"Avoiding the US technology bandwagon has come at a large opportunity cost over the past two years but we feel now is the time to stay disciplined…."

From the Platinum International Fund Quarterly Report, December 2024

Since Christmas Eve 2024, the Magnificent Seven (Apple, Tesla, Meta, Nvidia, Amazon, Alphabet and Microsoft) are down around 20%. Given the level of concentration in the US market their fall has quickly bled into major US markets. The S&P500 is down nearly 8% and the technology-heavy Nasdaq Composite off 13%.1

So why did it happen? And what does it mean for Platinum investors?

Over the past few years the US market was largely driven by those seven stocks, adding significant ‘concentration risk’ to many portfolios. Whilst some of the seven are exceptional businesses – Platinum has owned some of them - the market’s concentration in just seven stocks made it very difficult for active managers like Platinum to outperform.

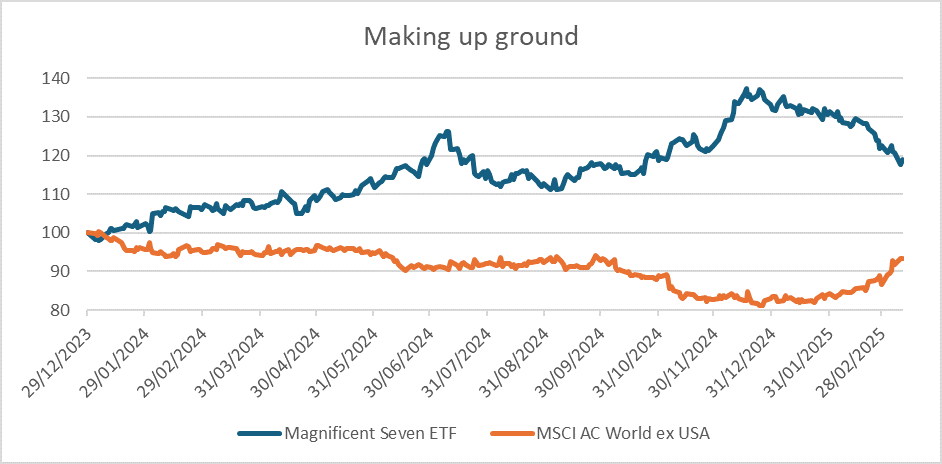

Yet the rollover of the Magnificent Seven is not a surprise. As the chart below shows, between June and October 2024, the market’s attitude to the Mag Seven cooled. There were concerns about their vast capex spending and questions over whether they would be the ultimate winners from AI. However, President Trump’s election reflated the tyres on the Mag Seven and the stocks accelerated into Christmas.

As the Trump administration’s policies unfolded, markets began reassessing the outlook for the US and global economy.

Spray gun tariffs could threaten world growth and inflate US goods prices. Any revival in inflation means the Fed will be less likely to cut rates and higher rates tend to cap tech stock valuations. Add in the President’s musing about a US recession and you have all the elements for a rotation away from the Magnificent Seven – and US shares.

Rotate to where?

Over the past two years Platinum’s International Fund (PIF) has been underweight US technology stocks and overweight China. That cost significant upside. But in 2025 so far, our positioning protected investors:

-

Since the peak in world markets – February 13 - the MSCI AC World Index has dropped nearly 6%. PIF is up 0.6%.

-

Our weighting to China has been crucial to this performance – YTD the MSCI China index and the Hang Seng are up around 18%.

-

Meanwhile Platinum’s Asia Fund is up over 2%.

The shape of our portfolio

Ted Alexander, the new PIF Portfolio Manager, joined Platinum on March 1st. Commenting on recent market moves he said, ”Andrew and Clay handed me a portfolio set up to withstand a rotation against the Magnificent Seven. The portfolio was underweight technology and overweight China and had a healthy exposure to Europe.”2

Since joining Platinum Ted has deepened the short against US technology stocks. He’s also capitalised on lower prices to add some quality US healthcare names to the portfolio.

Alongside Platinum’s Asia team – and PIF’s new China analyst, Ying Luo, Ted is continuing to seek out the stocks most likely to benefit from an upturn in confidence in the Chinese economy.

-

For more on the strategy, holdings and performance of the Platinum International Fund please visit our fund page.

-

To invest with Platinum click here.

1 Unless otherwise noted, performance and market numbers in this article are sourced from Factset to 12 March 2025.

2 Andrew Clifford and Clay Smolinksi were Co-Portfolio Managers of Platinum International Fund till 1 March 2025.