We conducted a survey to find out what was on our clients’ minds. But there was a twist. What interesting behavioural patterns did the experiment reveal?

Over the course of Platinum’s recent 2016 adviser and investor roadshows in Sydney, Melbourne, Brisbane, Perth and Adelaide we conducted an investor survey which contained an embedded experiment.

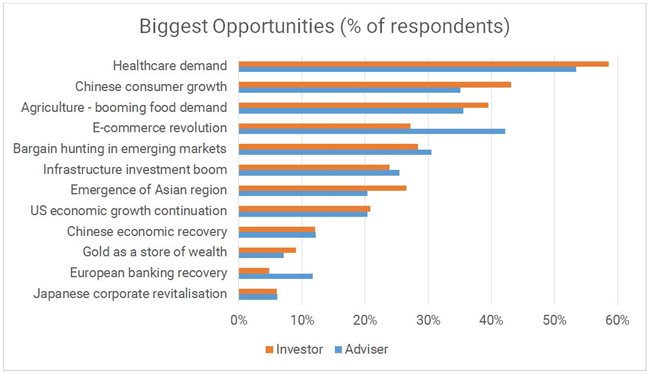

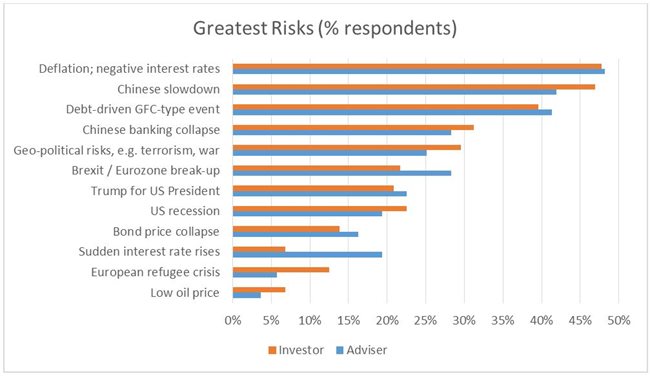

The first part of the survey asked roughly half of the total number of attendees in each venue what they considered the biggest investment opportunities were in the current market, and the other half was asked what they considered the biggest risks were. The findings from the some 1,200 surveys collected were broadly consistent across the groups.

The second part of the survey asked all attendees to give their estimate of market returns. The answers here appeared to have been influenced by the positive or negative framing of the first question. While not true in every sample group, across the aggregate data there was a marked degree of greater optimism among those who had considered opportunities compared to those who had considered risks.

Framing

In asking guests to focus on the market from two different angles (opportunities versus risks) prior to making an estimate of returns from global markets over the remainder of the year, the experiment we conducted attempted to highlight the risks of framing.

Forecast returns in each venue were measured across the adviser and investor sample and averages and medians of the opportunity and risk groups were compared.

The aggregate data is tabulated below, with over 1,200 surveys completed – the bottles of champagne on offer to the best forecaster in each session appeared an appropriate incentive!

|

(Average/ Median) |

Opportunities Group |

Risks Group |

Bias |

|

Investors |

5.6% / 5.1% |

3.8% / 4.0% |

1.8% / 1.1% |

|

Advisers |

6.1% / 6.0% |

4.6% / 5.1% |

1.5% / 0.9% |

The findings suggested that there was a positive bias in forecasts exhibited by those who had been given the positively framed survey. The extent of this appeared to be around 1-1.5% against an average forecast level of about 5%.

This is consistent with behavioural psychology studies on the framing effect, which is a cognitive bias that causes our analyses of information and decision-making to be influenced by “variations in the framing of acts, contingencies, and outcomes”. Tversky and Kahneman famously demonstrated that depending on whether questions are formulated in terms of gains versus losses, our perception and assessment of risk and rewards changes even though actual probabilities are the same.

The survey results also showed a tendency for advisers to be more optimistic than investors, perhaps itself an interesting topic. Also worthy of noting is that returns forecast tended in aggregate to be broadly consistent with long-term returns from equity markets in the high single digits, with 5% to the end of the year equating to about 7-8% annualised before dividends, an additional 2-3%. This suggests no particularly strong view from the group surveyed that they believe markets are excessively cheap or expensive.

Opportunities and Risks

In the first part of the survey guests were asked to select the three biggest opportunities or the three biggest risks from a list of 12 options.[1]

Healthcare polled as the leading opportunity in each of the samples, with agriculture in the Top 3 of every group except for Sydney advisers. Advisers were interested in e-commerce which had a Top 3 position in all adviser surveys, while no investor group ranked this in their Top 3. Meanwhile every group of investors saw the Chinese consumer as a Top 3 choice, but only Sydney and Adelaide advisers were convinced. Clients may be encouraged to know that our portfolios have considerable exposure to their areas of interest[2]. Chinese consumer growth and e-commerce have been key areas of Platinum’s focus for some time and the presentations by Andrew Clifford and Clay Smolinski address our key investments in some detail.

On the risk side, both investors and advisers had the same Top 3 concerns and deflation and negative interest rates caused a little more alarm than the Chinese slowdown or a debt-driven GFC-type event. Here, while the China slowdown concerns a lot of people, Sydney investors were the only group to rate this #1, perhaps symptomatic of their perception of what has been driving their home apartment market. We feel that our clients absolutely had their fingers on the pulse – how to find interesting investment opportunities in an environment of chronic low rates is the top question on our minds as is on yours. In fact, low interest rates are the central theme of this year’s keynote presentation by Andrew Clifford (Chief Investment Officer and Co-Manager of the Platinum International Fund) who drew some important lessons from similar periods in history. More specific insights on how to navigate such a deflationary low-rates environment as investors were addressed in further detail by Clay Smolinski, drawing lessons from our direct experience with Japan.

Donald Trump’s tilt at the US presidency was the most interesting, as it concerned 40% of Adelaide attendees, versus 20% across the other venues. This could to an extent be a case of “recency bias” as the Adelaide session took place on the day when headlines were dominated by the news that he was to be the Republican nomination. Recency bias, also known as availability heuristic, is the tendency to give more weight and attribute more relevance to information with greater “availability” in memory, which is often influenced by how recent the memories are.

Sudden interest rate rises seemed only to be a concern of advisers – perhaps after the presentation around the lack of inflationary pressures, we hope this fear may have been assuaged somewhat.

This data is a telling snapshot of what is on investors’ and advisers’ minds at this juncture, and along with the illustration of the impacts of framing, it provided a useful interactive lesson amidst this year’s roadshow. We hope our clients in turn gained some useful insights from the presentations by Andrew and Clay on the challenges and opportunities in today’s world of investments.

[1] This analysis excludes the first session in Brisbane where the survey was freehand which led to difficulties in collation and steered us to adopt a more refined approach for the subsequent sessions.

[2] Except agriculture where many of the best opportunities are unlisted, although Platinum has made good returns in this area pre-GFC.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances. The above material may not be reproduced, in whole or in part, without the prior written consent of Platinum Investment Management Limited.