Jack Cao, investment analyst from Platinum’s Asia team, gives some highlights from the rapid rise and multi-faceted development of China's internet companies.

Below is an edited extract from the presentation given by Jack Cao at Platinum’s Regional Adviser Roadshow Series in mid-August 2016.

One does not need to be an astute observer to have noticed that a number of the Platinum funds hold positions across several Chinese internet companies. Many of these companies have leading positions in products that are analogous to what most members of the audience are familiar with. Such holdings include Tencent (the Facebook of China), Baidu (often called the Google of China due to its dominant positions in search and maps), Alibaba (an absolute powerhouse in e-commerce), JD.com (often called the Amazon of China due to its position as the leading direct online retailer) and Sina (the Twitter of China). So I thought it would be worthwhile to share with the audience today why we believe the Chinese internet sector is a prospective area for investment.

When one reads the financial press these days, one cannot help but face a barrage of negative headlines on the impending doom facing China as the country undergoes an economic transition from a fixed asset investment-led economy to a consumer-led economy. What these doomsayers fail to mention is that there is a vibrant services sector that is playing an increasingly prominent role in driving the next leg of growth in China. The services sector accounts for half of the country’s total economic activity and almost 90% of its economic growth. What makes the internet companies interesting is that they are playing a pivotal role in supporting the development of the service sectors.

An important point to note here is that our internet investments are all in privately owned enterprises that are being run by commercially minded management. These are not state-owned enterprises which sometimes have multiple conflicting agendas and for whom earning a return for shareholders is sometimes subordinate to the priorities of national development.

The Size of China’s Internet Population

Let’s start with some background numbers to set the scene on the scale of the opportunity that we are staring at: China currently has around 710 million internet users, or just over half of its total population. That’s 30 times the size of the entire Australian population! In the more affluent coastal areas, internet penetration rate is considerably higher than 50%.

In China, because internet adoption had a late start (compared to the West) and is still ongoing, we are witnessing several forms of leapfrogging all occurring at the same time compared to patterns witnessed in developed countries. Users are bypassing PCs and keyboards, going straight to mobile handsets (90% of internet users in China access the internet through mobile). Why is this the case? Mobile internet provides greater accessibility and 24 hour connectivity. It is also cheaper to own – you can buy an entry level Android smartphone for under $100 while you need to pay $600 to own a PC.

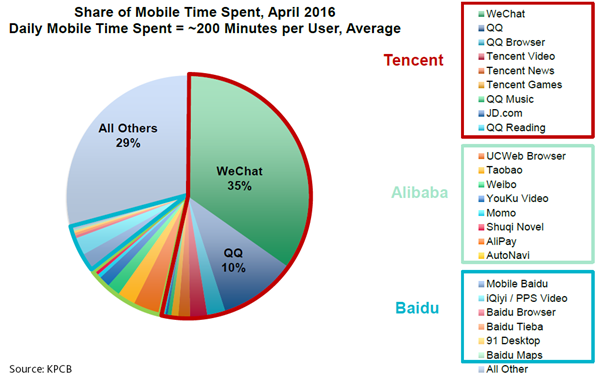

The piece of metric that I think is most likely to surprise is the average daily time spent on mobile per user: 200 minutes! That’s almost 3.5 hours on the phone each day browsing, shopping and playing games.

Know Your Customer

At Platinum we think that the Chinese internet landscape is still often misunderstood and misrepresented by the Western press. Over the years many Silicon Valley giants have tried, but failed, to crack the Chinese market, including Google, eBay and Yahoo. This has led some cynics to believe that the Chinese government blocks Western services in order to promote the development of home-grown companies, who are simply imitators of existing Western products. There is no shortage of people who naïvely believe that Chinese citizens are being obstructed by the Great Firewall of China and are desperately waiting for the arrival of Facebook and Google, when in fact they have got their own internet and it is just as good as what’s available in the West. The reality is that when you have a country that has a radically different language and culture, it is difficult for foreign companies to understand the nuances of local market quick enough to be able to outcompete their local rivals.

Just last week it was reported that Uber has chosen to exit China after 2.5 years of fruitless competition against local incumbent Didi. Uber had failed, not because it did not have access to the Chinese market, but because it did not understand the Chinese market and the Chinese consumer. This was evident in Uber’s business practices that antagonised user experience for the locals, such as its use of Google Maps (even though it is notoriously inaccurate in China), the lack of integration between the Uber app and social messaging apps (which had become a key part of the daily life for the Chinese long before Uber’s arrival), and requiring users to validate their credit card account details before they can open an account on Uber (even though only a fraction of China’s population have credit cards)…

Master Innovators at Master Apps

Not only do Chinese companies have a home ground advantage in understanding local user preference, but also, in many ways, China already leads the world when it comes to mobile tech and applications. Let’s look at some concrete examples of this.

