Human beings are generally metathesiophobic, i.e. we have an intrinsic fear for change.

On the North Island of New Zealand Roadshow on 7-9 November 2016[i], Douglas Isles, Investment Specialist, delivered a presentation titled “Embracing Change”, which addressed the idea that China’s recovery and political events such as Brexit and Trump’s candidacy were evidence that markets were pointing in the wrong direction at a point of inflexion. This note is a precis of the discussion around the importance of having an analytical framework for dealing with change.

A Framework for Dealing with Change

Human beings are generally metathesiophobic, i.e. we have an intrinsic fear for change. Modern portfolio theories reinforce this – students of investment management are taught that returns should be proportional to the volatility of assets. Where there is more uncertainty, investors are conditioned to demand a higher return, or in other words, to pay a lower price. In recent years, this preference for certainty has led to a crowding into bonds, which confusingly in some cases offer negative yields, and equities with bond-like characteristics, such as real estate investment trusts (REITS), Utilities, and the more predictable Consumer Staples – after all, as we are constantly spun by marketers, we need to clean our teeth, drink coffee and soft drinks, smoke[ii], etc.

As analysts, we need to have a framework for dealing with uncertainty. At Platinum, we focus on buying companies that we think are being overlooked by the market – where they are temporarily out of favour, and this works over time. We think it is important to understand change and how to deal with the vast amount of information we are presented with daily.

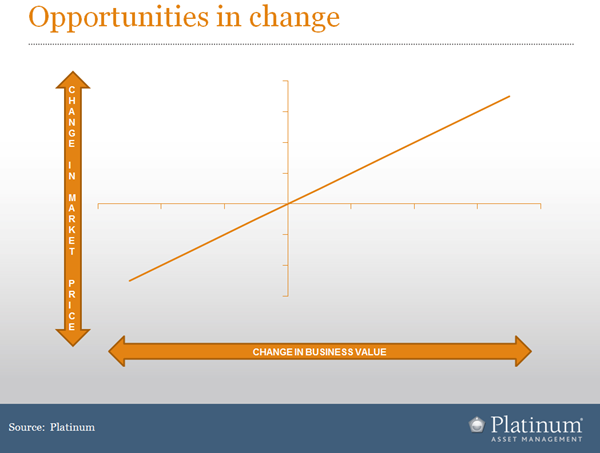

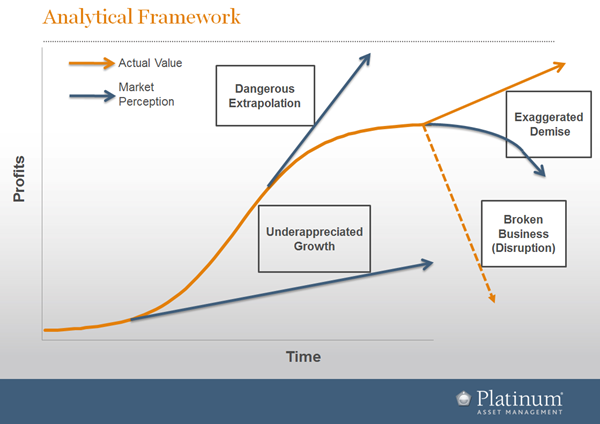

So, when we look at a business, and once we have assessed what we think is its fair value, we can then try to assess accordingly how the market reacts to new information. A simple graphical representation follows. On the horizontal axis, we have variations in the “intrinsic” value of the business, which slowly changes as technology develops, regulations shift, and customers and competitors respond, etc. The vertical axis represents the market response, which we know from experience is more volatile.

In an ideal (“theoretical”) world, for every small change in the value of a business, the market would react in equal measure. As a result, we would end up with the 45-degree line shown for changes in market value versus that of the business’s intrinsic value.

