Over the past year, China’s SSE Composite Index is down around 12%1. That’s affected the performance of some key Platinum funds and prompted a lot of reflection about our Chinese holdings.

In this article we:

-

assess what’s happening in China’s investment markets

-

review some of the Chinese companies we hold – and why

-

share our over-arching approach to Chinese stocks.

China – the economic backdrop

Prior to COVID, parts of the Chinese economy were already weak and this was exacerbated by Zero-COVID policies. Once COVID cleared, many expected the Chinese economy to rebound like its Western counterparts. It didn’t - and the real estate market is one major reason why.

Urbanisation has been a key part of China’s economic miracle – driving employment and wealth generation. Analysts estimate that real estate comprises 20% of Chinese GDP and around 70% of household assets. However, in recent years, some large players made deeply speculative bets on property.

Concerned that these excesses would weaken affordability and create social unrest, the government limited finance to the sector. The subsequent credit crunch meant some developers found it difficult to deliver presold homes. Some defaulted. House prices fell. This damaged confidence in the property market and unleashed a ‘negative wealth effect’.

The missing foreigners

As a result of these weaknesses Chinese investors left their sharemarket. Perhaps more damagingly, foreign investment dried up, with international investors spooked by the poor economic backdrop and geopolitical tensions.

At Platinum we’ve been investing in global markets for nearly 30 years and we’ve seen these scenarios before. When investors ‘need’ to take their money out of markets, the fundamentals are ignored and prices can fall to illogical lows.

Figure 1: Hang Seng Enterprises Index, back at GFC levels

Source: FactSet, data from 4 March 2003 to 6 February 2024

Given this backdrop, why is Platinum still investing in Chinese stocks?

Why we’re investing in China

China is out of favour

We believe the best long-term returns are found in parts of the market that are unloved and today the markets’ attitude to Chinese shares is extreme. “It’s always uncomfortable in these situations,” says Co-CIO, Clay Smolinski. “Whether it’s buying travel stocks in the middle of Covid, or investing during the GFC, you’re dealing with a market where fear has taken over from fundamentals. As a value-oriented investment manager we must look past that fear in search of opportunities.”

