The energy transition designed to decarbonise the world is well underway but it’s becoming increasingly clear success is about much more than renewable energy. We talked to two Platinum Portfolio Managers to see how they think the transition will really work – and what that could mean for investors.

Regardless of whether you are a climate change sceptic or wish Greta Thunberg went to school with your daughter, the push to decarbonise the planet is on and reshaping our lives. More than 140 individual countries and countless global agencies and companies have signed on to the Net Zero 2050 target. In China, one in every three vehicles sold is a ‘battery with wheels'.[1] According to the World Bank, nearly 20% of global energy consumption in 2020 came from renewables. [2]

Yet while the momentum for decarbonisation appears unstoppable, its shape is changing as the reality of the task becomes clearer. Experts like Canadian-Czech scientist Vaclav Smil have pointed out that decarbonisation can’t happen overnight: “We are a fossil-fuelled civilization whose technical and scientific advances, quality of life, and prosperity rest on the combustion of huge quantities of fossil carbon, and we cannot simply walk away from this critical determinant of our fortunes in a few decades, never mind years,” he wrote[3].

There’s also an increasing focus on ensuring the costs of climate change mitigation don’t fall on poorer nations and poorer people. In short, the drive to create a low-carbon economy has to make economic as well as environmental sense in order to be affordable for consumers.

“Moving from an economy based on oil and gas to one run on wind and solar sounds appealing, but there’s a huge gap in terms of energy density,” says Liam Farlow, Co-Portfolio Manager of the Platinum Global Transition Fund (Quoted Managed Hedge Fund) (ASX: PGTX). “It’s a technological, political and social change which will take time – and a vast amount of capital.”

A capital idea

That capital needs to be deployed to reshape a whole range of systems – food production, transport and energy to name just a few. It’s needed to fund the development and rollout of new technologies. And to help companies reinvent themselves as low-carbon businesses. All this creates a generational opportunity for investors if they put that capital to work in the right places.

“There’s always fantastic investment opportunities during economic transitions,” says Jodie Bannan, Co-Portfolio Manager of the PGTX. “There’s winners – but losers too. You need deep research and real insight to find the businesses that will be successful. You also need to be nimble. In a revolution, things change quickly.”

Wind in the doldrums

Jodie cites the ups and downs of wind energy stocks as an example. As interest rates plummeted during Covid, wind energy stocks soared. By 2023 a range of forces were working against them - technical issues, higher interest rates and supply chain inflation meant wind energy became a much less attractive investment. To take just one example, shares in Denmark’s Orsted have fallen 75% since December 2020[4].

On the flipside, shares in the uranium sector have outperformed. After years where many mines were shuttered, they’re responding to the recognition that nuclear offers a reliable source of low-carbon energy[5]. Companies like Cameco, a Canadian uranium producer, have benefited from tight uranium supply[6] and rising prices. Their shares are up over 100% since the end of 2022.[7]

Where to invest to change the world?

The divergence between uranium and wind energy stocks highlights an ongoing debate around the right way to invest in the energy transition. Some investors will prefer ESG or renewable-themed investment products that exclude metals and mining and seek out low-carbon businesses. Platinum has an alternative view.

Metals and Mining – companies who mine transition minerals like lithium, copper and rare earths like neodymium, praseodymium and dysprosium need capital. Without it we can’t build the technologies – like batteries, wind turbines and solar panels - needed to drive a low-carbon economy. According to the International Energy Agency, generating energy via offshore wind technology requires 12 times more metals and minerals per megawatt than natural gas[8].

High-emission businesses – the PGTX can and does invest in businesses that have high carbon emissions. Why? Because funding low carbon firms – think intellectual property businesses like advertising or finance – doesn’t materially change the carbon produced in an economy.

“One of our Fund’s key holdings is AGL, an Australian utility with a clear 10-15 year plan to become a low-emission energy-provider and be part of a zero-emission grid,” says Jodie Bannan. “The high emitting companies can make the biggest difference. By investing in these businesses, you can help them change – to reduce their emissions whilst growing their businesses.”

