Kerr Neilson delves into the ins-and-outs and pros-and-cons of investing in real estate, and sheds light on why a well-managed share portfolio is quite as attractive as property.

How often are you told that you can’t go wrong with property, it’s tangible, you know what you are doing and "everyone knows it only goes up in value".

I could say all the same things about shares but more about that later…

Here are the positive bullet points:

1. You feel you know the worth of a residential property proposition.

2. It’s a familiar asset and is something you can touch and feel; it’s safe.

3. Land supply is limited.

4. Over time it appreciates.

5. You can borrow against it (mortgage-or negatively gear) and that can lever-up your return.

6. Why pay rent and end up with nothing to show for it?

All these points are true, in part, but are heavily influenced by extrapolating WHAT HAS BEEN TRUE. A more critical analysis could poke holes in each and every point. It is highly unlikely that these same warm embracing views about property would be shared by long-standing holders of houses in Buenos Aires, former smart suburbs of various African cities or in parts of Japan. Yes, you are correct that these are special cases where the host country has experienced economic disruption. However, a long-term resident of Detroit or parts of Boston can probably still recall the glory days when their cities seemed to reach for the sky. Alternatively, in more recent times, enthusiastic buyers of homes in places like Las Vegas, Phoenix or Miami, just before the Lehman’s crises in the US, would still be ruing their haste. By now they may be feeling better but imagine the pain of uncertainty and discomfort when their mortgage was getting the better of them and their jobs seemed much less secure and countless inspections brought no buyers.

This is the key point; housing has many of the qualities enumerated above but it’s all about time and is framed by the familiar. When conditions change, a lot of the assumptions are found wanting.

The facts:

1. Returns from housing investment are often exaggerated and flattered by inflation.

2. Holding costs of rates, local taxes and repairs are estimated to absorb about half of current rental yields.

3. Long-term values are determined by affordability (wages + interest rates).

4. To be optimistic about residential property prices rising in general much faster than inflation is a supreme act of faith.

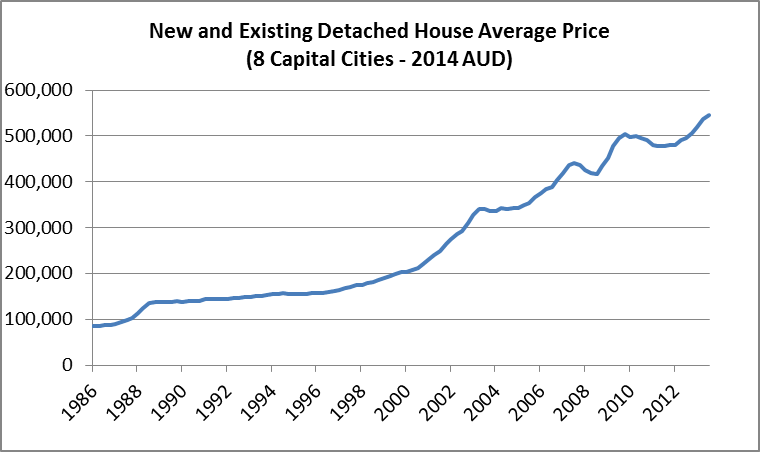

Let's start with returns. If we look at the rise in the price of an average home in Australia, the Bureau of Statistics reckons it's been about 7% a year since 1986. In dollar terms, the average existing house has risen in value by 6.3 times over the last 27 years. No wonder most people love the housing market! Even in weak periods like 2007/8 and 2011, the dip in prices was fleeting.

Source: Australian Bureau of Statistics, Bank of International Settlements

Source: Australian Bureau of Statistics, Bank of International Settlements

There will also be those who believe that they can do even better than ‘the statistical average’ by getting into an up-and-coming suburb before others, buying the worst house in the street and tarting it up, or by acquiring at the bottom of the cycle off a desperate seller when buyers are few. However, the main influence in many people’s minds is the absolute magnitude of appreciation which has often been multiples of their annual salary.

Apart from capital appreciation, a leased house should generate a rental return. The official statistics show that rent expressed as a proportion of the cost of a typical residential property has progressively fallen from about 6% in the 1990s to around 4% now.

So today we earn a starting yield of say 4% on a rented-out home or if you live in it, the equivalent to what you do not have to pay in rent. But again, looking at the Bureau of Statistics numbers, they calculate that your annual outgoings on a property are around 2%. This takes the shape of repairs and maintenance, rates and taxes, and other fees. This therefore reduces your rental return to 2%, and what if it is vacant from time to time?

Alright, so we earn 2% pre-tax from rent, but what will be the FUTURE capital appreciation. If it matches the experience above, it will probably be a marvellous investment. The rental yield plus the historic rise in house prices (over a very select 27 years) would suggest a total return of 9 to 10% compound pa (before tax.)