Valuations are extremely attractive

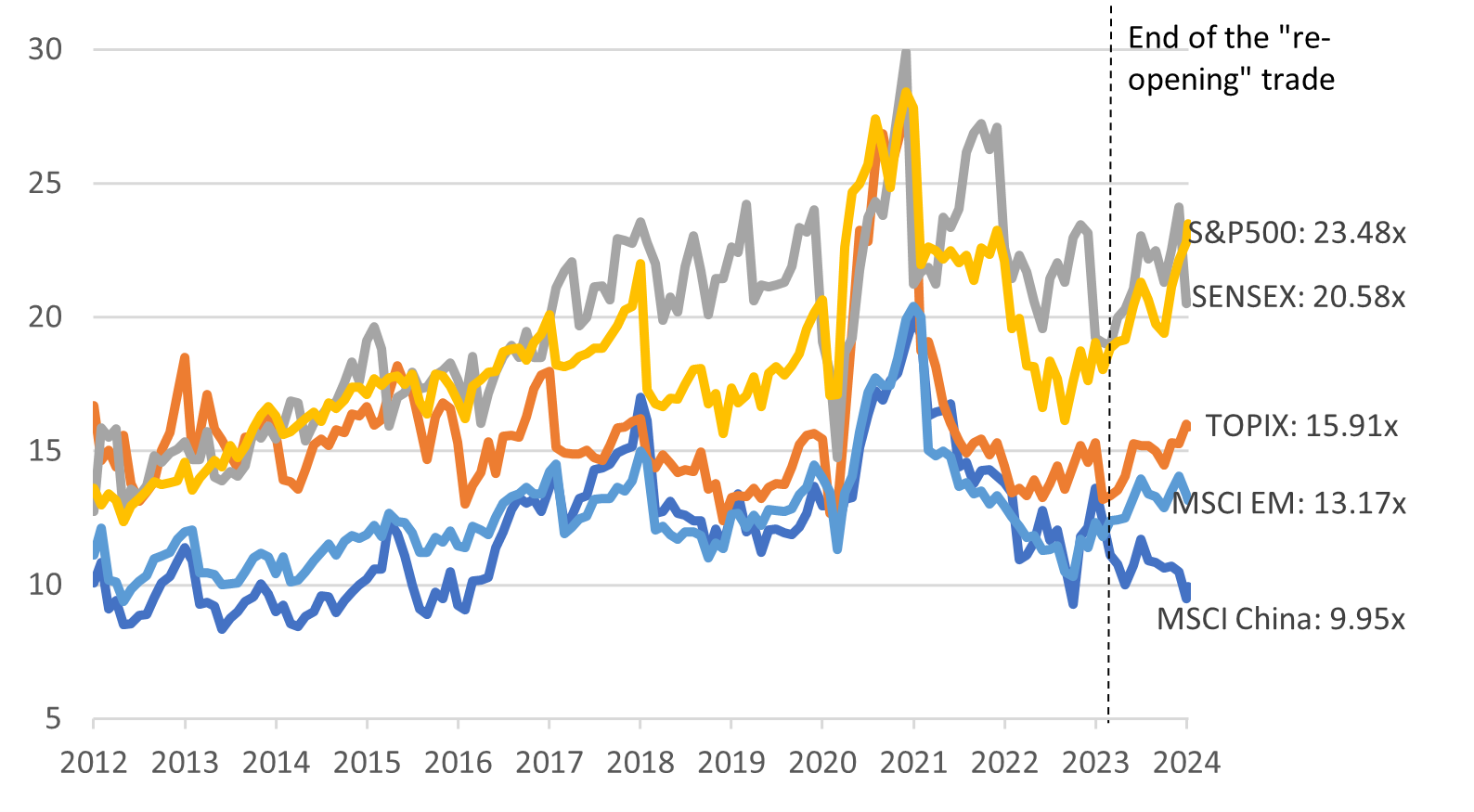

Chinese shares are cheap. Since January 2023, the MSCI China Price to Earnings (P/E) ratio – effectively the price you’re paying for a given amount of company earnings - has fallen to around 10 times. Meanwhile the SENSEX (India), S&P500 and the Topix (Japan) have all re-rated upwards. The Indian market is now twice as expensive as the Chinese market.

Figure 2: China’s stock market valuation (measured by 12 month forward P/E) has decoupled from other indices since January 2023

Source: Bloomberg, Macquarie Research, January 2024

Stimulus as catalyst

While the government has announced some stimulus measures, they’ve been small and targeted. As a result China hasn’t had the much-anticipated bounce back. The upside? China does not have an inflation problem. And it has plenty of ‘dry powder’ left to unleash as stimulus.

High quality stocks at bargain prices

We don’t allocate capital to China but rather into stocks that present the best risk/reward trade-off around the globe.

“Our Chinese holdings are simple businesses, driven by simple premises”, says Clay Smolinski.

“Take our holding in Chinese online travel agent, Trip.com. The Chinese travel market is still a growth market, demand for travel is roaring back and a good portion of Trip.com’s competition was wiped out with the lengthy travel bans during the zero Covid period. All these factors combined should be very good for Trip. The evidence? They’re earning record profits even before international travel has fully recovered.”

Signs of strength

Despite the headlines, it isn’t all doom and gloom in China. Parcel volumes are up 15%, ad revenue up 25% and travel spending up 15-20% on pre-COVID numbers.

China is now a key player in large and growing industries – like EV production. “The idea of China as the world’s factory is completely out of date,” says Platinum’s Co-CIO Andrew Clifford. “There are a lot of companies – like EV leaders BYD and CATL - that are growing because of their ability to innovate.”

Measuring the risks

As with any investment, we assess the risks to Chinese stocks.

-

Taiwan. There are geopolitical risks in the Taiwan Straits. These risks have existed in some form for 50 years and are well understood. And it’s arguable that China has more to lose from a Taiwan incursion than ever before.

-

US tariffs. Likely Republican Presidential candidate Donald Trump has promised punitive tariffs on Chinese goods. These would hurt the Chinese economy. They would also hurt influential US firms like Walmart and Apple whose supply chains are integrated into the Chinese economy. The Trump tariff might face as much resistance in Washington as in Beijing.

-

Regulation and governance. All countries have strengths and weaknesses when it comes to economic policies, regulation and governance and we take these into account in our investment and ESG research. Corporate governance in China is probably superior to that in India - where prices have rocketed over the past year.

We also use diversification to manage risk. Whilst we believe our Chinese holdings are high quality companies, only around 20% of the Platinum International Fund is in Chinese stocks.

The case to stay

“We know holding these stocks is having an effect on investor returns,” says Andrew Clifford. “Yet in our considered view, their strengths – the profits they’re generating, their market positions and attractive valuations - outweigh the current geopolitical and economic negatives. And in oversold markets like China, a recovery, when it comes, can underpin excellent longer-term performance.”

1: To 8 February 2024, Source: Factset Research Services