The last four weeks has seen a rapid rebound from one of the sharpest falls in market history and yet, in our flagship global fund, the Platinum International Fund, we have remained conservatively positioned. This update explains why we remain comfortable with such a position.

The framework we have been using is that the removal of substantial amounts of labour as an economic input, due to coronavirus lockdowns, has had a catastrophic impact on economic activity, and that the market needs to be able to anticipate a clear path back to work before we can contemplate a sustained recovery.

While some of the elements appear to be falling into place i.e. lockdowns are working to slow the spread, ICU capacity has been increased, and progress made on an anti-viral, our sense is that while we have had a bounce for now, we are not out of the woods.

In simple terms, the market has so far treated the events of the last couple of months as a correction (like the Asian crisis or European sovereign crisis) and focused on a so-called V-shaped recovery. We have been managing the flagship portfolio as if we have fired the first warning shots in a bear market. Avoiding permanent impairment of capital remains a critical element of our investment approach.

Having taken swift action in late January when the virus impacted Wuhan and again in late February when it reached South Korea, Iran and Italy, one might say that we missed the opportunity to meaningfully increase exposure when the market hit its 23 March lows. However, we would argue that the economy is damaged and we have still to work out how we pay for the stimulus. While we did some buying near the lows, the sharp jump up in the first couple of days left us unwilling to chase the market higher.

With rates near zero at the start of this event, we have seen stimulus as the main response. This is a critical point; the cost of money to corporates has risen as spreads have blown out, not fallen. This is not helpful. In previous bear markets – the tech wreck and the GFC, interest rates were a tool, now they are a blunt instrument.

As longer term bond yields fell to all-time lows, the market has continued to widen the spread between so-called value and growth/defensive stocks; we have highlighted this gap for some time and our desire to avoid overpaying for apparent certainty.

This recovery so far looks to us to be an expression of the ultra-low bond yield, indicative of poor economic prospects, as opposed to a bet on economic recovery. Using equities as proxies for bonds seems odd to us – why not just lock in the sub-1% returns for 10 years that are offered with no risk from the US government, if one is so risk averse?

Through this period, we have been building increasing value into the long side of the portfolio (adding for example, semi-conductors, travel, industrials and autos), and maintaining a relatively large short book – this became more stock specific near market lows, using companies that have defied gravity in preference to broader indices. In a bear market, the obvious areas get hurt first before the hotter parts of the markets sell-off later.

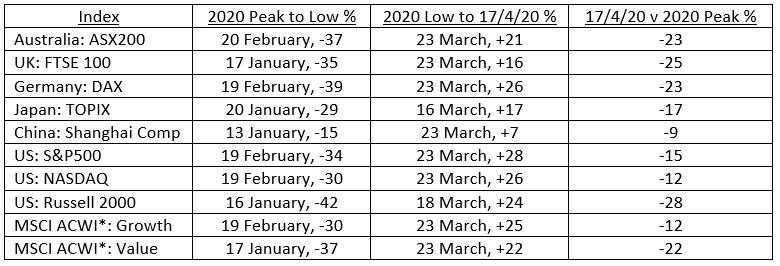

Some of the market moves off lows are quite spectacular (in local currencies) as this table below shows, with the US only 15% from all-time highs. We note in the post-GFC recovery it took two years to get back to such a level.

To read the table e.g. Australia, from its peak on 20 February it dropped 37% to its low on 23 March; from its low on 23 March to 17 April (most recent figures) it has rebounded 21%; from 17 April (most recent figures) to the markets peak on 20 February it has dropped 23%.

*MSCI All Country World Index

Where we are today, at a global level, we find it hard to see things get much more positive in terms of the narrative about recovery, and while we would like to deploy more cash, and remove shorts, in time, we would likely need a price setback to entice us. Where this might differ is if we were to form a stronger view that government intervention will simply lead to asset price inflation, but we think economic activity is more important in driving sustained recovery.

It seems hard to believe that only a month on from lockdown, that the economies of the world are not impaired and that all stocks should have been punished, yet, for example, the technology heavy Nasdaq Composite Index, remains very close to all-time highs. That seems anomalous and a reason to be very wary.

Having a virologist on the team and an intense focus on Asia as it emerges first from lockdown, gives us a good insight into the key issues and comments follow from our Health Care and regional portfolio managers.

