The focus and behaviour of commentators and investors often reflect their assumed knowledge and individual experience. These factors, if not guarded against, create natural biases that are not easy to overcome. Perhaps, this is no more apparent than in investor sentiment towards China today.

Below, we explore a number of observable social and economic trends and associated policy responses currently taking place in China, that with a slightly different perspective, may surprise many.

Targeted Policy Response

China is known for its centralised command. However, like all political systems, within this, there is a set of behaviours highly focused on survival of the status quo; the maintenance of power and authority. Therefore, there is a highly developed streak of policy action that seeks to look after the people’s interests. This is, front and centre, the implementation of populist policy. The policies may not always be successful or seem sensible to the outsider, but the ‘protectionist’ intent is there.

There are currently three areas of populist policy that are of interest to us.

Multiple Child Policy

The aging and future declining population needs resolution. This is typically mitigated via increased birth rates (although, for many countries these remain stubbornly low), migration and/or productivity increases. While there was a recent relaxation in the ‘number of children policy’ to three, this is purely a signal trying to encourage families to increase their population replacement rate. Although signalling in such a fashion is logical, there is also an understanding that they need to address the root cause: the prohibitive cost of raising a child in China.

China is a hugely competitive country, where there is a strong desire to see their offspring have a higher standard of living than they experienced themselves. The meritocracy and associated hugely competitive environment has resulted in a massive after-school tutoring industry, growing from RMB 203 billion (US$32 billion) in 2011 to an expected RMB 564 billion (US$88 billion) in 2021[1], supplementing the standard school system.

The cost associated with this has grown commensurately, making it prohibitively expensive to raise a child. In response, legislation has been introduced to cap both the duration and cost of tutoring. A pilot trial placing restrictions on tutoring is expected to be conducted in nine cities/municipalities including Beijing, Shanghai and Jiangsu for twelve months, before being rolled out across the country[2]. Furthermore, there is the potential increase in school hours, beyond 4:30pm, allowing parents to continue to work longer (and for teachers to work longer too), therefore removing the need for the gap between school and work to be picked up elsewhere.

Effectively, this legislation is an attempt to narrow the inequality gap as well as help improve the affordability of having additional children. The outcome has been catastrophic for the tutorial suppliers, and one that may prove an opportunity to invest, which we are currently exploring.

Property Affordability

In the midst of a requirement to transform the quality of the country’s property stock to a modern standard, there is currently a property boom in China and resultant affordability issues, which is also replicated in many countries globally. Such is the level of demand that the sale of new apartments is managed through a lottery system, with potential buyers hoping their number is selected, and if successful, they must choose a property on the spot.

The demand is also seen through the secondary market, with property being more expensive than the primary market. For example, in Shenzhen, new builds are being developed at rates of up to RMB 40,000 (US$6,200) per square metre (sqm) less than neighbouring properties in popular areas[3]. In response, a range of controls have been established to direct development towards the lower-quality tiers, as well as an attempt to constrain demand to avoid a ‘bubble then bust’ cycle.

These controls are aimed at both developers and individuals. Developers are faced with apartment price caps, forcing them to build lower-margin, lower-quality tier property (social housing for the mass population). There has also been a forced reduction in financial leverage available to the developers (a similar edict exists against individuals, as well as restrictions associated with owning second homes). Finally, there is now centralised land bidding, with multiple blocks of land being released at the same time. This requires the ability to access significant funding all at once, a clear constraint when coupled with restricted access to credit.

These impositions are clearly having an impact on property developers’ operations. Block land releases favour the larger and better-funded players. Pricing restrictions further impacts the profitability of firms. The combination of these factors has meant that the higher-quality, better-managed developers are more likely to survive as lower-quality operators are forced out. We are starting to see this impact through the likes of China Evergrande, a developer currently being forced to sell assets (its land bank) to lower its debt exposure in order to survive[4]. As its financial position becomes more untenable, a vicious circle emerges as property buyers are reluctant to transact with them (all purchases are paid for up front), fearing the property developer will not be able to deliver the property. It does not take much imagination to see where this is going.