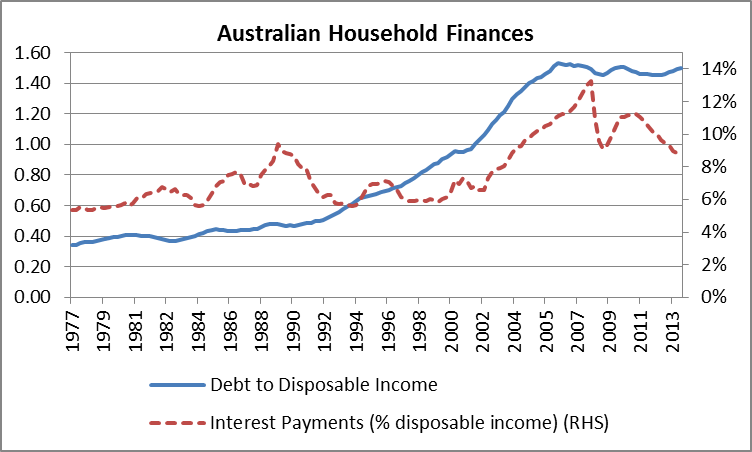

But what has been the driver of this strong residential property market? Principally it has been the willingness of Australians to progressively use much more debt, assisted by progressive falls in interest rates.

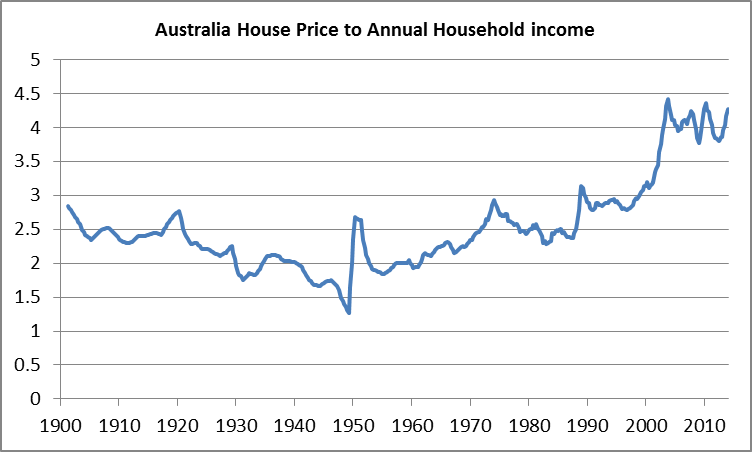

Many readers will reject the idea that over the long-term house prices are principally governed by the increase of salaries and wages. They will reject it because they have seen a very different pattern in the past. For example, they may recall this or that house which sold for $270,000 in 1994 and that it is now “worth” over $ 1 million (a capital appreciation of about 7% pa). The truth, however, is that the last 20 or so years has been exceptional. Australian wages have grown pretty consistently at just under 3% a year since 1994 - that is an increase of about 1% a year in real terms.

Affordability is what sets house prices and this has two components: what you earn and the cost of the monthly mortgage payment(interest rates). There are economic linkages which cause these components to track one another through time. The problem is that many of us only think in terms of say five years during which time there can be large swings in the relative rate of change of these two variables. This can cause problems because property tends to be a longer term investment where one can seldom sell or buy immediately and haste can be expensive.

From 1970s through to the early 1990s, Australians typically borrowed the equivalent of 40 cents for each $1 of disposable income. This willingness to borrow rose steadily through the 1990s to 2007 when on average, Australians had borrowed $1.50 for each $1 of disposable income! After the GFC it has dropped back slightly. So even though interest rates have progressively dropped, interest payments today absorb 9% of the average income, having earlier been only 6% of disposable income.

Source: Reserve Bank of Australia

Source: Reserve Bank of Australia

Today, houses cost over four times the average household’s yearly disposable income. At the beginning of the 1990s, this ratio was only about three times household incomes. As the chart over shows, this looks like the peak. To believe that home prices in the next 10 years will meaningfully outpace the consumer price index (CPI), as they have in the past, would require a remarkable set of circumstances.

Source: Australian Bureau of Statistics, Real Estate Institute of Australia, RP Data-Rismark, Stapledon, Barclays Research

It would need a combination of some or all of the following:

- Continuing low or lower interest rates.

- Willingness to live with more debt.

- Household income being bolstered by greater participation in the income earning workforce.

- Average wages growing faster than the CPI.

The last point is improbable seeing that wages and the CPI have a very stable relationship, while the other points are not very likely.