Dr Bianca Ogden (Health Care) notes that the US, for now the epicentre of the crisis, continues to expand testing capacity, while several countries are debating how to include serological testing. Roche and Abbott both launched their serological lab tests last week which will allow wider and more standardised antibody testing. As economies re-open, testing and tracing will become paramount to identify local outbreaks early.

On the vaccine front, BARDA awarded Moderna a significant amount of money to accelerate manufacturing capacity for mRNA-1273, while Sanofi and GSK have joined forces to develop a vaccine. In addition, a new article highlighted Gilead's remdesivir as having efficacy in patients recruited as part of Gilead's clinical trial. Caution, however, must prevail as these are anecdotal observations, with the real clinical trial data currently being analysed and due to be released very soon. We own Moderna, Sanofi and Gilead in the global funds[1] and Platinum International Health Care Fund.

Dr Joseph Lai (Asia) has been increasing the exposure in his portfolio, adding across the region. China continues to return to work and activity levels are normalising (travel is weak but improving). Our focus is on adding to strong companies, unfairly sold off. India remains in lockdown with new cases rising as testing ramps up (with a net invested position of 6% in the Platinum Asia Fund as at 20 April). We are starting to see the chance to add to good Indian companies at much lower valuations.

Scott Gilchrist (Japan) points out that the impact of the virus in Japan is slowly but steadily worsening and hence there is an increase in social distancing and remote working. At this time, the Japanese portfolio remains conservatively positioned. Core holdings include many companies exposed to the digitisation trends that the virus appears to be accelerating: Nintendo, Nexon, Oracle Japan, GMO Internet and Cyberagent are example. Astellas, Eisai and Takeda are major components of the Platinum Japan Fund’s large medical exposure. The medium to longer term investment case for Japan has been clearly laid out over recent quarterly reports.

Nik Dvornak (Europe) observes that lockdown measures are successfully disrupting the transmission of COVID-19 across Europe. Many countries are preparing to loosen restrictions in early May led by Denmark, Germany, Austria, Switzerland and the Czech Republic.

As per the global context, the European rally has been uneven as markets have recovered some of the lost ground – simply put, businesses seen to be insulated are back near previous highs and cyclicals remain close to lows.

The key uncertainties in Europe, as per the rest of the world, relate to the rate of new infections after restrictions are loosened and how quickly activity recovers. This pace of recovery coupled with specific lockdown exit strategies should be the key determinant of whether this gap narrows.

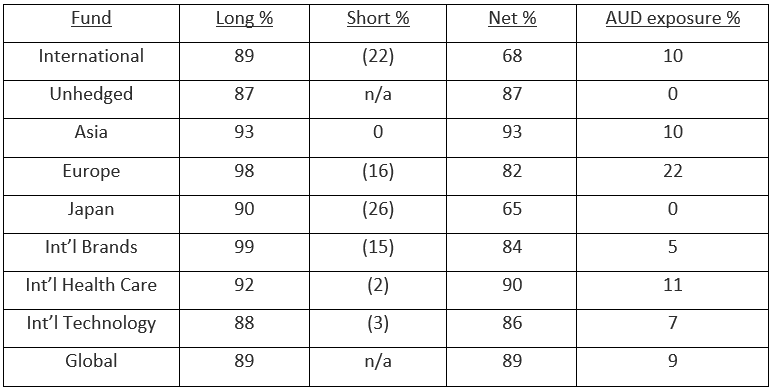

Below we publish the most recent portfolio exposures as at the close of business on Monday, 20 April 2020.

The Platinum Trust Fund Quarterly Report is now available on Platinum’s website.

[1] Platinum International Fund, Platinum Unhedged Fund, Platinum Global Fund, Platinum Capital Limited.

DISCLAIMER: This article has been prepared by Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”). This information is general in nature and does not take into account your specific needs or circumstances. You should consider your own financial position, objectives and requirements and seek professional financial advice before making any financial decisions. You should also read the relevant product disclosure statement before making any decision to acquire units in any of our funds, copies are available at www.platinum.com.au. The commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. No representations or warranties are made by Platinum as to their accuracy or reliability. To the extent permitted by law, no liability is accepted by Platinum for any loss or damage as a result of any reliance on this information.