Those of us that are Facebook users would have noticed that Facebook has recently introduced live streaming. Facebook has also reportedly been working on integrating taxi hailing and mobile payment services within Messenger. Meanwhile Snapchat users would have noticed the introduction of a QR code scanner in their Snapchat app which readily connects one user with another by scanning codes made up of misshaped checkerboards. All these features were first popularised in China.

Whereas Western tech companies emphasise simplicity in their app designs, Chinese companies compete to create master apps with as many functions as is practical. This leads to better integration of services and a more frictionless mobile-first experience. The result is three dominant companies which together account for 70% of mobile time spent. And one company, in particular, single-handedly accounts for over half of all user time spent on mobile.

That company is Tencent, which owns the dominant mobile social network in China – WeChat, with over 700 million active users. Practically every internet user in China is a WeChat user, and 55% of users open the app more than 10 times a day.

What started out as an instant messenger in 2010 has now become a fully-fledged mobile operating system for a wide range of daily lifestyle services, so much so that users’ daily lives now revolve around the app. Users use WeChat to order taxis, send money, order food from restaurants, follow celebrities, track companies and the list goes on. An important factor in WeChat’s phenomenal success is that it has been able to layer on monetisation in ways that did not interfere with user experience.

Mobile Payment

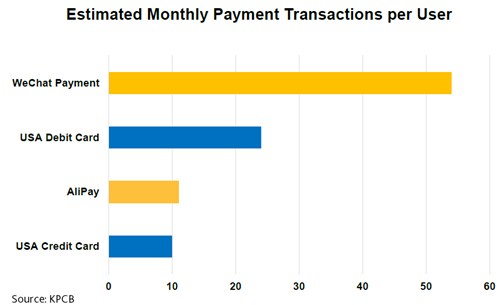

A key enabler of these services is the introduction of the WeChat Wallet mobile payment platform. In China, users are leapfrogging credit cards and moving straight to mobile wallet. The intensity of engagement is simply off the charts. Users on average make over 50 transactions per month. That’s twice the usage level of all debit cards in the US and five times the level for credit cards.

The popularity of its payment platform is in turn enabling WeChat to challenge native apps and browsers as the default gateway for e-commerce. Almost one-third of WeChat users are now making purchases within WeChat. At 220 million users, that accounts for almost half of all e-commerce buyers. So we now see a virtuous cycle forming for Tencent – the more companies’ official accounts and more merchants are set up on WeChat, the more likely it becomes for users to transact within the app.

E-Commerce

In e-commerce, online transaction value now accounts for 13% of China’s national retail sales. That means for every $100 spent on retail, $13 is spent online, with the remaining $87 spent in brick and mortar stores. This is nearly double the 7% online retail penetration seen in the US. To get an idea of the scale of online retail activity in China, just picture the 50 million parcels delivered on a daily basis.

Why is e-commerce thriving in China? In developed countries, offline retailers have had a multi-decade head start over their online rivals in building out their supply chain. Wal-Mart has been in operation since 1962 and generates over $300 billion in turnover. This volume gives Wal-Mart substantial sourcing advantages in terms of price and trade terms which the retailer in turn passes on to consumers in the form of lower prices. Note that despite the onslaught by Amazon in recent years, Wal-Mart’s sales are still four times those of Amazon.

In China, offline retailers have not had sufficient time to build out this supply chain advantage before being disrupted by online retailers. Offline retail is not only fragmented, but retail infrastructure outside of big tier-1/2 cities is underdeveloped. Those who have travelled around China may have noticed that when you go to a small city or county, it is completely different to large cities. There you can’t find a pharmacy or supermarket within driving distance. Consequently, consumers are leapfrogging brick and mortar stores and going directly to e-commerce. Not only does online retail offer wider product selection, the convenience of fast delivery and more competitive prices, many of the daily necessities are simply not available at physical stores in small townships.

An important unique characteristic of the Chinese e-commerce market is that it is highly concentrated. Rather than having retailers large and small operating their own independent sites, retailers instead open storefronts on one of Alibaba’s platforms. This centralisation of shopping destination and standardisation of user interface and check-out process leads to less friction in user experience. Rather than having to remember a dozen sets of different login details, you have a single set of login and one online wallet. For every $100 spent online in China, $77 is spent via Alibaba’s Tmall and Taobao platforms. In the US, Amazon has an estimated share of “only” 25% of online retail volume.

So, how are we participating in the growth in this dynamic space? We own positions in the following companies. Each of Tencent, Alibaba and Baidu is very profitable and commands large numbers of eyeballs. JD.com and Sina have differentiated propositions and we see these companies gaining strength over time.

|

Company |

Market Cap (US$bil) |

Revenue (2015) (US$bil) |

Growth Rate |

|

Tencent |

230 |

16.4 |

30% |

|

Alibaba |

210 |

15.9 |

32% |

|

Baidu |

60 |

10.5 |

35% |

|

JD.com |

30 |

28.8 |

55% |

|

Sina |

4 |

0.9 |

15% |

|

Source: Bloomberg, Platinum |

|||

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.