How does investor behaviour impact the performance of asset management businesses and how does Platinum counteract these biases in order to deliver better investment outcomes for clients?

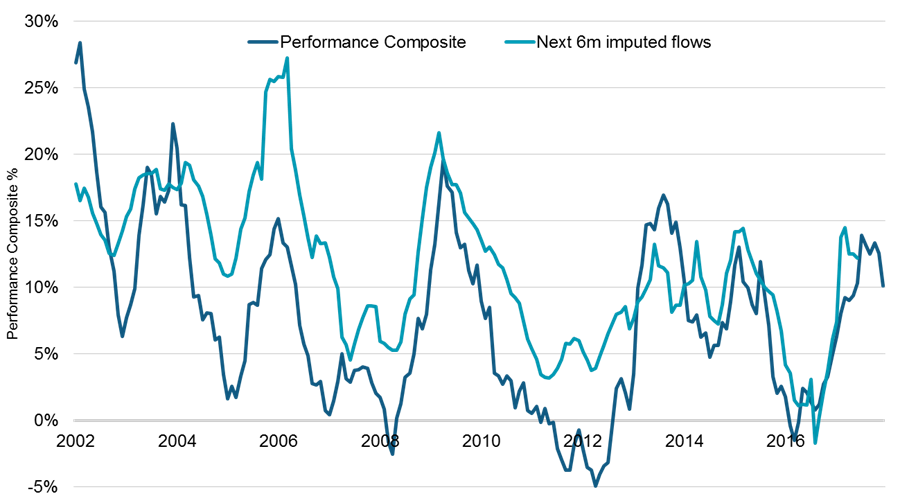

Asset management businesses need three things to succeed: client awareness, good client service and superior investment performance. Assets under management drive revenues. Once investors in a market segment are aware of an asset manager, investment performance primarily drives net flows (applications less redemptions), if underpinned by good client service. The chart below illustrates this tight historical relationship between investment performance and flows, using data for the Platinum International Fund.

Chart 1: Platinum International Fund - Performance vs. Flows

Source: Platinum Investment Management Limited and FactSet. Past performance is not a guide to future performance. Performance Composite: Average of 1 and 3 year absolute & relative returns (pre-tax and net of fees and costs) of the Platinum International Fund (C Class), assuming the reinvestment of distributions (relative to MSCI AC World Net Index $A). Imputed flows: Sum of NAV t – NAV t-1 * monthly return; for the 6 months following composite result. NAVt: publicly available month-end Net Asset Value as at time, t.

Source: Platinum Investment Management Limited and FactSet. Past performance is not a guide to future performance. Performance Composite: Average of 1 and 3 year absolute & relative returns (pre-tax and net of fees and costs) of the Platinum International Fund (C Class), assuming the reinvestment of distributions (relative to MSCI AC World Net Index $A). Imputed flows: Sum of NAV t – NAV t-1 * monthly return; for the 6 months following composite result. NAVt: publicly available month-end Net Asset Value as at time, t.

Investment performance also contributes to the growth (or reduction) in asset management businesses as investment returns increase (or decrease) the value of assets. While cited often, fees tend to be a focus for investors only when investment performance is weak.

Investors suffer from a multitude of biases when making investment decisions. One of the most common mistakes, as Chart 1 highlights, is choosing your asset manager based on recent investment performance. Various studies, including our own, show “chopping and changing” managers can cost a few percentage points a year. Take heed of the adage – past performance is not a guide to future returns.

This can result in a poor customer experience as implicit expectations calibrate incorrectly. Poor timing can be detrimental to an asset manager’s ability to build long-term client relationships.

These biases affecting asset management businesses also influence asset pricing. Platinum seeks to exploit the latter, aiming to deliver superior returns for our investors.

Behavioural finance has gained prominence in recent years. Nobel-prize winner Daniel Kahneman’s 2011 bestseller Thinking Fast and Slow explores this in detail. Platinum’s Curious Investor Behaviour booklet, first published 15 years ago, concisely introduces the basic principles of his work. These ideas are at the core of our investment philosophy. This revolves around avoiding the crowd, and exploring change, while thinking like private owners.

