What to watch if The Magnificent Seven is over

Andrew Clifford, Co-CIO and Co-Portfolio Manager, Platinum International Fund

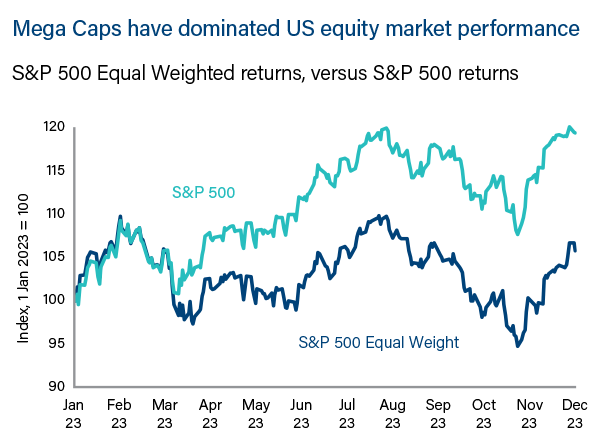

Any predictions about 2024 need to start with an understanding of 2023 and the dominance of mega-cap stocks. Last year there was an unusually high 10% difference in returns between the S&P 500's equal-weight and capitalisation-weight indices[1] see the chart below). The performance of the ‘Magnificent Seven’ tech companies (Apple, Amazon, Google, Facebook, Nvidia, Microsoft, Tesla) was the most talked about element of this theme.

In 2024, the great opportunity may lie in the stocks that struggled in 2023. Many of those companies are in China. The property crisis has sapped consumer and business confidence and so some top quality companies are now very cheap – and that’s very interesting territory for us.

We hold a Chinese company called CATL that is the global leader in batteries and renewable energy storage. EV demand is slowing in markets like the US and Europe, but in China it’s booming and you can buy CATL at just 15x earnings. In 2024 we’ll be happy to own stocks on numbers like that.

Of smartphones and smarter chips

Clay Smolinski, Co-CIO, Portfolio Manager, Platinum Global (Long Only) Fund

When assessing prospective investments we are looking for companies that:

- Are likely to be earning significantly larger profits in 2026

- Can deliver those higher profits almost regardless of prevailing economic conditions

- And where we can identify a reason why that company is mispriced by the market and why investor perception can improve in the future.

One of those companies is the Taiwanese chip-maker TSMC. It’s the leading manufacturer of the chips we all rely on in our smartphones and PCs. Demand for smartphone chips has been weak for the past two years and that’s reflected in the current TSMC share price – the company is priced on just 14x earnings. Looking forward, TSMC’s earnings recession is ending and a big rebound possible.

The new growth accelerator for TSMC is the global capex spend on leading edge AI-chips, where TSMC is the key manufacturing partner for companies like NVIDIA. When we look for companies to pass our three-year test, TSMC is a standout.

The land of the overdue realignment

James Halse/Leon Rapp, Co-Portfolio Managers, Platinum Japan Fund

A prediction for 2024? By the end of the year many Japanese companies will be different companies.

The Tokyo Stock Exchange (TSE) is pushing corporates to be more focused, to use their capital more wisely and to focus on higher returns to shareholders. That’s driving a series of changes:

-

There’s going to be more management buyouts (MBOs). In late 2023 we saw the largest MBO in Japanese history, a US $4.75 billion deal involving Taisho Pharmaceutical Holdings.

-

Listed companies – including titans like Toyota - are refocusing their businesses, selling non-core assets and unknotting the tangle of cross-shareholdings that’s typified Japanese business for many years. Last year Toyota sold US$1.8bn of shares in KDDI, a telecoms company. Now it’s selling US$4.7bn worth of its parts supplier, Denso.

-

For too long, Japanese industrial businesses tied up shareholders’ capital in real estate. That too is starting to change. Meanwhile more companies are bringing their supply chains back out of China and management teams are focused on productivity. A rising yen – which makes Japanese exports less competitive in global markets - will push companies to seek even more efficiencies.

As these forces coalesce to create leaner, fitter companies we expect Japan’s economy and its people to benefit. Investors in Japan could do the same[2].

Never mind the ballots

Kirit Hira, Co-Portfolio Manager, Platinum Asia Fund

Asian scrutineers will be busy this year with Taiwan, Indonesia, India and Korea all going to the polls. As I write, all these elections look tight but opinion polls in Asia often have limited predictive value.

As the elections loom, we’re likely to see more crowd-pleasing policies laid out. Happily the impact of these short-term manoeuvres should be limited and the market-friendly reform that’s marked these economies over the past few years is likely to continue. To take just some examples: India is investing the equivalent of two trillion US Dollars in infrastructure – across 9000 projects. They’ve also reformed labour markets, with employers now dealing with just four employment codes – IR, OH&S, Wages and Social Security - rather than the 28 different laws they used to navigate.

In Vietnam they’re setting up new industrial zones with preferential tax rates to help the country capture more of the world’s high-technology supply chains. And spending USD 16 billion on a new Ho Chi Minh City airport.

Indonesia is the world’s biggest nickel producer and they’re moving from pushing out the raw material to producing battery grade nickel and partnering with companies like Hyundai to build EV plants.

The Koreans are following Japan’s lead in corporate governance, improving disclosure, the protection of minority shareholders and dividend policy. That’s good news for the 15 million Koreans who trade the market – and for foreign investors too.

