Given the resoundingly negative and sometimes apocalyptic view of Japan held by a wide range of foreigners, it is always with some trepidation that I board the flight to Haneda Airport in Tokyo, only to arrive and find a gap between perception and reality.

Japan isn’t Zimbabwe or Venezuela, as sometimes described. It even feels awkward to write that sentence. While Japan has undoubted problems, there is a cohesion and stoicism inherent to the local population which has withstood three decades of grinding deflation and centuries of irrepressible change. In today’s uncertain world, Japan’s stable political system stands out with virtually no protest or social unrest. In perhaps the most striking repudiation of the negative views of Japan, the country’s unemployment rate is now lower than seen in many decades. Prices are starting to rise in some sectors after decades of stagnation. While strident predictions of the future are perilous at best, I think it is an interesting exercise, and likely a financially rewarding one, to ponder what Japan might look like if it does indeed see a paradigm shift after thirty years of a post-bubble, deflationary regime.

The founders of Platinum have been visiting Japan for almost three decades, so my recent trip with Kerr Neilson and other colleagues to visit 34 Japanese companies was a longitudinal study of one of the longest bear markets in the financial market history of the developed world. While we were working like bees on detailed company and industry analyses, we spent a little time walking around Shinjuku Gyoen National Garden and the Imperial Palace and sampling the local cuisine. The atmosphere was pleasantly subdued as the arrival of the cherry blossoms was two weeks hence. One meal in particular brought the overall conundrum into context. We sat at a counter top made of silky untreated Nagano cypress in a superbly designed small restaurant, and were treated to a meal of a quality hard to find anywhere in the world at a price a fraction of what might be expected. The value, quality and uniqueness of the offering, combined with a wide variety of experiences in a safe, clean, green and attractive environment, go a long way to explaining Japan’s resurgence as a tourist destination.

Over seven days in Tokyo and Kyoto we met with 34 companies, plus most of our regular contacts and a set of security analysts. It was a very productive sequence with almost two-thirds of the company visits prompting urgent further work. The quality of the meetings has also noticeably improved with the majority conducted in English. There was a sense of a genuine attempt to assist us with our lines of enquiry, rather than stonewall, as seen so often in the past. Unprompted, the mostly diminished envoy on the other side of the table would often offer financial targets and talk about profitability.

The broad Japanese stock market is currently at the same level as it was in 1990, almost three decades ago. During this time, the Dow Jones Industrial Average has risen by 700%. The German stock market has performed with similar strength. Global bond and real estate markets have produced stellar returns. The absolute and relative return of the Japanese equity markets over the last three decades has had a deep and profound impact on investor psychology. Currently, this is expressed as a set of subliminal concerns, the true depth of which only surfaces after a detailed discussion. The list of longer-term worries includes demographics, corporate governance, natural disasters, North Asian competition and future tax increases. More recently, the headline concerns have centred on North Korea, Chinese naval excursions and Prime Minister Abe’s security of tenure. Where concerns can be expressed, they are most likely being addressed by the relevant authorities and assessed by the financial market.

One discussion at the forefront for domestically-biased corporates is demographics, due to government predictions of a base case population decline from 130 million to 60 million over the next four decades. This obviously changes the investment focus for housing, insurance and other domestic industries as the nation would retreat to a handful of major conurbations. In Japan, fertility is a complex topic involving public health, marital relations, economics and working hours. Sitting across the table from a Japanese man and woman attempting to explain the century long development of male/female relationships is a fascinating study. In brief, the absolute primacy and misogyny of the male of the elder generation has been denied by the current generation. This is not unique to Japan in Asia. A revised set of terms of engagement has been negotiated, but not yet fully implemented. The fundamental human impulse has not been lost. This undeniable demographic trajectory is well understood by all levels of society, and recent improvements to working hours have been made with this in mind. This change in the work-life balance started a few years ago, but has now spread and is implemented in legislation. Immigration is almost certainly not the main solution, although it might contribute. Projections by Japanese corporates who sell baby supplies to the domestic market show a benign medium-term outlook with a slow and manageable population decline for the next decade as the children of the baby boomers move through the system.

Behind all of the underlying concerns is the key issue: the structure and stability of the overall financial system. Most Japanese debates end with or sidetrack into it at some stage. This topic is particularly pertinent for financial markets today as the Japanese system moves along an experimental path which other mature democracies are likely to follow in future decades. In the official accounts, the Japanese government will have more liabilities than assets within the next 12 months. This seems problematic at first, but when considered in the context of the Japanese system, the global network and a slowly growing world economy, it is perhaps not of primary importance. It is hard to estimate the total financial assets in Japan, but it could be around US$80 trillion, which makes the overall debt burden seem less onerous, especially when the obligations are to internal entities and the country as a whole has a large net foreign asset position. Nevertheless, it is a complicated topic, and our best efforts have failed to identify the underlying plan. The recent suggestions from foreign experts seem ill conceived, particularly with regard to practical implementation. Our conclusion is that there isn’t a master plan, and thus there remains a high degree of path dependency which obviously has a large impact on future asset prices, inflation, currency and the local economy. In summary, Japan is a functional and competitive economy which, due to a past major financial event, is financed inappropriately and will eventually undergo a financial restructuring, probably without too much major disruption, but with outlier cases of systemic breakdown. This seems rather similar to many other nations and perhaps the global system.

