The present decade is a particularly interesting time for automotive technology, where a number of changes may be conspiring to turn the industry upside down, creating risks for incumbents and opportunities for newcomers. They may also bring investment opportunities for us, if we can get it right.

The drive towards electric and autonomous vehicles

Technology has always been at the core of both product and production innovation in transport. In fact, Ford’s greatest innovation was more in the revolutionising of the modern assembly line, which lowered production costs and made cars widely accessible, than the Model T itself. Similarly, GM’s contribution to the industry was in vertical integration – at one point they even owned their own rubber plantations for tyres. On the product side, technology has improved the safety, performance and efficiency of motor vehicles steadily over the last century. Just think seat belts, airbags, turbo chargers and catalytic converters.

The present decade is a particularly interesting time for automotive technology, where a number of changes may be conspiring to turn the industry upside down, creating risks for incumbents and opportunities for newcomers. They may also bring investment opportunities for us, if we can get it right. And if we want to get a bit hyperbolic, some of these changes could have wider ranging societal impacts.

The major changes can be boiled down to two intertwined developments: electric drive trains and ever-increasing computing power. The former is levelling the playing field and enabling those with an edge in the latter to make an unprecedented challenge on incumbent carmakers.

Electric Drive Trains

The Tesla that has captured mind share is essentially a large washing machine motor (or two) hooked up to a massive liquid-cooled battery pack. But it’s this simplicity that makes it so interesting. The CEO of BYD, a Chinese battery and electric vehicle (EV) maker, once made the comment that EVs represent for traditional cars what quartz watches meant to Swiss mechanical watches. They had no chance of catching up to the centuries of accumulated know-how in making mechanical watches (or combustion engines), but the simplicity of EV construction levelled the playing field much like what quartz movements did for the watch industry. This is a slight over-simplification in order to illustrate the point, but an EV is almost maintenance free and electric motors are extremely efficient (meaning that 95% of the energy is converted into movement, compared with 20-40% for internal combustion engines).

The biggest bottleneck at the moment is the battery. They are expensive (Tesla’s pack costs $30-40k today to make), has low energy density, take a long time to charge and can stop working altogether (and even explode) if not charged properly.

But if there is ever an immutable rule in technology, it is that small, steady improvements bring down cost and improve shortcomings. A good example is the solar industry, which once only made sense with subsidies, but is now challenging fossil fuels on an unsubsidised basis in sunny regions. We are optimistic that in a surprisingly short period, EVs will move from being expensive statements about one’s green credentials to the low-cost winner on a total cost of ownership basis.

(The developments in battery technology that are increasingly making this transformation a reality deserve a paper in their own right. There may also be implications for demand for some of the raw materials required to make battery. Lithium is an obvious candidate, but it is in fact a particularly abundant element that can be retrieved quite easily. The price of lithium carbonate has spiked in the last year, bucking the trend of most commodities, but that mostly has to do with some company specific issues at the largest maker, Chilean company SQM.)

The important point is that EVs level the playing field to some extent, which has enabled new entrants such as Telsa to join the match. (When was the last time you heard of a new carmaker?) Combine that fact with the steady march of Moore’s Law and you have a potent recipe for disruption.

One of the tangential benefits of declining battery costs is the nascent market for residential batteries to store electricity generated by solar panels. This is a topic worthy of separate discussion, but Australia is likely to be an interesting market given the confluence of high retail energy prices, abundant sunlight and wealthy, tech-savvy consumers. There is significant potential for disruption to monolithic power generation and distribution.

Moore’s Law and Cars

To recap simply, Moore’s Law, which was more an observation than a rule, stated that the number of transistors on a chip would double every two years. This has remained remarkably accurate since it was observed by Gordon Moore, a founder of Intel, in 1975. The processing power of chips increases as the size of transistors decreases (since more transistors can be fitted onto the same sized chip), but power consumption stays in proportion with area and the cost of chips (which is correlated to the size of the chip) also does not increase as much. What this means is that the cost, both in dollars and energy, for a unit of processing power halves every two years. In practical terms, computing power that was once only available in a supercomputer became available in desktop PCs over a ten year period and in smartphones in about twenty years.