So 2024 might see short-term volatility – and surprise election results. But these could be less important than the evolution of more dynamic economies, more efficient markets and more competitive companies.

Profits based on data

Adrian Cotiga, Co-Portfolio Manager, Platinum European Fund

As we start 2024 there’s an intriguing interplay between demographics, interest rates and technology playing out in the European Fund and more broadly in the Financials sector.

Across the UK and Europe (and in the US) there’s a big demographic tower forming around the 25-34 year-old cohort. This cohort is in the prime age of household formation and accordingly they’re driving underlying new home demand, even in the face of punishing interest rate rises. We believe our holding in UK residential developer, Barratt Developments, will benefit from this trend.

If rates ease in 2024, home builders will benefit but so too will companies like Intercontinental Exchange (ICE) and TransUnion, two data-focused business that will profit from increased activity in the mortgage market. TransUnion provides data to banks to help them assess loans and manage their lending. ICE sells mortgage technology and made around 27% of revenue from this segment in 2022. During the rate-rise cycle in 2022-23, there were major job cuts in the mortgage sector and that means technology solutions are even more valuable.

The growth in data businesses is playing out in a similar way in the financial sector where a company like the London Stock Exchange, which traditionally relied on listing fees, now earns around 40% of group revenue from data services.

What to do when the trend unfriends you?

James Halse, Portfolio Manager, Platinum International Brands Fund

During Covid, one segment of retailers did well from consumers stuck at home with little to do but redecorate, refurbish and refresh those homes. Hardware, homeware and furniture retailers watched sales and margins swell. Their share prices reacted accordingly.

With low rates and loads of stimulus cash sloshing through markets, meme stocks – those whose price was driven up by a small segment of buyers and pundits - had their own short heyday. Stocks in electric vehicle makers also profited from easy money, the sustainability angle and the appeal of new models.

The market trends are now turning against these stocks. Economies are weakening, money is more expensive and EV demand is slowing in Europe and the US as early adopter demand is satisfied and costs and charging issues offset some of the attractions of greener motoring.

Over the next year one likely source of outsize returns lies in some quality consumer staple brands - such as the Dutch beer business Heineken - who are now cheaper than they have been for a very long time. Similarly, companies that service the under-pressure Chinese consumer could rebound as that economy slowly recovers. Some of the companies we rate most highly include infant formula leader China Feihe, online travel agent Trip.com and the dominant food delivery and local services platform Meituan.

Buying the research

Dr Bianca Ogden, Portfolio Manager, Platinum International Health Sciences Fund

The drug discovery/development ecosystem is made up of a limited number of large pharma companies and many smaller biotechs. While the big pharma companies spend a lot on R&D, the breakthrough innovation often happens outside their walls.

That means the big companies need to be skilled not just at R&D but at building partnerships and licensing deals with these smaller and sometimes smarter players whose research is solidified into assets – prototypes, patents, molecule and drugs. Often the big companies need to buy these biotechs to access those assets.

It’s not cheap. Competition is fierce and negotiations require stamina, patience, a feel for the competitive landscape and an understanding of valuations. There were 16 companies vying to buy Prometheus Biosciences and its TL1A asset[3]. Merck eventually paid US $11b. By comparison, Roche bought a TL1A asset from Roivant for just over $7b.

We’ll see whose investment decision pays off in years to come. The ability to acquire – by whatever means – access to great science and promising drug assets may now be the most important skillset a pharma company can have. And that’s what we look for when assessing those companies.

Streaming at scale

Jimmy Su, Portfolio Manager, Platinum International Technology Fund

We’ve always believed the media distribution business – what consumers call streaming - is about scale. Being the biggest means you can pay up for new content and it’s new content that both reduces churn and drives engagement which can be monetised e.g. through ads. In short, the biggest streaming businesses should be the most profitable.

In 2023 our thesis was reaffirmed. Legacy competitors Disney, Warner Discovery and Paramount all gave up on their targets for streaming and started to license content to other services.

We believe the return on capital for Netflix and Amazon’s streaming services will continue to improve:

o Rising ARPU (average revenue per user) across the industry gives the two big streamers room to lift prices. Reduced competition for viewers’ attention - and subscription dollars - should also cut customer acquisition costs.

o The big two will be able to license content from Disney, Warner and Paramount instead of making originals – that will reduce the amount of capital they need.

o Advertising video on demand should drive a new leg of revenue growth at incrementally high margins for both. Amazon should benefit most as they have high household penetration in the US (~150 million Prime subscribers). Their ad targeting should be superior given their access to user data and purchase history.

o Live sports should also drive a new leg of revenue growth at decent margins. The NBA is up for renewal next year and Amazon is in the mix to acquire the licenses.

More information

For a full update on what’s been happening in the markets and on the strategies of the Platinum Trust funds, you can read our full Quarterly Report here.

[1] As the name suggests, equal weight-indices assign an equal weight to each company in an index. A comparison to a cap-weight index can highlight the outsize effect the performance of a few large companies can have on indices like the S&P500.

[2] For more on Japanese reform and what it means for investors, see: https://www.platinum.com.au/the-journal/japans-reform-new-dawn-or-same-old-story

[3] TL1A is a type 2 transmembrane protein. An anti-TL1A antibody may be a promising part of treatments for inflammatory disorders like rheumatoid arthritis, inflammatory bowel disease, psoriasis and lupus.