Platinum is a specialist international equities manager, with an excellent track record. The fund manager adds value by investing in companies that are out-of-favour, described as “seeking neglect”, and by employing risk management strategies, particularly short selling and foreign exchange (FX) management.

Seeking Neglect

Utilising a combination of quantitative screening and observations of the world, Platinum’s experienced team of analysts challenge the market view when share prices suggest a stock is unloved. The critical element is to focus on a deep understanding of business logic, and to ascertain a future roadmap for what companies will achieve in determining whether or not an investment is worthwhile. Simply put, are the woes the market is focussing on temporary or permanent?

Ultimately it is human behaviour that creates most of the opportunities. The “herd mentality” is well- documented – market optimism is highest after stock prices have gone up, and vice versa. Tendencies to extrapolate trends, and to over-emphasise the latest data points (“recency bias”), rather than being pitfalls, can be exploited when one is acutely aware of them.

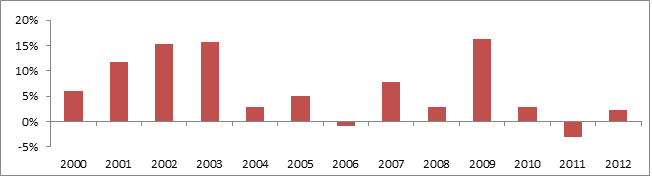

The chart below highlights excess returns of the long portion of the Platinum International Fund (PIF) by calendar year from 2000 to 2012 over the MSCI AC World Index, highlighting outperformance versus the opportunity set. This demonstrates the value added through stock picking skills. Across the Platinum Trust Funds, the vast majority of returns over time have been generated by the long portion of the portfolios.

Risk Management

Risk management (risk being risk of loss, not variance of returns) is a key role of the fund manager. At the stock level, detailed analysis of investments with a keen eye on downside risks, prior to purchase is the first important step. Avoiding excessive exposure to particular themes, industries or markets is an additional layer.

This component is captured within the long portion of the portfolio. The long exposure (up to 100%) is a function of the weighting of the ideas generated by the team; it has tended to be around 80-90% for the PIF.

Platinum additionally uses two key tools to protect the portfolio – short selling and currency management. Without these, the Fund would be more exposed to the vagaries of market sentiment.

When short selling, the fund manager identifies areas of risk, which can be at a market, industry or stock level. The manager short sells assets that they believe are overvalued, and profits if and when they are re-appraised downwards. This is the mirror-image of finding long positions and reduces net exposure to markets.

For currency, the Fund “inherits” exposure to FX via the stocks owned, and the manager considers two key elements of risk. Firstly, if the home currency (Australian dollar) is undervalued, the manager seeks to protect the Fund from that currency rising, by hedging. Secondly, the manager looks to strengthen the portfolio by increasing exposure to currencies that analysis suggests have better prospects. For example, in late 2012-early 2013, the Japanese stock market was cheap but the Yen was expensive, so Japanese stock holdings were hedged into the US dollar, which the manager believed to be a stronger currency unit than the Yen.

The primary benefit of risk management is to reduce the Fund’s downside, exemplified in bear markets. The techniques do add positively to returns over time, but the big pay-off in times of crisis can be viewed like insurance policies.

The chart below highlights the performance of the Platinum International Fund (PIF) in the worst 10 calendar quarters for the MSCI AC World Index since inception of the Fund (1995) to the end of 2012. The PIF returns are split into the long portion (which is heavily influenced by the market – “no port in a storm”) and the risk management performance (benefits of shorting and active FX management). The 10 quarters shown saw average losses of 11% for the market (as measured by the MSCI World Index) versus only 4% for the Fund. The compound effect of these periods left investors in the Fund with more than double the capital of the typical market investment.

Combining superior stock selection, with the risk management tools described above has led to an excellent long-term track record across the entire range of the Platinum Trust Funds.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.