Simon Trevett, portfolio manager of the Platinum International Brands Fund, discusses how we approach the question of gaining exposure to emerging market consumers, through a combination of investing in large multinationals and investing directly into emerging markets, depending on the balance of price and risk.

The quarter has been characterised by an increase in activity by multinationals in several of the Platinum International Brands Fund’s emerging market holdings. The interest in United Spirits by Diageo has been the subject of speculation and debate for several years and is perhaps less indicative of any underlying trends or signposts to future developments.

However, this wasn’t the only holding of the Fund to benefit from such external factors. Typically, in periods of increased uncertainty and recession there is the inevitable and necessary process of reorganisation, retrenchment and purging of the excesses of the previous expansionary phase. This is often accompanied by substantial changes in the ranks of senior corporate management which, post the house-keeping, provide for the development of new plans and objectives.

There seems to be an increasing willingness by companies to take advantage of the current very low cost of debt funding and to pursue opportunities in growing markets. Whether that is by acquisition or joint venture, the stronger companies are starting to make use of their competitive advantages. There are tantalising signs that the reluctance of company boards to engage in planning for the future, as opposed to reworking the past, is thawing, with commentary appearing about where the opportunities might be for both lower costs and growing markets.

The cautious approach is plainly still evident with a propensity for management to prefer the safer options of expanding joint ventures or increasing their interest in existing subsidiaries or associates. In this respect, the Fund has two investments where the parent company is seeking to increase its stake, in one case to fully delist the subsidiary.

The fundamental consideration, whether by investors or corporate management, is to identify which consumers, and where, are in a position to provide some growth opportunities of substance. On the one hand in some emerging markets there is still a migration from poverty giving rise to opportunities to provide basic household items. At the other extreme, there is the indulgence of new found wealth with luxury brands. Interestingly, the middle classes in these developing markets are giving rise to extraordinary extravagance in the purchase of cars, cosmetics, technology and a host of consumer products that would have been considered improbable only a few years ago.

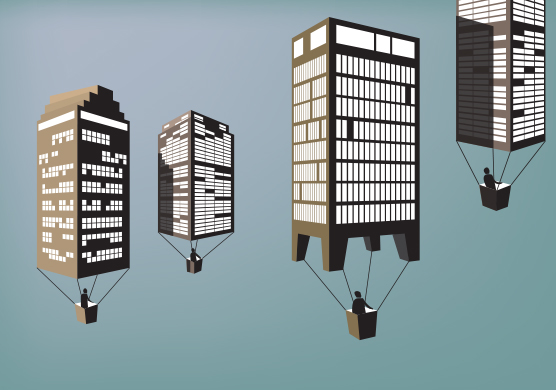

The choice for the Brands Fund is whether to gain exposure to these consumers through an investment in a multinational or directly into an emerging market. The Fund’s approach has been to pursue both avenues depending on the balance of price and risk. Indeed, within the quarter the Fund added to its holdings in Casino, the French listed retailer with a majority of earnings from Latin America and Asia.

The Fund has also held small positions in Zimbabwe, the brewer Delta being the main holding. In considering the viability of investments in such markets, ranging from Zimbabwe to Pakistan, the Fund has sought those companies where there is a multinational involved and some degree of reporting creditability and supervision.

In keeping with this, the Fund has started to accumulate two more holdings in Africa, outside of Zimbabwe. There has been something of an exponential change in the purchasing power of the African consumer. We believe this is driven by several factors: substantial foreign investment in infrastructure to meet the burgeoning demands of the resource industries; massive new discoveries particularly in energy; and the facilitation by the Internet and mobile devices of access to information thereby empowering both financial and labour mobility.

The adoption of mobile phones, at a phenomenal rate, has facilitated a growth in consumer transactions that were previously denied or at least tediously difficult. As an example, the ‘M-Pesa’ system operated in Kenya facilitates the transfer of funds across the mobile network such that money can be easily transferred back to families in remote towns or villages. Shop, or rather local kiosk style vendors, can accept payment for low value transactions through the system, thereby obviating many of the current difficulties with lack of physical currency and the giving of change.

To provide some perspective on this, the company operating ‘M-Pesa’ notes that transactions between customers on the network are growing at 32%pa! Whilst this is a transaction flow, the quantum of these is, by comparison, equivalent to some 30% of Kenya’s GDP.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.