During 2018, investor concerns coalesced around two key issues: slowing economic growth in China and rising interest rates in the US. These concerns weighed heavily on stock prices, afflicting emerging markets in the first instance, then spreading to developed markets later in the year.

As we entered 2019, the US Federal Reserve surprised the market by signalling a halt to its tightening campaign. It indicated that interest rate increases would be put on hold and attempts to unwind Quantitative Easing (QE)[1] would be curtailed. This change in stance eradicated one of the two main concerns tormenting investors. Bond yields fell and stock markets rallied vigorously in response.

The best performing segments were those that are most sensitive to interest rates. This includes fast-growing businesses whose life-time earnings mostly accrue in the distant future, as well as slow-growing businesses with defensive earnings and high dividend payouts (the so-called bond proxies).

The worst performing segments were those with cyclical earnings. The data coming out of China were mixed, while the Federal Reserve’s change in stance implied slower growth in the US, adding to investor concerns.

This bifurcation has impacted on the performance of some of our portfolios in recent months, in particular, those with a substantial exposure to cyclical companies have lagged the broader market.

So why, then, have we chosen to remain invested in cyclical businesses?

As a starting point, we don’t set out to construct our portfolios in any pre-determined way. Platinum’s investment process works the other way around. We investigate a broad range of investment ideas at the company level and invest in those we think have merit. Our portfolio positioning is a by-product of these decisions. It just so happens that the opportunities that are currently appealing to us are increasingly clustered in the cyclical category.

Investors today are assigning tremendous value to safety and predictability. The best example of this is the global bond market where some US$10 trillion worth of bonds are currently trading at negative yields. To be clear, if you buy these bonds, you are guaranteed to lose money. This is not so much investing as voluntary taxation. Yet investors are buying these bonds because they are so risk averse that a small loss with certainty is preferred to the wide range of possible outcomes that uncertainty can bring.

In the stock market, this phenomenon is reflected in the high valuations paid for businesses with defensive but growing earnings. Equally, it is evident in the very low valuations assigned to businesses whose earnings are subject to the vagaries of economic cycles.

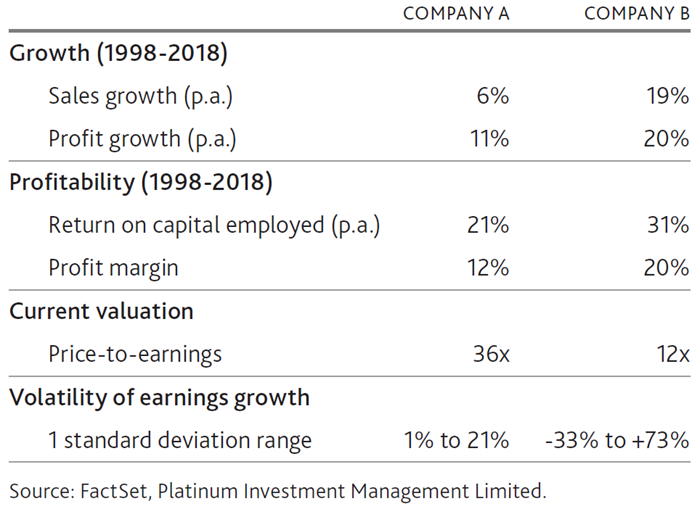

Such polarisation creates great opportunities. The most tangible way to demonstrate this is through a real-life example. In the table below we show the growth and profitability of two well-known European companies over the period between 1998 and 2018.

Company A grew sales at an average compounded rate of 6% p.a. and earnings at 11% p.a. This is an impressive track record of growth. However, Company B has performed much better, growing sales at 19% p.a. and earnings at 20% p.a. To illustrate the difference, over a 20-year period, Company A grew earnings 7½-fold while Company B grew earnings 40-fold.

Company A averaged a 12% profit margin and a 21% return on capital employed (RoCE) over this period, testifying to the quality of this business. However, it was once again outshone by Company B, which averaged a 20% profit margin and a staggering 31% return on capital employed.

These statistics are backward looking and the future may well be different to the past. However, two decades are a sufficiently long time period to include many episodes of adversity and provide a good sense of the mettle of each business.