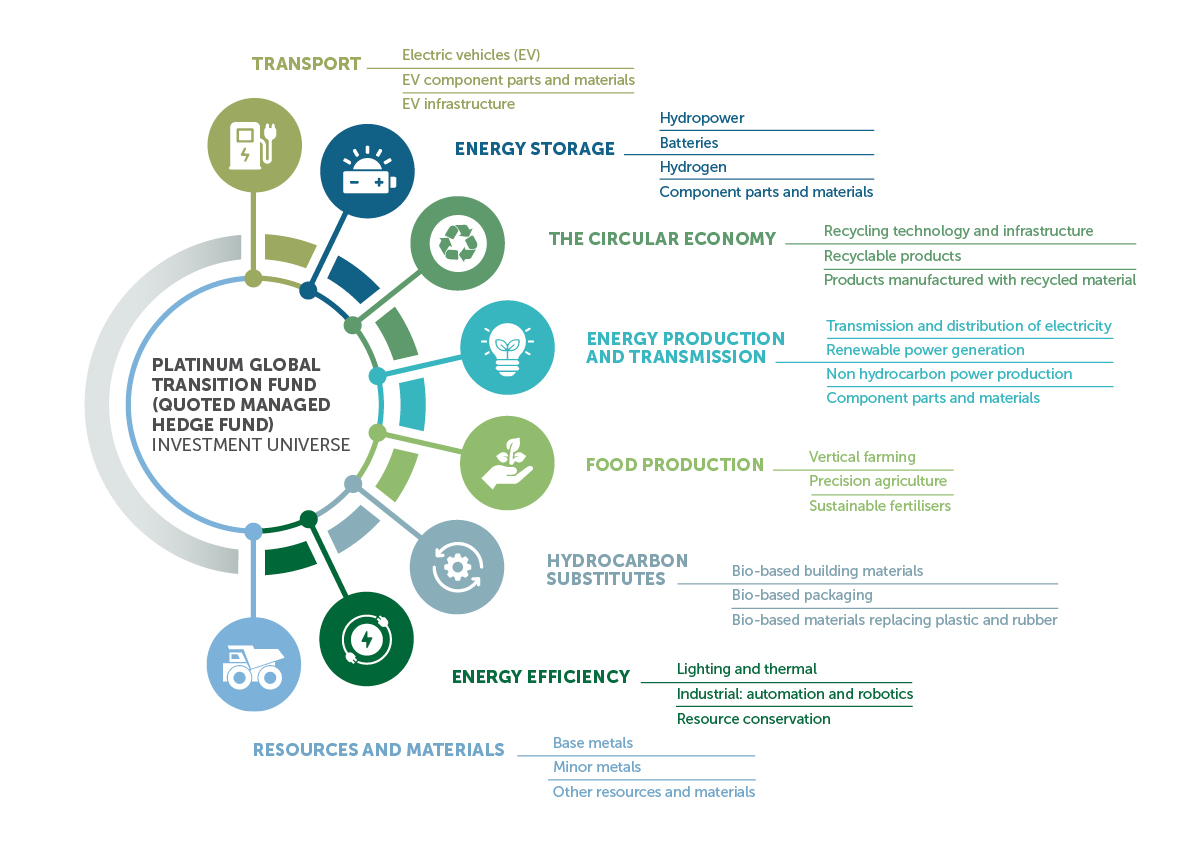

Chart One: Where PGTX invests.

How to ride the wave

To invest successfully in the energy transition means understanding the unique features of this economic upheaval. As discussed above, one of those elements is the vast amount of capital. Yet according to Liam Farlow, it’s not just the volume of money that matters. It’s how it moves.

