Founded

1994 – 30 years of investing across varying economic cycles

A$11 billion^

in total funds under management

Our Staff

remain co-investors in our funds and co-owners of the firm

The Platinum Way

Platinum’s approach to managing our clients’ wealth is shaped by six pillars:

- A contrarian, long-term investing philosophy

With a focus on achieving strong long-term absolute returns (rather than simply by comparison to a benchmark index), we look beyond short-term market turbulence caused by events of a transient nature to seek out ‘unfashionable’ companies whose actual worth is greater than the value implied in their present share price. - A bottom-up, index-agnostic approach to stock selection

As a true active manager, we build up our portfolios by selecting one company holding at a time through quantitative analysis and detailed fundamental research. The proportion that each investment represents in a portfolio of, say, 80 companies is based on the conviction we hold in that particular investment case. The composition of a portfolio is not influenced by what stocks make up the index that is used as a comparative reference to evaluate the portfolio’s performance (such as the MSCI All Country World Index) or the weightings of the stocks within that index. As a result, Platinum’s portfolios tend to give investors a very different exposure to that offered by commonly used market indices or index-tracking funds, whether by region, sector or in terms of opportunities in specific companies. - Uncompromising business ethics

Our business is centred on providing dependable service to our clients. That ethos has underpinned Platinum’s approach to investing, product distribution, investor communications and every other aspect of our operations since the beginning. We do not engage in active selling (such as cold calling) to market our products or services. Refer to our Complaints Handling & Dispute Resolution Guide if you have any concerns with our service. - A dedicated and experienced team

Members of the investment team have on average been with the firm for more than nine years, while the 8 portfolio managers’ average tenure with the firm is 16 years (as at 30 September 2024). - Alignment of interests

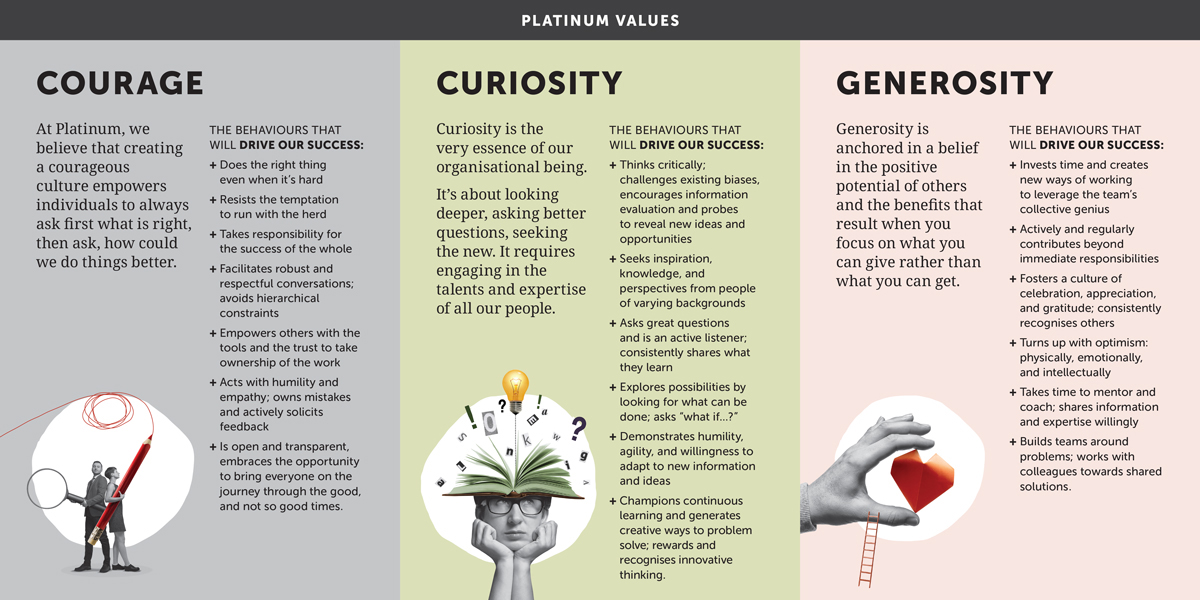

Many Platinum employees, including key members of the investment team, have co-invested their personal money in our funds alongside our clients. Platinum is ultimately owned by Platinum Asset Management Limited (ABN 13 050 064 287), a company listed on the ASX (ASX ticker PTM). Further, Platinum’s incentive structure emphasises performance-based remuneration, with one of the key components being a deferred bonus plan that awards high-performing employees with deferred rights in PTM shares. - Corporate Values

Our History

1994

Platinum Founded

Soros mandate (94-07)

Optima (Global)

MLC-Platinum Global Fund

Platinum Capital Limited

1995

Platinum International Fund

1998

Platinum European Fund

Platinum Japan Fund

1999

Optima (Japan)

2000

Platinum International Brands Fund

Platinum International Technology Fund

2003

Platinum Asia Fund

Platinum International Health Sciences Fund

2005

Platinum Global Fund (Long Only)

2007

Platinum Asset Management Limited ASX Listing

2014

mFund Platinum Global Fund

2015

Platinum Asia Investments

Platinum World Portfolios – International, Asia and Japan (UCITS)

2017

Platinum International Fund (Quoted Managed Hedge Fund)

Platinum Asia Fund (Quoted Managed Hedge Fund)

2018

Opened London Office

2017

Platinum Opportunity Cayman (×4)

2021

Platinum Investment Bond

2022

Platinum Global Transition Fund (Quoted Managed Hedge Fund)

Platinum World Portfolios – International Health Sciences Fund (UCITS)