Platinum's Investment Specialist Julian McCormack speaks with nabtrade's Gemma Dale on the huge disparity between the valuations of growth and value stocks.

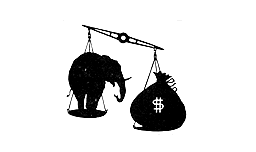

While Australia’s tech darlings have achieved spectacular share price growth, the global tech behemoths continue to dominate markets. These ‘growth’ companies are trading on eye watering multiples in many cases, while less glamorous companies languish on valuations well below their long run averages. The divergence in valuation between growth and value stocks has not been this great since 1999.

So what is an investor to do? In this podcast Julian McCormack discusses:

- Why investors continue to buy growth, despite the decreasing likelihood their investment will pay off

- Historical comparisons when markets reached such a wide dispersion of valuations

- The concept of the ‘new normal’ in a world of zero interest rates

- A reality check for investors on the Nasdaq, which dropped 75% in 2000 and didn’t make a new high for 15 years, and

- Thoughts on how to seek out companies with a strong track record of delivering value.

Disclaimer

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances.