Working within the Platinum investment process means seeking to own a share of a company when it has attractive growth potential and when it's priced at a discount to its potential to deliver a sustainably high return on invested capital (ROIC). To understand that ROIC potential we ask four high level questions:

- What value does the company bring to customers?

- Why is this company preferred by customers over competitors?

- Why does this company have pricing power?

- Is management trustworthy and credible?

Companies which rank well on these questions typically makes high margins and high returns on invested capital and sustain these high returns over a long period of time relative to the average company in our investable universe. We rank these companies as “above average” or “best in class” quality in our quality/growth matrix. These companies make up ~90% of the long portfolio in our Platinum International Technology Fund (see Figure 1 and 2).

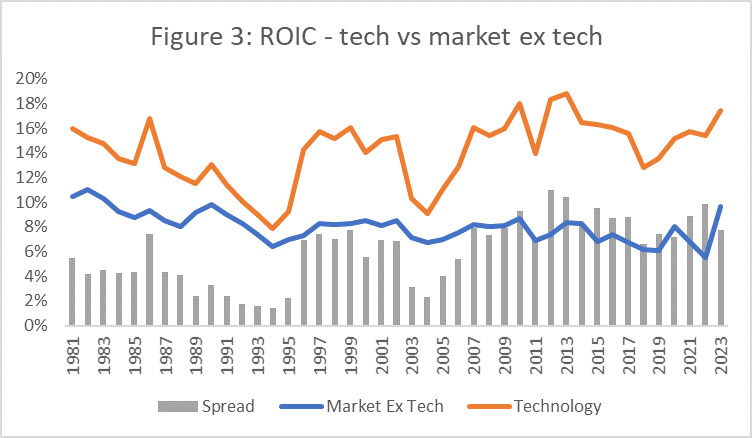

The technology sector has been a great place to look for companies who are, or have the potential to be, “above average” and “best in class”. As shown in Figure 3, whilst the constituents of that sector are ever changing, the sector is characterised by companies that delivered superior ROIC relative to the rest of the market.

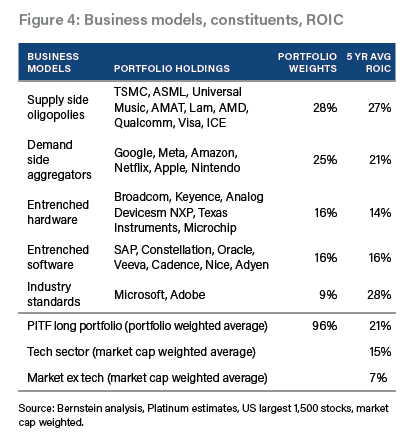

We have identified five tech business models which we believe have persistently delivered high and sustainable ROIC over the long term. We briefly discuss each below and try to identify the essence of each model. Figure 4 shows the constituents of each group, their portfolio weightings, their average 5 year ROIC - and how that compares vs the market.

The five models

Model One: Supply Side Oligopolies

Around 30% of the Platinum International Technology Fund is invested in supply side oligopoly businesses. These companies often control unique assets or technologies or possesses capabilities crucial to their customers' operations. When combined with limited competition, this grants them tremendous market power. In semi capital equipment suppliers, we own ASML, a monopoly on EUV machines which are critical for making high performance chips like CPUs and GPUs. We also invest in AMAT and Lam Research which operate in oligopolies in other parts of semi manufacturing. We also own TSMC, the only foundry in the world who can make leading-edge chips efficiently.

Model Two: Demand Side Aggregators

Another significant slice of the Fund (around 25%) is invested in demand side aggregators. In the online world where there is infinite number of suppliers fighting for consumer attention and wallets, these companies facilitate discovery and/or distribution. These companies aggregate consumer demand by providing tremendous consumer surplus1 and use this power to extract significant value from the supply side.

Platform network effects and distribution lock ins typically result in 'winner-takes-most' industry structures where effective competitors are rare. The services Google, Meta and YouTube provide to consumers are free but these companies command significant power over advertisers. Consumers shop on Amazon.com due to selection, price and the speed of Prime delivery. Amazon uses this to charge merchants increasingly higher fees. App developers and financial institutions pay Apple a fee to access its more than one billion loyal users.

Model Three: Entrenched Hardware Companies

Around 15% of the Fund is invested in entrenched hardware companies. Their products are typically mission critical to their customers but make up a small component of total costs. The companies have pricing power as price is a secondary consideration to performance, quality and reliability. Switching costs are notoriously high and customers stick with them for a long time. Examples include analog semi companies like Analog Devices and Texas Instruments. Analog components are chips used for processing real world continuous signals, for example converting temperature into digital signals. Given the complexity around converting real world signals, designing analog chips is hard to do and requires a lot of engineering experience. The chips are often used in mission critical applications in industrial applications and in autos - for example, in air bag sensors where the cost of the component is low (ASP ~25c) but the cost of failure is high (e.g. think of the cost of a model recall). Consequently, pricing is a tertiary consideration. Once designed in, customers stick with the component for the life of the platform (up to 10 years) given the high cost of re-qualification. Similar dynamics also apply for Broadcom in networking.

Model Four: Entrenched Software Companies

We invest around 16% of the Fund in entrenched software companies. Like their hardware counterparts, these software businesses are typically mission critical to customers’ workflows and processes and greatly enhance productivity. Their pricing power comes from the fact they are so entrenched that customers are loath to switch. In our research, customers said migrating to another vendor would be like “performing open heart surgery whilst running a marathon”. Examples include Veeva’s broad suite of products used in the marketing, sales and R&D departments at pharma companies, SAP’s ERP and supply chain suite and Oracle’s database business.

Model Five: Industry Standard Software Businesses

Around 10% of the Technology Fund is invested in industry standard software businesses. We believe these companies are of even higher quality vs entrenched software businesses. Not only are their tools and applications mission critical to customers’ workflows, these businesses also enjoy strong network effects thanks to broad industry adoption and need for interoperability. These companies typically capture the majority of the revenue pool in their respective vertical. Two examples in our portfolio are Microsoft's Office and Adobe's Creative Cloud.

The tech outlook

With most tech indices at or near all-time highs, we remain disciplined and are resisting the temptation to go down the quality or risk spectrum in search of higher returns. Instead, we continue to look for “best in class” and “above average” companies underappreciated by the market and uncorrelated to the AI capex cycle - such as SAP last quarter and Texas Instruments this quarter.

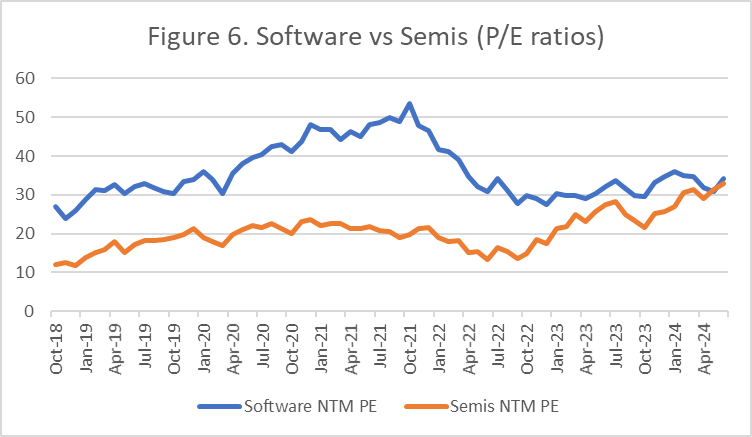

One area we are spending more time on is software, which has underperformed semis year-to-date (see Figure 5) and now trades cheap relative to history on PE basis (see Figure 6). The sector is currently out of favour among investors as top line growth is slowing due to labour cuts at customers and slower IT spending amidst tightening budgets and cannibalisation from generative AI projects. We think this slowdown is cyclical and temporary and could potentially provide us with attractive entry points into some high quality companies.

.png)

.png)

- Like to know more about Platinum's approach to investing in tech stocks?

- If you’d like to invest in Platinum funds, speak to your financial adviser. You can find information on investing with Platinum here.

1: The extra, free value consumers get from their services – for example, free Gmail accounts.