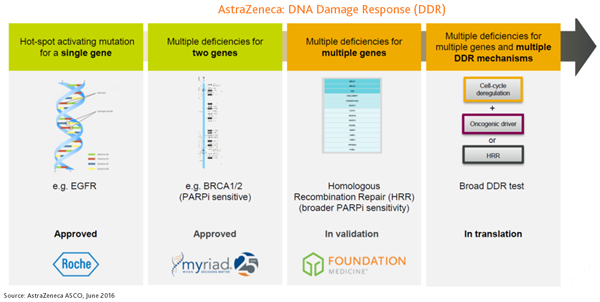

Another example of precision medicine is AstraZeneca and its DNA damage response portfolio.

Cells have mechanisms to repair their genome when it has been damaged. Again, a particular signalling cascade kicks in. And again, in cancer this response does not work properly, so damage persists rather than gets eliminated via cell death. AstraZeneca is developing several drugs (one of which has already been approved) that essentially push the cell over the edge despite the patient’s own built-in damage response failing to do so.

Again, AstraZeneca is letting science guide the way. The company is trying to decipher what mutations are causing the problem. First, there was one, then there were two, then multiple mutations were identified. Now things are becoming even more complex. Again, it is all about the profile of each tumour and it is all about data crunching.

Sequencing is just a means to an end. The real value is in the database that these companies are building. Both AstraZeneca and Roche have been putting a huge amount of effort into carefully analysing patients’ tumours and developing tests and algorithms that will ultimately find the right drug or drug cocktail. They have both spent considerable resources and time to deal with vast amounts of data which will be key for the industry in the coming decade.

Investing in Healthcare

As the examples of developments in DNA sequencing and immunotherapy illustrate, there is much more to investing in the healthcare space than the “aging population” argument. Pharma has caught up with biotech and is loving it. Innovation is indeed going strong and there is much more to be done. It is important to note that precision medicine is in its infancy and there are many opportunities, but it is as much about algorithms and software as it is about molecular biology and clinical trials.

Finally, here are some examples of the companies in our portfolio:

- AstraZeneca and Roche are both highly science-driven companies and both are big supporters of precision medicine/biologics. 80% of AstraZeneca’s portfolio has a precision medicine approach attached to it while Roche has made data and analytics core to its approach to drug development.

- Sanofi is an example of companies focused on rare diseases and RNAi. The company has a close alliance with one of the leaders in RNAi, named Alnylam.

- Qiagen, as described above, is a leader in diagnostics/precision medicine.

- Sartorius gives us exposure to biomanufacturing, another theme in the Platinum International Health Care Fund. The company provides vats and consumables for making biologics.

- Icon is a company that helps companies to run their clinical trial programs.

- Vectura, a UK biotech, focuses on respiratory diseases, an important area that is seeing a lot of activity.

In 10 years’ time, “doctors” and “physicians” may well have become outdated terms, and we may have to consult “biological tech support specialists” when something isn’t feeling right.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.