So how does this relate to the car industry? The dramatic increase in processing power of computer chips is getting to the level where they can start tackling technology as complex as self-driving or autonomous cars. Autonomous driving is an even bigger challenge than EV batteries. But, notably, this challenge has less to do with mechanical engineering and more to do with computing and software. As such, it plays to the strengths of Silicon Valley, not Detroit (or Munich or Stuttgart), and partly explains why Google and other tech companies are showing such interest.

ADAS vs. Autonomous

Rudimentary features of automation are available in many cars today, and are generally classified as Advanced Driver Assist Systems (ADAS). Examples include blind spot warning systems, automatic parallel parking, automatic emergency braking systems, etc. The automotive industry is taking the view that by incrementally improving the performance of these systems we will eventually have cars that can drive by themselves on the highway and ultimately on city streets.

The risk with this approach is “what if it doesn’t get there”. The piecemeal approach means that there may always be some outlying event that will require the human driver to make a decision and, if that’s the case, the car will never be truly autonomous. As a passenger, you’ll never be able to relax enough to take your eyes off the road (or your hands far away from the steering wheel). Google’s self-driving car project is approaching the question from the opposite end, starting with the assumption that the car will be entirely autonomous and getting through hurdles to reach that destination.

Google’s stated mission is to organise the world’s information and, from that perspective, they see autonomous driving much as they see their existing search business, i.e. as a big data problem. In other words, they think that if they collect, organise and analyse enough data they can build systems that fundamentally understand the world around us. It’s a huge task, but one that Google is uniquely suited to. I can think of few other organisations that have the skills to tackle such a problem.

But if Google is right and this is a big data problem, it also highlights the challenge faced by incumbent carmakers. Approaching autonomous driving as a machine learning problem highlights the need for lots of software engineers and a culture for them to thrive in, not something carmakers could claim as a strength. In fact, Silicon Valley insiders suggest that not even Apple (which is rumoured to have a secret car project) has the software chops to take on autonomous driving.

While exciting, the hurdles are so high that we may be jumping the gun by getting excited about self-driving cars now. For example, while Google’s non-threatening EVs are a marvel, they can only drive around a few suburbs of Silicon Valley, on roads that have been mapped by Google to unbelievable detail, and even then are often confused by the intentions of wavering pedestrians and other situations that humans take for granted.

Also illustrative of the need for further advancement in the technology is how computationally challenging it still is for autonomous cars today. For example, the sensors on Google’s cars are rumoured to cost around $80,000. Computer graphics chip company Nvidia has announced a machine-learning platform for carmakers this year that has 12 CPUs and the processing power of 150 MacBook Pros. Impressive on paper, but unlikely to be sufficient to run a fully reliable autonomous vehicle, not to mention how prohibitively expensive it is likely to be.

Investment Implications

Circling back to investment implications and what we are doing by way of stock selection, in EVs specifically, which we think will happen in a big way soon, we own battery manufacturers such as Panasonic and Samsung SDI, though we are wary of the competitive environment and severe price pressure. We also think batteries could have negative implications for utilities and as such are very selective about our exposure in that sector.

In an oblique sense, the ongoing electrification of cars means that the semiconductor content in cars is exploding, which is expected to grow at 5% above the underlying rate of production of cars. For EVs specifically, the value of semiconductor content is estimated to roughly double from $400 to more than $700. In this area we especially like chipmakers with automotive and power semiconductor exposure, such as Infineon (which we do not currently own for valuation reasons) and Rohm in Japan.