Stock market investor reaction has been to (not surprisingly) shy away from developers. Despite long-term historical earnings growth and the expected long runway of growth ahead, we have been able to buy selected high-quality Chinese developers, such as China Resources Land, China Vanke and China Overseas Land & Investment on single-digit earnings multiples on depressed earnings. Ultimately, we believe that there will need to be a return to the provision of properties of a quality expected by the wealthier demographic, with associated margin improvement.

Technology Giant Crackdown

To be clear, this is not unique to China, it’s a global phenomenon. Governments, regardless of their persuasion, are not in favour of wealthy entrenched interests. Whenever organisations hold significant power, both in terms of vast resources and audience, it is only natural for governments to want to curb that power.

China has a long history of cracking down across a wide range of anti-competitive (and anti-societal) practices, whether that be film stars not paying taxes or the destructive practice of uneconomical parcel delivery.

The fear of manipulation gives us the opportunity to buy stocks at attractive prices, and the curtailment of unprofitable practices allows our investment in independent well-managed high-quality and profitable companies, such as parcel delivery firms, the potential to realise normal/reasonable margins and profits.

Over the past few years, the Chinese government has placed various restrictions on the technology sector, including limiting online advertising practices in the medical sector and restricting the hours that minors can play computer games. More recently, we’ve seen an increased focus on e-commerce, as they look to push back against monopolistic practices and try to ensure the large internet platform companies don’t take advantage of their positions to the detriment of staff, consumers, retailers or manufacturers. It is an ever-shifting battleground, as the reach of these platforms grows, touching more and more areas of daily life.

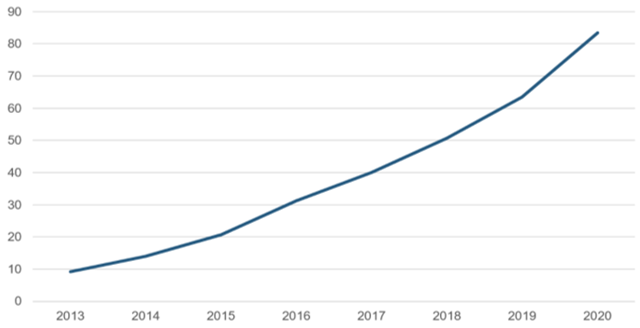

For example, this is readily seen in the rapidly growing e-commerce parcel delivery market (with over 80 billion parcels delivered in China in 2020, up from just under 10 billion in 2013[5]), where unprofitable practices, through a brutal price war, have been an attempt to grab market share away from the well-run independent players such as ZTO Express. While this has severely constrained ZTO’s profitability, legislation has emerged stopping the likes of Alibaba from supporting the delivery of parcels at unprofitable prices in an attempt to control the market. Financial services are also increasingly shifting online, again sparking concerns about the power of platforms, as well as their potential impact on financial stability.

Fig. 1: Chinese Parcel Volume - Billions

Source: Platinum, FactSet Research Systems, ZTO Express.

Unfettered Dynamism

These examples of centralised intervention, lead us nicely to thinking about the hyper-competitive and capitalist nature of the Chinese commercial environment. Within this, there is, not surprisingly, a changing perspective on local Chinese entrepreneurial activity, an increased confidence in the ingenuity of domestic entrepreneurs and what it means to consume locally made products.

We touch on three examples of this emerging entrepreneurial activity and consumer behaviour below.

Made in China

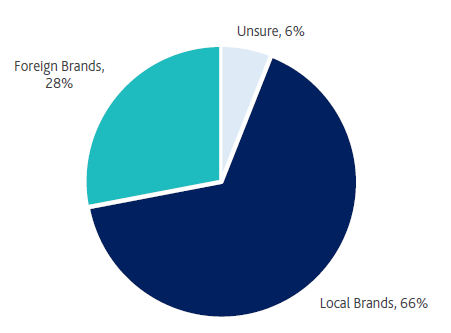

There has been a notable shift toward the acceptance of locally designed and made brands. Where ‘Made in China’ used to have a stigma, it now has some cache. According to a survey by Statista of Chinese consumers in 2020, around 66% of respondents preferred to buy products from local brands, up from 61% the previous year[6].