Credit Suisse estimates that the data volumes flowing across Reliance Industries’ new mobile phone network in India after six months of operation exceed those of any other global network, including developed markets and the core Chinese networks. After decades of post-Cold War experience, it should no longer surprise us how the dynamism and "invisible hand" of capitalism continues to improve the lives of people across the globe against the odds. The last decade saw more people brought out of poverty than any prior period. The correlation with smartphone proliferation is strong. The global population centre is Asian and, while Japan is perched on the edge of this region, the connection has deep roots. Indonesians respect the Japanese for their assistance in recent decades. Suzuki owns the leading car manufacturing and distribution business in India. A meeting with an investor who owns the first foreign accounting practice in Burma talked of the omnipresence of Japanese corporates throughout the country. Itochu’s work with Thailand’s Charoen Pokphand Group to purchase 10% of CITIC Limited, a key subsidiary of China’s first state-owned investment company founded at the command of Deng Xiaoping, talks to Japan’s deep connection with Thailand. Itochu was the first Japanese trading house to return to China in 1972, and is now only one of a multitude of Japanese companies operating and manufacturing in the world’s largest economy by physical volumes. Pigeon has a 50% share of the Chinese market for high-end feeding bottles and other baby goods through a wide range of physical and online channels. Minebea recently built Cambodia's largest building to increase its manufacturing capacity. We recently saw Minebea's world-record, commercially-manufactured, smallest ball bearing with an outside diameter of 1.5 millimetres and a selling price of a hundred dollars each. Nippon Ceramic makes a range of its ultrasonic and infrared sensors in both China and the Philippines and in fully automated factories in Japan. Sumitomo Metal Mining runs two high-pressure acid leach facilities in the Philippines, mixing waste ore with sulphuric acid at high temperature and pressure to recover high quality nickel and cobalt for Panasonic and, through it, Tesla’s battery production and its new Model 3 production facility in Nevada. As Asia grows, Japan will benefit. As Asia becomes richer, the people will increasingly gravitate towards the higher quality products, experiences and culture found throughout Japan.

Reminiscing by some of our hosts reminds one of the excesses of corporate Japan in the 1980s. “We spent money, made acquisitions and operated our company with no regard to financial returns or cash flows… Debt was freely available…” was a stylised comment made by some of the older executives we have met. They quickly followed this up by contrasting it with current behaviour which could easily be from a modern financial management textbook. Nevertheless, there is a wide dispersion of behaviour across the system. This is partly due to the lack of an active market for corporate control. It is easy to find companies where the breakup value is multiples of the current valuation. Behind-the-scenes efforts to effect change at these entities are thwarted in many different ways. Overall, the numbers show a record level of dividends and record value of share buy-backs, clearly evidence of continuing changes of behaviour. Further change will come, but it will occur in typical Japanese style. The pace is accelerating.

Yamato pioneered Japanese package delivery to households in the 1970s and has built an unrivalled network covering the archipelago servicing Rakuten, Amazon, Yahoo Japan, Start Today, other e-commerce companies and the whole of society. In the beginning, they struggled against the historical regulations and bureaucracy dating from feudal times which dictated the flow of goods along paths and routes. It was a grinding battle, the aftermath of which can still be seen today in the competitive dynamics of the industry. Similar societal and economic structures are evident today across the economy. For each example of dynamism, such as Nagamori-san, the founder and CEO of Nidec, Inamori-san, the founder of Kyocera and KDDI, or the early days of Sony, there is an example of corporate atrophy or capture. It feels as though the generation of leaders who rose through the bubble years are seeing out their dotage in leadership positions rather than allowing the rise of energetic younger members of the next generation. Some companies such as Nissan, Takeda and Sony have brought in foreign leadership with mixed results. Others have retreated into irrelevance as they adopted a castle type mentality while their competition in the West accessed all the help they could find across academia and industry. One example of this is Nikon, which is now struggling after losing the lithography business to ASML and is facing a rejuvenated Canon whose Tokki division builds the key capital equipment for Samsung’s OLED mobile screens. While Mikitani has built an interesting entity in Rakuten, the visionary for the broader sector, perhaps the “one-eyed dragon”, is Masayoshi Son of SoftBank. While the purchase price of ARM Holdings is high on many metrics, his track record with Yahoo, Alibaba, Vodafone Japan and now Sprint is a long string of global achievements.