At this point most people would gravitate towards Company B. It has grown much more quickly and has been considerably more profitable over a long period of time. But this is not reflected in its valuation. Company A trades on 36x earnings, while company B trades on just 12x earnings. What’s going on?

Company A is Lindt, the Swiss chocolatier. Demand for chocolate is considered recession-proof. Lindt has a strong brand and an excellent global distribution network, insulating it from competition and bestowing it with a degree of pricing power. Its earnings are highly defensive. They grow slowly but steadily each year. Over the last 20 years, the typical change in its earnings ranged between +1% and +21%. Lindt’s earnings rarely fall.

Company B is Ryanair, a European airline. Airlines are notoriously difficult businesses. Demand is fickle. Supply regularly overshoots. Competition is fierce. Ryanair is a pure price taker with largely fixed costs, making earnings terribly volatile. Over the last 20 years, the typical change in its earnings fluctuated between -33% and +73%. This year, earnings are likely to fall by over 30% and this is not uncommon.

Knowing the identity of these companies will likely curtail enthusiasm for Company B. Instinctively, people will want to discount its higher growth and profitability to adjust for the higher risk. The market valuation may even begin to seem plausible. Yet, this is where one needs to tread carefully. The identity of the companies is new information and human beings have a natural urge to respond to new information. But is this new information actually relevant? Or is it merely triggering a deeply ingrained bias?

Company B (Ryanair) is a great business with an outstanding track record. This remains true. It also happens to be an airline; a brutal business with volatile earnings. But it has always been an airline! Over the last 20 years, Ryanair has grown its earnings 20% p.a. and averaged a 31% return on capital employed, by being an airline. During this period the industry was savaged by the World Trade Centre attacks, SARS (severe acute respiratory syndrome) and the global financial crisis. Yet, Ryanair did not once report an operating loss. Over the last decade, Europe experienced two recessions and a sovereign debt crisis. Yet, Ryanair’s profitability matched that of the much lauded Coca Cola Company. Airlines may be terrible businesses, but nobody seems to have told Ryanair.

Nor is Lindt without its challenges. New brands face lower barriers to entry than ever, thanks to digital marketing and online retailing. Consumer tastes are skewing to products that are authentic, craft and artisan, sentiments which global mass market brands inherently struggle to evoke. Supermarkets are increasingly devoting premium shelf space to their own-label products. Promotions are becoming increasingly frequent to fend off competition, but risk eroding brand cachet. With a proliferation of flavours, Lindt must walk a fine line between being innovative and appearing ridiculous.

Lindt is a fine business that we’ve owned in the past. But its moat is shrinking, it is facing non-trivial threats and is valued on a multiple that means even a slight misstep can be very costly. Lindt is not a very risky business. But it may well prove to be a risky investment while the rewards seem slim.

Ryanair is a fantastic business that faces plenty of challenges. It is valued as if all manner of things will go wrong, which they mostly probably will. That’s just business as usual. But if things go only a little right for them, investors stand to make handsome gains. Ryanair is a risky business. But it is not necessarily a very risky investment and the rewards are potentially very high.

So returning to the original question: Why are we so heavily invested in cyclical stocks? Today, investors are clamouring for safety and predictability. The Lindt and Ryanair examples showcase how this affects the opportunity set at the individual stock level. We think opportunities like Ryanair are quite attractive on a risk-reward basis. Conversely, on the same basis, we think Lindt is downright scary. The portfolio skew to cyclical stocks reflects many decisions like these at the individual stock level, rather than a preference for cyclicality or a macroeconomic view.

This investment approach is what Platinum has consistently practised for 25 years. It does occasionally result in periods of significant underperformance. However, Platinum’s long-term track record testifies to the enduring merits of this approach.

The most encouraging phenomenon for us, right now, is that markets are becoming ever more polarised.

Companies with certain traits are held in extremely high regard while others are deeply out-of-favour. Such divergence will inevitably create opportunities and we have been investing in many them for their medium to long-term prospects, even if it means we need to patiently ride out some of the near-term volatility.

[1]QE provides liquidity to the bond market, driving yields lower. The winding back of QE reduces the liquidity in the market and therefore drives yields higher.