Beset by fears of trade wars and more, the stock market spring is again coiling. The opportunities are not unlike what we saw 2-3 years ago, which positioned us for the outstanding performance of 2017-early 2018.

Our last Market Update was in early February. Markets globally then fell sharply following a spike in volatility, and we thought markets might have set their highs following very strong performance in late 2017 and early 2018. That has turned out to be true, but many markets – the US, Japan and in Europe, have recovered well from their lows. China has not, and continues to sell off, along with many “emerging markets” including South Korea.

Markets are beset by fears of trade war, Chinese credit tightening, US dollar strength and emerging market weakness. Recall that two years ago markets were beset by fears of Chinese collapse, European banking crisis and Brexit/Grexit and so on. Now, as then, cheap markets and assets are getting cheaper.

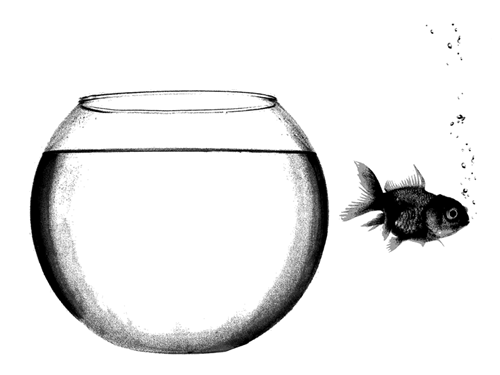

Our holdings in Asia are performing better than their local markets by and large, but in many funds we are surrendering some of the outperformance of recent years. Prior to our strong performance from 2016 to early 2018, we noted that our portfolios resembled coiled springs: valuations were becoming simply too delightful to resist, while the high flyers we had eschewed flew higher.

Once again, the spring is coiling. Cyclicals like industrials, miners, shippers or autos are getting ever cheaper, in a world with mild, positive inflation and reasonable global growth. Our past experience has shown that holding a portfolio of stocks with such attractive valuations can result in good returns for investors.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.