We believe behavioural finance 101 covers three key topics: social pressure, dealing with information and time, and loss aversion.

|

Bias |

Examples |

Platinum solution |

|

Social pressure |

- Herd mentality |

Avoid the crowd |

|

Dealing with information and time |

- Primacy/ recency biases |

Explore change |

|

Loss aversion |

- “Market coin toss” |

Think like a private owner |

Platinum counters social pressure by avoiding the crowd. We explore change to deal with cognitive challenges while thinking like private owners to help offset loss aversion.

Evolution created our biases. We cannot remove them. But awareness is not enough. To achieve better outcomes, we must actively counteract them.

Markets are a function of human behaviour. As a buyer, we need to understand the seller’s motivation. We need to understand others, and by extension, we must understand ourselves.

Starting with social pressure – we exist to survive and pass on our genes. Historically, the world was dangerous outside a tribe. Evolution favoured those in groups. Fortunately, we feel exclusion as acutely as physical pain, so we try to avoid this and do whatever it takes to “fit in”. Fear of missing out (FOMO) is a key driver of herd mentality in society, and in markets. It is most obvious in asset price bubbles. Despite recent attention on biases, Bitcoin in 2017 was an extreme example, having risen from US$100 to US$1,000 in just four years, prices surged to US$20,000 within the year.[1]

In dealing with information and time, behavioural economists such as Kahneman, Tversky, Thaler and others in the field have illustrated many of our biases via experiments. We can attribute this to evolution again, as we need to make survival decisions. On a first encounter, we must quickly judge “friend or foe”? Our first impressions give us the so-called primacy bias. We also suffer availability, or recency bias, overweighting the latest data point received.

The tragic events of September 11, 2001 illustrated recency bias. With intense media coverage shocking viewers, there was a noticeable drop off in flight bookings. Perceptions of risk were elevated.

Presentation of information, or “framing”, is critical. Marketers and politicians exploit this.

In 2016, we undertook an experiment with 10 groups of clients[2], providing a list of opportunities and risks to separate samples, and then asking them to forecast market returns. The positive or negative framing of the first question appeared to influence the answers, with greater optimism among those who had considered opportunities compared to those who had considered risks.

As for time, Bill Gates captures it perfectly, saying, “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten”[3]. You might laugh but in the tech boom of 2000, SMS messaging was a hot concept. People think exponentially not linearly, so the long-term benefit of compounding is painfully hard to convey.

Finally, loss aversion is critical and makes for a terrible journey for investors in listed assets. We feel losses twice as acutely as we enjoy equivalent gains. However, on any given day the market is a coin toss. Without an appropriate understanding and framework, staying the course is close to impossible for most people.

The combined impact of social pressure, the challenges of dealing with information and time, and loss aversion, creates barriers that investors must overcome in order to get better investment outcomes.

Educating people is harder than you might imagine given that these biases are inbuilt and are a function of thousands of years of evolution.

Buying out-of-favour assets, as a contrarian asset manager, can exaggerate this challenge. Our return profile is often at odds with that of the crowd, zigging when the market is zagging. Over the full market cycle, it has always achieved a superior outcome. Our biggest challenge is getting clients to experience that, as we often attract and lose investors at the wrong times, with the wrong expectations.

DISCLAIMER: This article has been prepared by Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”). This information is general in nature and does not take into account your specific needs or circumstances. You should consider your own financial position, objectives and requirements and seek professional financial advice before making any financial decisions. You should also read the latest product disclosure statement for the Platinum International Fund before making any decision to acquire units in the fund, a copy of which is available at www.platinum.com.au. The commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. No representations or warranties are made by Platinum as to their accuracy or reliability. To the extent permitted by law, no liability is accepted by Platinum for any loss or damage as a result of any reliance on this information. All data where MSCI is referenced is the property of MSCI. No use or distribution of this data is permitted without the written consent of MSCI. This data is provided “as is” without any warranties by MSCI. MSCI assumes no liability for or in connection with this data. Please see full MSCI disclaimer in www.platinum.com.au/managed-funds/pif#performance.