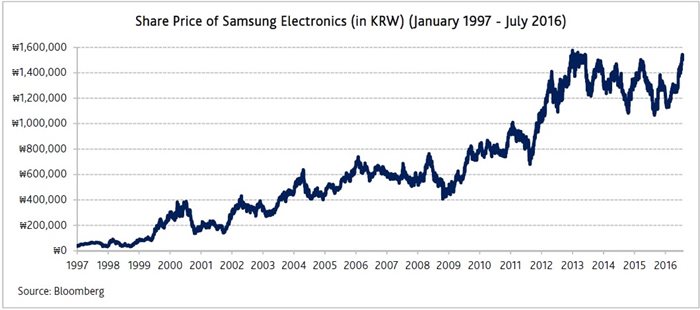

Samsung Electronics has been a key holding of the Platinum International Fund for the most part of the last 20 years. Over this period we've witnessed the company growing into an international leader in technological innovation, and saw its share price rise 25 times in AUD! It is an excellent illustration of the Platinum investment methodology at work.

There are several key features underlying Platinum’s investment methodology:

- We seek out companies that are ‘unloved’ by the market, i.e. companies with a solid growth trajectory but whose value is not (yet) adequately appreciated by the market.

- We take a long-term view to investing – investing in ‘out-of-favour’ stocks means that we have the patience for a company’s value to be fully recognised by the market over a number of years.

- Our approach to stock selection is focused on the fundamentals of a company’s businesses, and that analysis is underpinned by observations of broader economic, social and technological trends and themes.

An excellent illustration of this methodology at work is our investment in Samsung Electronics. The company has been at the forefront of technological innovation over the past twenty years, riding the waves of the digital age from laptops to best-selling smartphones, from VCRs to cutting-edge OLED, from random-access memory (RAM) to 3D NAND.

Platinum has been on this journey with Samsung for the most part of these last twenty years. Even after rising 40 times in local currency (and around 25 times in Australian dollars) since we first entered the stock in 1997, today Samsung Electronics trades on a forward P/E of 10x with US$60 billion of net cash on its balance sheet.

As at the end of June 2016, Samsung Electronics remains one of the largest holdings across the various funds and mandates managed by Platinum as a whole. It is the largest position in the Platinum International Fund (3.6%), the Platinum Asia Fund (4.3%) and the Platinum International Technology Fund (5.4%).

What do we see in the company? Let’s first take a flashback to Kerr Neilson’s Quarterly Report for the MLC-Platinum Global Fund from Feb-Apr 1997, and then hear what our portfolio managers have to say about Samsung now.

MLC-Platinum Global Fund – Feb-Apr 1997 Quarterly Report, by Kerr Neilson

Many of us would know Samsung as a maker of inexpensive colour TVs and VCRs but may fail to realise that almost 20% of the memory chips (DRAMS) that power our everyday electronic products such as PCs, microwaves and Nintendo 64 game players are made by Samsung. This is some achievement for a company that only started in this business in the mid 1980s. Consider the immense technical knowledge base required in placing 65 million transistors on a piece of silicon the size of a fingernail!

Aside from their leadership in memory chips, Samsung is responsible for 1 in 6 of all microwaves and PC monitors and 1 in 10 of all VCRs produced in the world today. In terms of emerging technologies they are at the forefront of new memory devices such as flash memory, LCD based TVs, high powered computer storage devices and CDMA based mobile phone equipment which is becoming a major new standard in the industry. Evidence of the company’s technical standing is found in the quality of its collaborative partners and the falling level of net royalty payments over time.

The case for Samsung primarily rests with the realisation that this is a truly global company that has demonstrated technical excellence in a broad range of products and is competitive with the big players in Japan and Europe. This observation is supported by the track record which shows superior sales and profit growth, and profitability measures that are at least on par with its peers. Whilst the businesses are highly competitive, Samsung appears to be a low cost producer.

Yet the valuation attributed to Samsung is well below that of its international peers. On the basis of market price to cashflow, Samsung trades at about 2.6x versus a grouping of peers of 5-6x. While some may argue that this discount is appropriate because of the Korean market’s high interest rates, the fact remains that Samsung exports 65% of its product and has the ability to access global capital markets at low rates of interest. Over time the marginal buyers of Samsung will be foreigners who are likely to set a much lower discount rate.

Platinum International Technology Fund – Apr-Jun 2016 Quarterly Report, by Alex Barbi

Samsung Electronics, the Fund’s largest holding, performed well during the quarter with evidence pointing to recovering revenue growth after last year’s decline and improving profitability across all divisions.

Historically investors have been critical of Samsung’s corporate governance (and South Korean groups in general) amid (valid) accusations of poor consideration for minority shareholders and favouritism towards the powerful families with controlling stakes. This scepticism has been the main reason behind the relatively depressed valuation of Samsung Electronics compared to its international peers, despite its strong profitability track record.

More recently, however, the company’s management seems to have adopted a more investor-friendly attitude: they approved reasonable-sized stock buy-backs and gradually increased dividend distributions long promised to yield-starved shareholders (mind you, the company still sits on a cash pile of US$62 billion!) While progress at Samsung, like many other South Korean chaebols, is only happening gradually, we are encouraged by what we have seen so far. As the younger Vice-Chairman Lee Jae-yong (the grandson of Samsung’s founder and son of the powerful but ailing Chairman Lee Kun-hee) increases his authority within the organisation, he has gradually started to instil a new culture: faster decision-making, flat and open organisation, and greater focus on innovation.