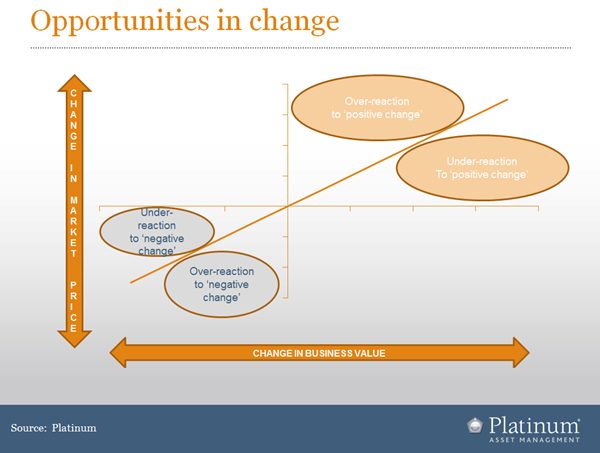

However, reality is very different to theory. The market does not always respond exactly in proportion to changes in business values, contrary to the so-called “efficient market hypothesis”. This is due to a variety of reasons, including the difficulties we face, as human beings, in processing information.

If we use the underlying value of the business and the “ideal” or theoretical market response as a yardstick, we can see that actual market response typically takes one of four forms. Two are under-reactions and two are overreactions, each in response to either positive or negative news. The following chart shows what these look like graphically. The blank quadrants reflect that there is unlikely to be a negative response to positive news, or vice versa.

This in effect can lead us to one of four opportunities, and once we are aware of this, it can provide us with a framework to better respond to the market’s response. The two positives are “buy-triggers”, while the two negatives can be used to sell, or even short-sell.

If we look at each of these in turn, we are better placed to deal with events and capture the opportunities, whether it is from binary outcomes that we know in advance we will have to deal with (such as elections/referenda), sudden new pieces of information (e.g. profit warnings, takeovers), or more subtle observations we make as analysts that the market has not yet factored in (e.g. changes in management or strategy).

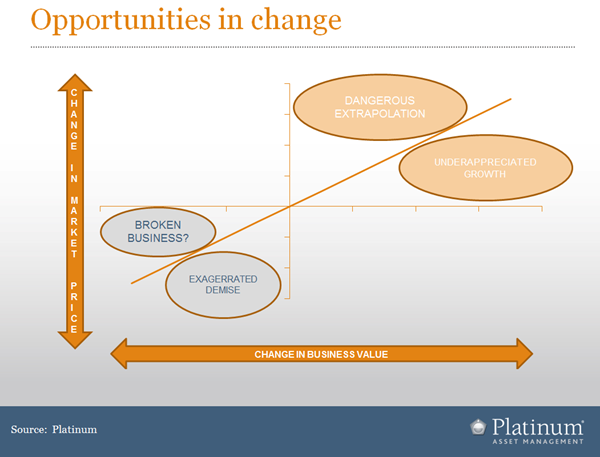

Over-reaction to negative news (or exaggerated demise) can provide entry points to companies that we like and know to be solid businesses. For example, when Brexit took place in June this year, there was a negative over-reaction in the share prices of European banks, which provided us with an opportunity to add to positions. Often when companies appear to be slowing down, investors look elsewhere for opportunity; sometimes this can be a short, sharp shock. Here, the suggestion is to look at companies that have either seen a violent downward movement in price or where valuation metrics suggest they are cheap.

Under-reaction to positive news (i.e. underappreciated growth) is where the more perceptive analyst can get an edge over the field by observing changes for the better, ahead of the market. Changes in company strategy, for instance, can be viewed with broader industry understanding and put into a longer term context to get an edge.

Under-reaction to negative news (i.e. broken businesses) – in a world full of disruption, the market may be slow to respond to the threats posed to traditional stalwarts and champions. This can be an opportunity (to short, or simply to exit) if one can assess that certain changes will lead to serious challenges to incumbents.

Over-reaction to positive news (or dangerous extrapolation) tends to bring stocks to their most dangerous levels where they offer low prospects for longer term returns. The market has a tendency to “fall in love” with success stories and like to eulogise about their future prospects to the extent that they assume invincibility. Here, avoiding such traps is advisable, and indeed, again, sometimes what the market sees as a compelling time to buy may in fact be an opportunity to short sell.