Fig. 2: Chinese Consumers’ Brand Preference: Local vs. Foreign (2020)

Source: Statista.

Certainly, there is a way to go for home-grown luxury goods to be accepted. However, for the likes of Anta Sports Products and Li Ning, their sport apparel and trainers are now increasingly preferable to the US and European brands[7].

This has a significant impact for both sides to the story. With a deep and growing customer base, China has always been held out for Western brands, as the next potential leg of their growth story, benefiting the valuations of many. The demise of this ‘given’ growth path will not be helpful for valuations. Conversely, as this momentum grows, local brands stand to benefit, providing the ability to improve their margins. It is also reasonable to anticipate this preference for locally made brands to move to a wider range of consumer goods. For example, the rise of China Feihe (a leading provider of infant formula and other dairy products), compared to a2 Milk. Historically, it was the trusted nature of the Western brand that furnished their impressive growth and associated valuations. As the faith in the domestic produce increases, the halo effect for a2 Milk diminishes.

Technological Development

There has been a history of Chinese firms being ‘encouraged’ to support domestic technology development, thereby spurring the development of local expertise. This reflected an early recognition of the need and desire to avoid the reliance on foreign firms. In a competitive global market, this directive to adopt what may potentially be inferior technology, is uncomfortable; it probably dilutes your edge and ability to compete.

While lately, given tensions with the US, this approach seems like prudent anticipation, after a long period (decades) of commitment, Chinese firms are now in a position where companies are choosing local technology on its own merits. Indeed, we are also seeing the adoption and recognition of Chinese technology advances being accepted beyond China.

Within this framework, Huawei’s experience frames the perception of many investors. Huawei has for a long time been one of the main providers of telecommunications technology – a position that was not as easy to remove as first hoped by the Trump administration. Huawei’s technology was first-rate, providing a vital contribution that could not be readily replaced by non-Chinese solutions. Directions by the US government to cease using Huawei components proved difficult, resulting in delays in implementation of the directive. By 2019, in the face of Trump’s anti-Huawei edicts, rural networks that were built using lower-cost Huawei components were still struggling to find replacements, despite the original directive being made in 2012[8].

This perception of inferiority may result in missing opportunities such as OneConnect (which was part of Ping An Insurance and a factor in our original Ping An investment). OneConnect produces auto insurance claim assessment technology, where post a car accident, drivers are able to send a video of the damage to their vehicle to their insurance company and they assess the damage and process the claim on the spot. This technology is now starting to be adopted by Western insurers. Furthermore, we are also starting to see Chinese technology firms popping up in various other high-end applications such as robotics, machine vision and power controls.

Financials

As China moves through the various stages of socio-economic development, consumer expectations and needs shift. This is seen in many of the subjects above, but the development of a financial ecosystem has a long path to follow. While housing and industries all need funding, via debt or equity, insurers also stand to benefit. With the rise in consumerism, there is a meaningful growth runway in the insurance industry. A report by McKinsey and Company released in November 2020 on the Chinese consumer, stated that four out of five Chinese consumers intend to purchase more insurance products post the COVID crisis[9].

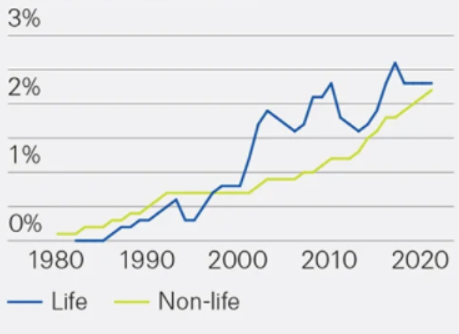

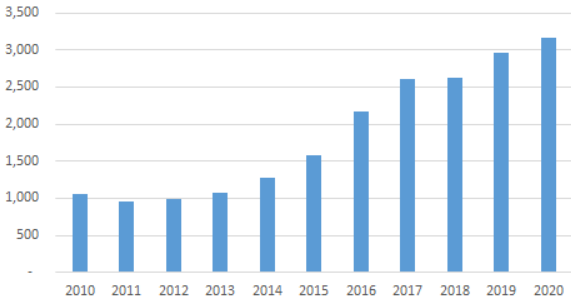

The Western world is used to financial products being a major component of our lifestyles, but in China this is only just beginning (see Fig. 3 and Fig. 4). For firms like AIA, who have over many years proved themselves to be a trustworthy operator, this has meant progressive expansion of licences into additional regions.