After a difficult 2015, which saw declining profitability in Samsung’s smartphone division, all four major divisions of the group (Semiconductors, Display Panels, Mobile Communications and Consumer Electronics) are expected to report improving or stabilising results in both 2016 and 2017.

Last year, Semiconductors, driven by the company’s leading Memories divisions (DRAM and NAND) contributed 21% of group revenue and 48% of group operating profit. This year, Samsung is expected to further increase its market share in both DRAM (47%) and NAND (39%). Thanks largely to its superior scale and technology, achieved after years of heavy R&D investments, Samsung remains ahead of all its peers in this space (SK Hynix, Micron, Toshiba/SanDisk) and it should maintain its lead for the foreseeable future.

Mobile Communications is also improving after the company reduced costs by streamlining its mid-to-low-end smartphone supply chain to efficiently leverage component sourcing across different models. With sales of more than 310 million smartphones each year and US$12 billion in operating profits, Samsung remains the number one smartphone vendor globally, well ahead of Apple (another holding of the Fund).

But the area of Samsung’s prospects that we are most excited about is the Organic Light Emitting Diode (OLED) business. We have been following the development of OLED technology for more than a decade and some of you may remember that the Fund used to own Cambridge Display Technology, the owner of key patent OLED technology developed at Cambridge University in the 1980s (refer to the Fund’s June 2005 quarterly report[1]).

As is often the case, early excitement did not translate immediately into economic success as the technology took longer than expected to achieve commercialisation. In 2007, Cambridge Display Technology was acquired by Japan-based Sumitomo Chemical and the majority of other display makers scrapped their OLED R&D programs, concentrating their efforts instead on the cheaper Liquid Crystal Display (LCD) alternatives.

The exception was Samsung which persisted with its R&D on OLED. This led to US$13 billion being invested in its OLED project with a further US$7.4 billion planned for the next two years. South Korean rival LG Electronics also invested heavily in OLED technology, but adopted a slightly different version which relies on a separate light source.

The adoption of OLED technology for small and, eventually, large display screens is going to be driven by: 1) better picture quality, 2) faster response time, 3) lower power consumption, 4) thinner form factor, and 5) wider viewing angle. The downside is that OLED still has a shorter lifespan than LCD and the manufacturing process is more complex and more capital-intensive.

Samsung used its own OLED screen in its original Galaxy S1 smartphone, which was launched in 2010, while Apple until now has not used OLED in its iPhones, relying instead on its LCD-based Retina display technology. In 2013 both Samsung and LG Electronics started commercial production of “flexible” OLED displays on plastic substrate, now being used in their flagship smartphone models. While the device maker bends or curves the screen to create new shapes to adapt to the phone’s contour, they are not yet quite bendable from the user’s perspective. Apart from allowing novel designs, OLED displays are also lighter, thinner and more durable compared to glass-based screens. Second generation flexible OLED displays may indeed be flexible for the final user, but there is still some distance to go before the technology is mature and economically viable.

Nevertheless, we are likely to see more brands launching smartphones with OLED screens in the near future, and even Apple is expected to release one in 2017. That would make Samsung a major beneficiary as it is currently the only supplier with the know-how and sufficient manufacturing capacity to supply Tim Cook’s highly demanding engineers. We believe increasing OLED adoption will contribute to Samsung’s profit growth trajectory for the next few years.

In light of these developments, at a P/E multiple of 10 times and 1.2 times book value for December 2016, the current valuation of Samsung Electronics looks remarkably attractive.

Platinum Asia Fund – Apr-Jun 2016 Quarterly Report, by Joseph Lai

Samsung Electronics is one of the Fund’s nice long-term holdings. It is a technological leader and continues to strengthen its lead by investing in new technology and capacity, ensuring its long-term profitability. The company is at an interesting juncture as its two emerging but world-leading technologies (organic light emitting diode (OLED) and 3D NAND) are now set to be adopted by mainstream consumer electronics companies. Despite the obvious strengths in its core businesses and its focus on the long-term, Samsung Electronics is attractively valued at 10x 2016 earnings and offers a dividend yield of nearly 2%.

OLED is a superior display technology that will be the ‘next big thing’ for smartphones. It offers higher resolution, bendability as well as lighter and thinner design. Apple is rumoured to be incorporating flexible OLED display in its new generation of iPhones, allowing for interesting form-factors. Come 2017, the new iPhone may have quite a different look. If the rumour turns out to be true, Apple, Samsung’s most formidable smartphone competitor, will likely be sourcing almost 100% of its OLED supplies from Samsung!

3D NAND is a data storage technology that is more reliable and cost effective than conventional flash memory (e.g. USB drives). Samsung is on its way to becoming an industry leader in this space as superior attributes (light weight, low power consumption) and lower costs propel its products to rapidly displace traditional hard drives.

[1] See Platinum International Technology Fund 30 June 2015 Quarterly Report.

“OLEDs are molecules that glow when stimulated by electric current. You may recall that any liquid crystal display comprises, in very simple terms, millions of liquid crystals sandwiched between two sheets of ultra thin glass. Each panel needs to be lit by a number of fluorescent tubes mounted at the back. OLED displays do not require such a crude lighting mechanism. Instead of liquid crystals, millions of OLED molecules are embedded between the two sheets of glass. While in LCD panels, each crystal acts like a shutter to allow light to pass, in OLED displays it is the electric current that passes through the organic molecules that produces the glow.”

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.