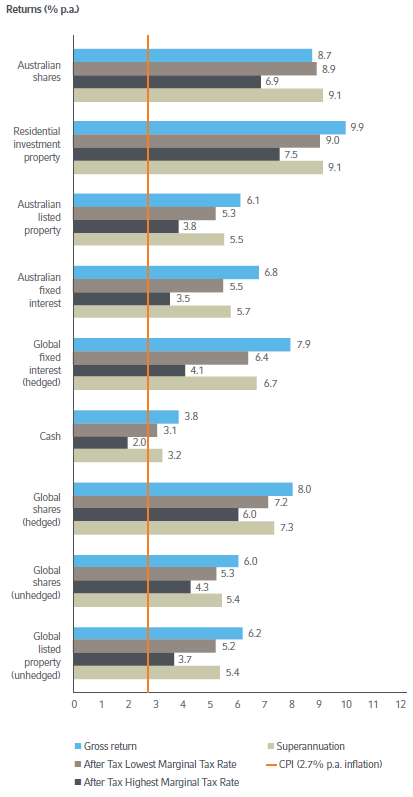

At the start I suggested that shares can do just as well or even better.

There is one drawback of which you are clearly aware; share prices bounce around (so do property prices but then a home doesn't have a daily willing buyer or a willing seller so the bouncing is hidden.)

In fact, had you placed $20,000 with us in the Platinum International Fund 19 years ago, today it would be worth over $200,000 (~13% compound pa, 30 April 1995 to 30 June 2014). This assumes that you reinvested your distributions each year. As this is pre-tax there is need for some adjustment but do remember that half of the capital gains from shares or funds are free from personal tax. To compare this with the experience you have had with a property investment, you will need to make comparable adjustments.

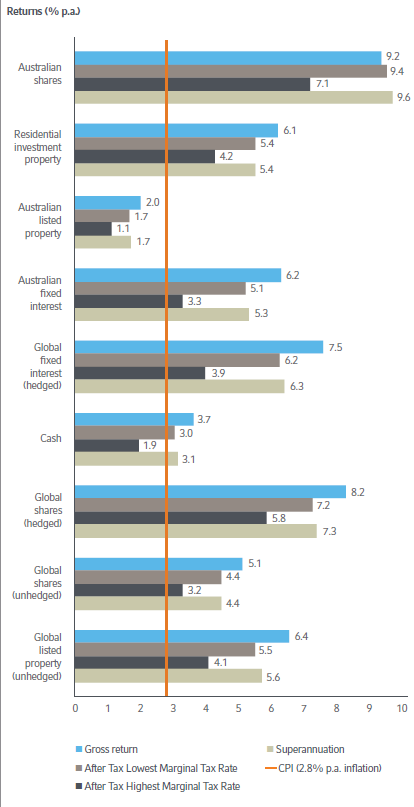

Over the last 20 years, Australian residential property has returned around 10% pa but only 6.1% pa over the last 10 years. By contrast, both global and Australian shares have returned 8-9% pa over both 10 and 20 years. This suggests that well-managed share portfolios are quite as attractive as property with the great advantage that you can come and go with ease, and enjoy some tax shielding.

Appendix – Investment Returns for the 20 years to December 2013

Source: 2014 long term investing report (ASX, Russell Investments)

Appendix – Investment Returns for the 10 years to December 2013

Source: 2014 long term investing report (ASX, Russell Investments)

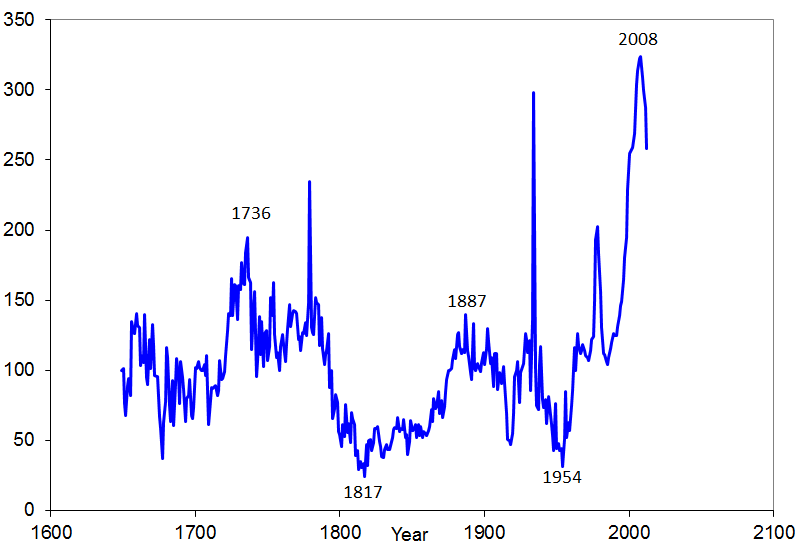

Appendix - In real terms, the average house price in the Netherlands has since fallen 26% from the peak shown in the graph below.

So even with income growth, property prices have been not far from flat in real terms over almost 400 years.

Real House Prices in the Herengracht neighbourhood, Netherlands, 1649-2013

Source: Eicholtz, Piet M.A., 1997, “The Long Run House Price Index”. The Herengracht Index, 1628-1973,” Real Estate Economics, updated to 2008 by Eicholtz.

Updated to 2013: https://www.dallasfed.org/assets/documents/research/events/2013/13housing_shiller.pdf

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.