From our detailed company and industry work, a surprising number of global capacity constraints are becoming evident across chemicals, semiconductor components, electrical components, and some complex manufactured items. Perhaps after almost a decade of slow global growth and reluctant spending by corporates, bottlenecks are now starting to appear. Minebea is expanding their production capacity for miniature ball bearings for which they have a 60% global market share as they have reached their capacity of 255 million units per month! In a domestic context, the construction and IT sectors are seeing wage growth. This has yet to spread across the economy, although a recent survey, which showed small company wage growth rising faster than large companies for the first time in the 22 year history of the data series, is just one strong data point in an overall robust picture.

We hear repeatedly that fully automated Japanese manufacturing is now competitive with low-cost labour for a wide range of products, especially higher-end complex goods. Thirty years ago, Fanuc was manufacturing electric motors in a fully automated factory using a robotic workforce, which reminds one of Japan’s lead at the time, just as the shift to China and other low-cost labour countries built momentum. While the perception of Chinese manufacturing competing against developed world incumbents is widespread, a parallel reality is that many Japanese companies compete against each other on the basis of fully automated factories in Japan competing against labour-intensive factories in low-cost labour areas. While Fanuc was an automation pioneer, the knowledge is widely dispersed across the country. Hogy Medical is an assembler of surgical kits for domestic hospitals. Their recent factory expansion reduced staff numbers from 200 to below 20 while doubling capacity. Toyota Industries, Daifuku, Omron and Mitsubishi Electric are only a small number among the companies providing equipment and services in this area. Fanuc, Nabtesco, Yaskawa, Harmonic Drive and many others produce the components and robots for the production lines. There are many production processes which are hard to automate, or where flexibility is required, and these factories will remain in China, Vietnam, Cambodia, India or wherever the necessary combination of infrastructure, personnel numbers and quality can be found. However, Japanese-based manufacturers such as Canon, Alps Electric, Icom will retain their positions. Lixil was adamant that one of their fully automated factories would be competitive if they are required to manufacture in the USA.

Over the last 19 years, the Platinum Japan Fund has appreciated nearly 15% compound per annum.[1] The MSCI Japan Net Index (A$) has risen 2% per annum. Performance over the tenure of the Fund's four portfolio managers has been strong, a testament to the culture of the firm, the investment style and longevity of the founders.

A Historical Note

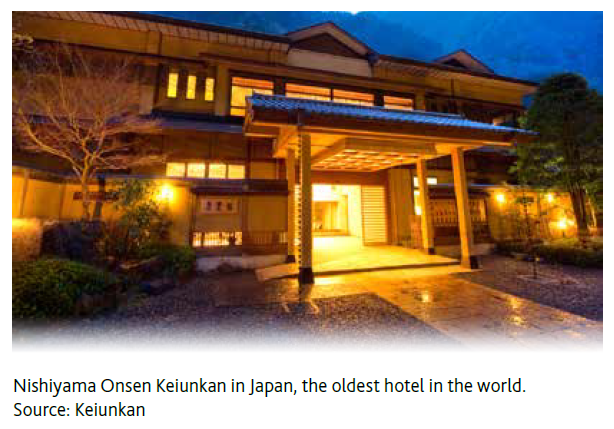

Nishiyama Onsen Keiunkan, a small property located in the town of Hayakawa, about 110 miles southwest of Tokyo, has been open to guests for about 1,300 years. Not only does this mighty age make it the world’s oldest hotel, but it also makes it a striking piece of world history. The Onsen was founded in the year 705 A.D. – roughly 225 years before the establishment of [a united] kingdom of England and approximately 300 years before Vikings made their way to America. Since then, 52 generations of his descendants have kept the stay in the family including the recent facilities upgrade.

Nishiyama Onsen Keiunkan is 13 years older than the world’s second-oldest hotel, which also stands in Japan, but the third-oldest wasn’t founded until hundreds of years later – in 1120. Zum Roten Baeren, in what is now Freiburg, Germany, was constructed before that city was established. And since that time, it’s survived devastating world events, from the Black Plague to two World Wars.

– by Zachary Kussin, The New York Post

[1] The investment returns are calculated using the Platinum Japan Fund’s unit price and represent the combined income and capital return for the period from the Fund’s inception on 30 June 1998 to 31 March 2017. They are net of fees and costs (excluding the buy-sell spread and any investment performance fee payable), are pre-tax, and assume the reinvestment of distributions. The investment returns shown are historical and no warranty can be given for future performance. Historical performance is not a reliable indicator of future performance.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.