When you have big waves of capital sloshing around in an industry or sector the investment cycles can become exaggerated and volatile. You can see quick moves in supply and demand as productive capacity expands in response to that rush of capital. “We’ve seen this play out recently,” says Liam. “There was a huge influx of capital into lithium mining because the world wanted more EV batteries. Lithium production increased, the lithium price fell, profits and margins cratered and that fall was compounded by a drop in the pace of growth in EV demand. Suddenly you don’t want to be in the lithium space any more.”

The ebb and flow inherent in these capital cycles is one reason investors in the energy transition may want to be active investors. Jodie Bannan says, “You want to be buying into your preferred sectors and companies at the moments in the cycle where buying makes sense. The volatile capital cycle doesn’t just move supply and demand – it increases the chance of mispricings. That gives us a chance to buy assets at prices that improve the prospects of good long-run returns for our investors.”

Two paper and pulp companies, Suzano (Brazil) and UPM Kymmene (Finland) are examples of this mispricing potential. Paper is an increasingly viable replacement for plastics. Both stocks have strong balance sheets and are low-cost producers. The PGTX bought into those stocks at cyclical lows.

No shortage of bad ideas

Capital cycles are a defining part of the energy transition. Unfortunately, so too are hype cycles. History tells us that in any market that’s being disrupted and where money is plentiful you’ll find businesses without business models, technology companies without working technology and consumer businesses without customers.

“We can short stocks,” says Jodie Bannan, “and that may work for our clients in two ways. We can potentially make money from shorting companies that don’t have financially sustainable businesses – and we’ve done that recently in the hydrogen and EV charging space. And we can short stocks to seek to protect investors’ capital during market sell offs.”

The ability to short stocks is important because the Fund is investing in cyclical commodities, materials and industrial companies. It gives the Portfolio Managers the tools to seek to make money for investors on both sides of the cycle.

A place in the portfolio?

The Platinum Global Transition Fund is focused on an area where the potential for growth is elevated. It’s structured with enough flexibility to adapt to the trends that will drive the energy transition , whilst still focusing on long-term financial outcomes.

Disclaimer:

Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”). This information is general in nature and does not take into account your specific needs or circumstances.You should consider your own financial position, objectives and requirements and seek professional financial advice before making any financial decisions.

You should also read the Platinum Global Transition Fund (Quoted Managed Hedge Fund) product disclosure statement and target market determination before making any decision to acquire units in the fund, copies of which are available at www.platinum.com.au/Invest-Now.

Commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. Certain information contained in this presentation constitutes "forward-looking statements". Due to various risks and uncertainties, actual events or results, may differ materially from those reflected or contemplated in such forward-looking statements and no undue reliance should be placed on those forward-looking statements.

To the extent permitted by law, no liability is accepted by Platinum for any loss or damage as a result of any reliance on this information.

Risk warning:

The Fund may invest in companies that currently have material fossil fuels businesses who have made commitments to reduce their scope 1, 2 and 3 emissions. By investing in companies involved in manufacturing or resource extraction, the Fund will not by its nature be a low carbon emissions fund relative to the broader listed global equity market and may have investments in companies that currently have material fossil fuels businesses. The Fund will not necessarily be invested in all of the areas displayed in the Chart above at any given time. New technologies and areas may emerge which seek to financially benefit from the energy transition, over the next 20 years or so, which are not included in the Chart above. It is therefore not possible to exhaustively list all areas in which the Fund may invest.

[1] Energy Intelligence

[2] https://data.worldbank.org/indicator/EG.FEC.RNEW.ZS?end=2021&start=1990&view=chart

[3] In his book, How the World Really Works: The Science Behind How We Got Here and Where We're Going

[4] Source: Factset Research Services 11/12/2023

[5] According to Eurostat, 25% of European electricity is generated by nuclear power (2021)

[6] For more on the potential of the uranium market see the PGTX Quarterly Report for September 2023

[7] Source: Factset Research Services, 11/12/2023

[8] https://www.economicsobservatory.com/energy-transition-minerals-what-are-they-and-where-will-they-come-from