Alex Barbi, portfolio manager of the Platinum International Technology Fund, discusses the onset of the electric and hybrid vehicle revolution and the attendant development in battery technology.

The recent success of US EV manufacturer, Tesla Motors, in designing, marketing and achieving relative popularity for its high-performance cars, despite widespread scepticism, has surprised many industry observers. The company’s founder, Elon Musk, whom many like to compare to Steve Jobs for his visionary skills (he co-founded PayPal and is also behind other high-tech ventures like Solar City and Space-X), has definitely captured the attention of many car industry participants.

Perhaps for the first time since the introduction of the highly innovative hybrid EV Toyota Prius, traditional automotive players are seriously considering alternative propulsion systems for their cars, either as full EVs, hybrids (traditional combustion engine combined with a battery-powered electric one) or fuel cell (hydrogen powered) EVs.

Notwithstanding the prevalence of doubts concerning the limited driving range and the inconvenience of long charging times, the technology is rapidly improving and costs are gradually coming down. Hence we believe it is only a matter of time before these “alternative fuel vehicles” gradually come to account for a larger portion of the global car fleet.

The innovative design adopted by Tesla for its battery pack (based on traditional Panasonic small cylindrical cells) is probably only the beginning of a long series of improvements that will help promote higher EV adoption in the mass market.

We are, however, still in the early stages of this secular trend. In 2014, out of a total of 17.5 million cars sold in the USA, probably the most advanced market, only 100,000 were EVs and plug-in hybrid EVs (PHEVs) – a relatively small amount, but still an increase of 30% from the previous year. Individual resistance to adoption is understandable due to higher initial costs, range anxiety and questions about battery longevity. Moreover, the recent oil price collapse has made the economic benefit of driving an EV less compelling.

But things may change. Other factors like high levels of air pollution in urban areas and regulation on carbon emissions may provide additional momentum in the short and medium term. In the USA, for example, eight States representing in aggregate around a quarter of all car sales in the country are aiming for a fleet of 33 million zero emission vehicles by 2025. In major European cities, diesel cars are targeted by local authorities due to their health damaging particulate emissions: both London and Paris are planning to limit or ban diesel cars from the streets from as early as 2020.

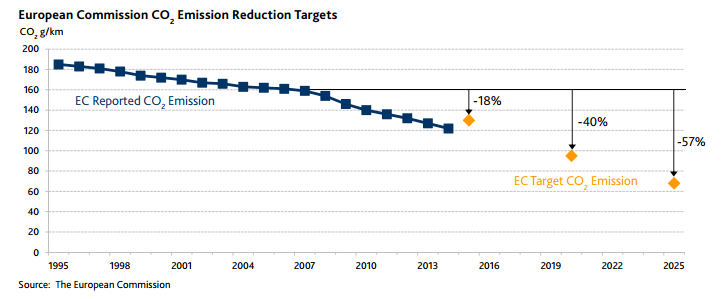

Moreover, European Union (EU) legislation has set mandatory emission reduction targets for new cars:1

The fleet average to be achieved by all new cars is 130grams of CO2 per kilometre (g/km) by 2015 – with the target phased in from 2012 – and 95g/km by 2021,phased in from 2020.The 2015 and 2021 targets represent reductions of 18% and 40% respectively compared with the 2007 fleet average of 158.7g/km. In terms of fuel consumption, the 2015 target is approximately equivalent to 5.6 litres per 100 km (l/100km) of petrol or 4.9 l/100 km of diesel. The 2021 target equates to approximately 4.1 l/100 km of petrol or 3.6 l/100 km of diesel.

In case you are in doubt about the seriousness of the European Commission, they have also provided for penalties:

If the average CO2 emissions of a manufacturer’s fleet exceed its limit value in any year from 2012, the manufacturer has to pay an excess emissions premium for each car registered. This premium amounts to €5 for the first g/km of exceedance, €15 for the second g/km,€25 for the third g/km, and €95 for each subsequent g/km. From 2019, the cost will be €95 from the first gram of exceedance onwards.

In China, the government has become increasingly worried about the broad effects of unsustainable levels of air pollution and introduced new subsidies for “green” vehicles. All “new energy” vehicles would be exempt from the 10 national sales tax, which goes hand-in-hand with local and national incentives. For example, Beijing now provides a subsidy of up to CNY60,000 (A$12,700) for the purchase of an all-electric battery car and up to CNY35,000 (A$7,500) for a “near all-electric” plug-in vehicle. Buyers of these vehicles are also exempt from the costly licence plate lottery, which was instituted to stem the tide of new cars flooding China’s roads. China also ordered government officials to use more EVs and PHEVs as part of its drive to cut pollution by putting five million such vehicles on the road by 2020.

It is therefore not surprising that even traditional car manufacturers are announcing new electric cars and particularly PHEVs2, which can help achieve more easily the mandated carbon emissions reduction. So, in Germany, BMW has promised that its entire range will eventually be electrified and that a PHEV version of the popular 3 Series should hit the market probably in early 2016. Similarly, Volkswagen, Audi, Daimler, Volvo, Mitsubishi, Renault, Nissan and others have all launched or are in the process of launching new PHEVs.

SDI is well-placed to benefit from growth in this emerging industry, thanks to its existing expertise with Lithium-ion batteries for consumer electronics and smartphones in particular – they are the leading supplier of small-size batteries to Samsung Electronics and its competitors. More recently, they have also developed new medium and large size batteries targeting EVs and energy storage systems (ESS). SDI is supplying large Li-ion batteries to BMW for their current EVs (i3 and i8) and future PHEVs (SUV X5 and possibly the 3 Series). It is also a leading supplier of ESS batteries to manage power storage/distribution for customers as large as electricity networks/grids as well as smaller commercial and residential users.

While SDI’s medium and large size battery businesses have not achieved optimal scale and they are still losing money, we are confident that, once the end markets mature, they will become profitable. In the meantime, corporate profitability will be supported by expected solid growth in small batteries (e.g. new polymer batteries for the Galaxy S6), electronic materials (largely polarising film for flat panel displays and organic light-emitting diode (OLED) materials) and other semiconductor materials.

In this context, we think that SDI, trading at only 0.9x its book value, represents an attractive play on the future development of this emerging industry over the next five years.

1. The European Commission: http://ec.europa.eu/clima/policies/transport/vehicles/cars/index_en.htm.

2. A PHEV requires a smaller battery pack compared to a full EV, typically a 9-15 kWh capacity versus 80-90 kWh. The advantage is that it takes less space and is easier to adapt to existing conventional combustion engine-based power-trains.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.