This framework can be embedded in our minds by re-casting the previous charts to reflect the underlying message.

So we now have four scenarios which we can take advantage of when the market reacts too much or too little to new information.

We can also characterise the path of a typical company (see chart below) and compare it with market expectations to derive a similar set of opportunities.

The orange line in the next chart shows the potential path of a typical corporate. Investors often collectively miss the inflexion (“tipping”) point where growth accelerates (though, often, this takes place before listing, e.g. Facebook, Uber), then become too comfortable with a company’s growth trajectory which can lead to excessive valuation (note, in 2016, The Coca-Cola Company’s share price is around the same as it was in 1998 when the company was trading on almost 50X earnings[iii]). This all leads to a quandary as businesses start to slow.

This quandary opens up many opportunities for Platinum. In today’s context, the market may be exaggerating the demise of the troubled – but resilient – Europe, or the corporates in Japan that are focused on self-help. Needless to say, having seen the playbook for Kodak, Xerox and Nokia, the market often sees slow-down as terminal; but good companies like Intel, Samsung and Toyota have demonstrated how to re-emerge. One must be careful at this point to avoid investing in (or may even consider shorting) those that are in decline – Wal-Mart today may be joining the likes of Woolworths and Tesco, with Amazon posing a real and lasting threat.

We hope that this framework provides a useful way of thinking for our clients. We have been concerned, though not surprised, by the way in which our collective client base utilises our investment offering.

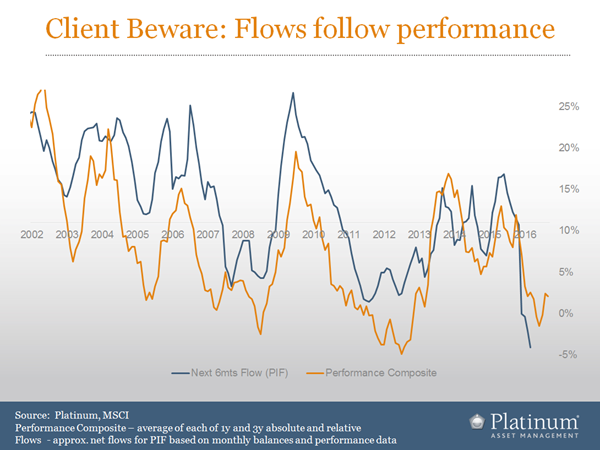

As we plot an aggregate measure of our performance[iv] over time, we unfortunately see that strong performance attracts investors (dangerous extrapolation?) while periods of less-than-optimal performance tend to be followed by outflows (exaggerated demise?).

The problem with this is not so much the impact on Platinum (indeed, money is generally being withdrawn at times when we want to be buying, ironically increasing the net exposure for those who remain, and vice versa). The impact is on the client. A decision-making framework that sells at the bottom likely also buys another asset (often a fund) near its top. As a result, those who leave us at the wrong time may have a tendency to mis-allocate that capital on receiving the proceeds of their redemption.

The above chart is a stark reminder of the irrationality in human behaviour. To avoid this, first one must be aware of it, and secondly, once must make appropriate decisions in future.

Our suggestion is that, with world markets at an inflexion point, embracing change and looking forward (not back!) will prove to be the right course of action at this time.

***

Subsequent to the talk, the market had to deal with the surprise event of a Trump presidency which initially led to a violent negative reaction, particularly in the Asian time zone, but activity in the US market was more nuanced with the market selecting winners and losers from perceived shifts in policy. Within 24 hours, Asia-Pacific markets were regaining ground lost in the knee-jerk response.

[i] Wellington, Palmerston North, Napier, Tauranga and Hamilton.

[ii] Note that some of the best performing funds in recent years have been beneficiaries of exposure to the tobacco sector, which we choose not to invest in.

[iii] We own Coca-Cola in the Platinum International Fund and Platinum International Brands Fund at the time of presenting.

[iv] We average 1 and 3 year relative and absolute returns to reflect different time frames and “user needs” (i.e., investors seeking absolute (our offering) and relative (“opportunity cost”) gains) as a composite performance measure.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.