Fig. 3: Insurance Penetration in China

Source: Swiss Re Institute.

Fig. 4: Life Insurance Premiums in China (RMB)

Source: Credit Suisse.

This has been an identifiable trend for some time and accordingly, an area our strategies have exposure to. The natural next step for the Chinese financial system is the development of a more mature savings industry. China’s pension system is multi-dimensional. There is a basic state pension as well as a mandatory employee contribution second tier. Provisions also differ between urban and rural regions. The State pension system consists of various provincial pension plans and accounts for two-thirds of total pension assets. While we won’t delve into the detail in this paper, needless to say, the demand for personal long-term saving mechanisms is growing, and with it, the opportunity for players to enter the market. According to McKinsey and Company, a survey in 2020 of post-COVID consumer behaviour found that 41% of consumers planned to increase their sources of income through wealth management, investments, and mutual funds[10].

This is a rapidly changing model, and as regulators open the gates and allow access, the lure of the potential savings pool will see all-comers arrive. While today, this means the likes of Goldman Sachs opening-up in China, the local players such as leading independent Chinese wealth manager Noah Holdings and China Merchants Bank are of greater interest to us.

Biases and Opportunity

In this article, we have merely touched on a range of changes within the Chinese ecosystem that we believe provide further opportunities. As we are aware, and our investment process dictates, this does require that our natural biases be put aside.

By no means do we advocate making observations around China through rose-tinted glasses, simplistically suggesting volume, duration and development offer a failsafe opportunity. However, it highlights to us, how our immediate reactions need to be tempered.

[1] Source: Deloitte China, Deloitte-cn-tmt-china-education-development-en-report-2018.pdf

[2] Source: https://www.reuters.com/world/china/exclusive-china-unveil-tough-new-rules-private-tutoring-sector-sources-2021-06-16/

[3] Source: https://sg.news.yahoo.com/bad-news-shenzhen-housing-speculators-080146565.html

[4] See: https://www.reuters.com/article/us-china-evergrande-breakingviews-idUSKBN29O08R

[5] Source: Platinum, FactSet Research Systems, ZTO Express.

[6] Source: https://www.statista.com/statistics/1183456/china-preference-of-local-and-foreign-brands/

[7] Source: https://www.scmp.com/lifestyle/fashion-beauty/article/3129648/anta-sports-and-li-ning-rival-nike-and-adidas-sportswear

[8] See https://www.wsj.com/articles/rural-u-s-carriers-resist-proposed-chinese-telecom-ban-11549886402

[9] Source: China consumer report 2021 - Understanding Chinese Consumers: Growth Engine of the World (Special edition Nov 2020)

[10] Source: See previous footnote.

DISCLAIMER: This article has been prepared by Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”).

While the information in this article has been prepared in good faith and with reasonable care, no representation or warranty, express or implied, is made as to the accuracy, adequacy or reliability of any statements, estimates, opinions or other information contained in the articles, and to the extent permitted by law, no liability is accepted by any company of the Platinum Group® or their directors, officers or employees for any loss or damage as a result of any reliance on this information.

Commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. Commentary may also contain forward-looking statements. These forward-looking statements have been made based upon Platinum’s expectations and beliefs. No assurance is given that future developments will be in accordance with Platinum’s expectations. Actual outcomes could differ materially from those expected by Platinum.

The information presented in this article is general information only and not intended to be financial product advice. It has not been prepared taking into account any particular investor’s or class of investors’ investment objectives, financial situation or needs, and should not be used as the basis for making investment, financial or other decisions. You should obtain professional advice prior to making any investment decision.