As to the most obvious EV name, Tesla, we just don’t think the valuations justify owning the stock, even with recent falls in stock price. Also, as stated at the beginning, the history of the car industry tells us that innovations that have resulted in meaningful and sustained market share changes have all been production innovations – Ford with the production line, GM with vertical integration, and decades later the Japanese made their mark with just-in-time lean production methods and other assembly line improvements. Conversely, product innovations have typically spread throughout the industry quickly, giving no single manufacturer a sustained advantage. The shift to EVs is a much more significant change than, say, airbags. While this may not be a rule that’s set in stone, it is something to keep in mind when thinking about Tesla, or any carmaker for that matter (which we have little exposure to). What has surprised us is that so far the competitive response to Tesla has been muted. If the historical baggage (or other disincentives) prevents a timely competitive response from incumbent automakers, it may give Tesla the opportunity to establish itself as the brand for fast, cool and environmentally conscious vehicles.

With regards to ADAS/autonomous vehicles, again, we think this will drive increased semiconductor content, similar to EVs, with increased focus on the range of sensors required to collect information from the environment. Again, names like Infineon come up as well as a range of smaller chipmakers and auto parts suppliers in the US, Japan and Europe. The poster child in this space is a company called Mobileye, which was an early entrant into the ADAS space, but valuations became extreme and have now more than halved in six months.

In a broader sense, we own Google, Intel and Samsung Electronics, though obviously not solely for the future opportunities in autonomous driving, given the long time horizons.

Other Impacts

We are by no means certain that any of this is going to happen and there are many sobering data points as well as questions we don’t have answers to. For example, somewhat disappointingly, since the release of the Toyota Prius almost 20 years ago sales of hybrids and other electric drive train cars have never managed to gain more than a few percentage points of the market and have consistently missed expectations. Falling oil prices at times during this period probably played a part, but surely there must have been other contributory factors.

This historical observation also highlights some of the potential unintended consequences of these trends, should they play out. Passenger cars account for more around half the world’s oil demand and the impact of EVs combined with tighter emission standards may suppress demand in the longer term (though not a factor in the weakness we have seen in the last two years – that said, the Saudi’s decision to keep pumping in the face of oversupply could be interpreted as a ‘use it or lose it’ attempt at getting revenue for something that might be a stranded asset over the long-run).

Another interesting outcome might be the societal impact autonomous driving has on car ownership in general. Is the future a fleet of driver-less Ubers shuffling people around and, if so, what implications would it have for the fleet? Today, fleet utilisation rate in the US is a merely 4%. Will the future fleet be much smaller than it is today? Will Uber force us to have more flexible working hours because of surge pricing for the commute to work (which is one reason why the fleet is currently so large and underutilised)? What does it mean for the design and pricing of cars if the buyer is no longer the end user? The market today supports such a range of brands and models in part largely because one’s choice of car is a statement about who we are. Will there still be a small market for enthusiasts who drive for pleasure, much like horse ownership became purely a leisure activity 100 years ago? Will mass-market carmakers like Toyota be more adversely affected than, say, Ferrari? Will auto insurance premiums rise or fall as computers take over the steering wheel from humans?

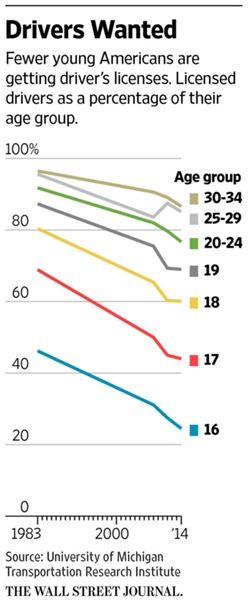

To conclude with one final observation: the development of autonomous cars is, interestingly, coinciding with a trend showing falling interest in driving in Western countries. In the US, for example, while car demand in 2015 was a record 17.5 million vehicles, the numbers are hardly encouraging for carmakers once adjusted for population and an aging fleet.

Source: University of Michigan, Transportation Research Institute; The Wall Street Journal.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.